You have to do CPE. It isn’t a choice. I mean, unless you’re fine with losing your license, but if you’re here… that’s probably not the case. So, if you have to fulfill those requirements, you should make a thoughtful decision and choose a provider with a subscription you’re excited about renewing each year.

I passed the CPA exams myself and, though I’m no longer a practicing accountant, I understand the struggle of CPE. You dread it and dread it until you get hit with a last-minute surge of energy, knocking it all out in a caffeine-fueled panic, trying to beat the clock.

I studied the most popular options, searching for good fits for a variety of accountants to help you find the perfect fit (without the weird, gross sales pitches). Here are some of the highest-quality options I’ve found with all the details you need to know to help you make the right choice. Let’s go.

Accounting CPE Course Comparison

| Feature |  |  |  |  |  |

|---|---|---|---|---|---|

| Price Range | $329 to $1,429 | $99 to $399 | $549 to $899 | $250 | $12 to $600 (Ranges by Hours) |

| Financing | Yes(2-Year Prime Only) | N/A | N/A | N/A | N/A |

| Discounts | Save $715 | Save 20% | Save $270 | Save 10% | |

| Package Options | EssentialsSelectPrimePrime (2-Year) | Team CPEOn DemandPremiumPremium+ | Unlimited Self-StudyUnlimited WebinarsUnlimited Plus | 1 Year All Access | 1-Hour2-Hour3-Hour4-Hour20-Hour40-Hour60-Hour |

| Live Webinars | (2,300+ Events) | N/A | |||

| On-Demand Courses | 700+ Courses | 3,000+ Courses | 2,300+ Credits | 250+ Courses | 60+ Courses |

| Unique Features | CPE Podcasts50+ State-Specific Ethics CoursesCritical Update, Current Event, Hot Topics Courses | Course Recommendation EngineProfessional Reporting ToolsOptions for Teams | Gamified Courses | Unlimited Credit ConsumptionOptions for Teams | Hour-Based Packages |

| Get Started | Start Now | Start Now | Start Now | Start Now | Start Now |

Which Online CPE Provider is Right For You?

- Becker is the best choice overall with a large library of on-demand classes and live webinars.

- Illumeo is ideal for self-paced learners, offering 3,000+ on-demand courses at an affordable price.

- Lambers offers a cheap, simple way to quickly complete your CPE requirements.

- Surgent is a great fit for live webinar lovers, with over 2,300 live events every single year.

- Gleim is a good choice if you need last-minute credits to fulfill your quota.

- MYCPE ONE is one of the only CPE providers with a mobile app, catering to on-the-go learners.

- Sequoia CPE is an adequate provider for unlimited, cheap, PDF-only continuing education.

1. Becker: Best Choice

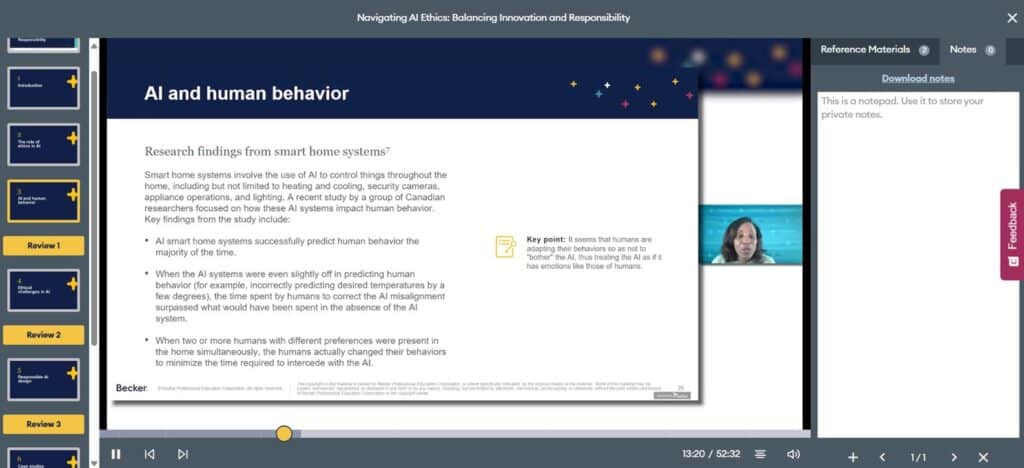

Though Becker is well known for their exam prep courses, particularly for the CPA exam, their CPE subscriptions have a lot to offer the right accountant as well. With over 1,000 webinars with a live chat feature and 700 on-demand classes, Becker has a large library of resources, and in my experience, the quality is pretty high. I really enjoyed both the on-demand and live classes, which featured true experts who talked to the audience like friends and colleagues, not students. Many of them had a good sense of humor as well, and the higher entertainment level made it easier to listen. This meant I could very quickly pass the pop-up questions and quizzes without having to stumble my way through on guesses.

However, Becker also delivers some unique features; most notably, their CPE podcasts, which allow you to fulfill the requirements for your state by listening to 30- to 50-minute-long episodes about AI, career paths in accounting, and true stories from successful accountants. In fact, you can listen to them for free right now, but you can only earn credit by answering the questions and taking the final quiz on Becker’s platform. Becker also offers ethics courses across all 50 states (plus some additional jurisdictions) and a CPE compliance tracker that ensures you meet all your requirements. I was able to plug in a state and easily see the types of courses I needed to complete, along with recommendations for which courses to take.

“Using the Prime CPE subscription. Most instructors are good, 3 live trainings every weekday, and lots of in-demand trainings.”

Anthony Jobe, Trustpilot Review

What’s Included?

- 90-day, 1-year, or 2-year subscription options

- State-specific ethics courses approved by every state board (plus D.C., Puerto Rico, and Guam)

- Over 1,000 live-chat webinars and 700 on-demand classes in the catalog

- Unique “frequent update” courses cover hot topics, critical updates, and current events

- Customizable CPE compliance tracking tool

- CPE podcasts accessible on Spotify, YouTube, and Apple Podcasts

Becker CPE Promo Code

Save $715 on Becker’s comprehensive continuing professional education subscription packages, including CPE podcasts and frequently updated classes on hot topics in accounting.

Extended Sale – $715 Savings on Becker CPE Prime (2-Year)

Extended Sale – Enjoy $400 Off Becker CPE Prime

Take 30% Off Becker CPE Course Bundle

Up to 30% Off Becker CPE Course Bundle

Enjoy Up to 25% Off Becker CPE Course Bundle

Get 30% Off Becker CPE Course Bundle

Score Up to 30% Off Becker CPE Course Bundle

Pros

-

Podcast Credits: Fulfill your CPE requirements while doing chores and commuting with podcasts. -

Ethics Coverage: Becker covers ethics requirements for 53 jurisdictions in 3/4 of the packages. -

Update Courses: Stay compliant and informed with frequently updated current event classes. -

Flexible Length and Price: Choose a “mini” or “maxi” package customized to your needs. -

Stay Organized: Meet deadlines and check off credits with the CPE compliance tracker.

Cons

-

Premium Price: The Prime (1 and 2-Year) packages’ premium features come at a higher cost.

Bottom Line

Overall, I think Becker has a lot to offer as a premium CPE provider. They offer an excellent balance of materials and value, with packages varying wildly in price and structure so you can choose the perfect fit for your needs. Further, Becker’s quality podcasts and live and on-demand classes make it easy to stay tuned in and answer questions, no guessing required. I’d recommend Becker to most accountants looking for a simple, engaging way to complete their CPE.

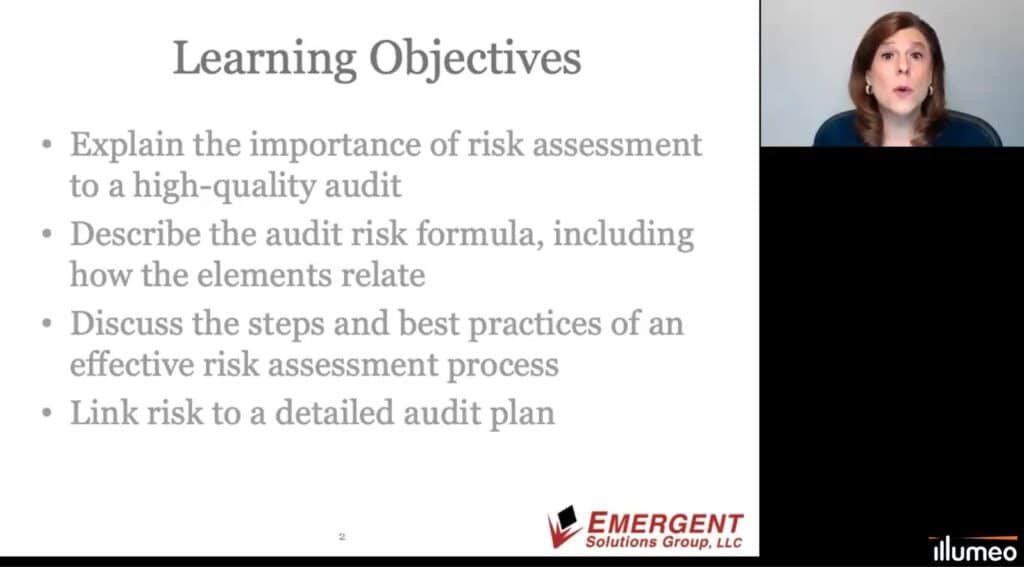

2. Illumeo CPE Training

As someone who prefers to study independently and hates being stuck on someone else’s schedule, I found Illumeo to be a solid match. The platform’s 3,000+ on-demand courses let me filter by topic, course type, or credit amount, which made it easy to target specific areas I wanted to improve. I tried several courses in the audit, Excel, and ethics categories, and while the delivery was pretty traditional—slides with voiceover narration and quizzes at the end—I appreciated the straightforward structure. The interface wasn’t flashy, but I didn’t have to click through extra filler or guess where to go next.

I especially appreciated the micro-certifications—short, curated course tracks that made the learning feel purposeful, not just credit-chasing. I tested one in financial planning and liked that it offered practical application, not just surface-level review. The AI course recommendation tool was more useful than I expected; it accurately flagged knowledge gaps and suggested targeted courses, which helped me avoid wasting time. While Illumeo doesn’t have extras like podcasts or gamification, I never felt like it was missing anything essential. It’s built for professionals who want control, depth, and a clear path to completion (with a massive number of courses to choose from, of course). One Redditor summarizes Illumeo’s perks:

“I can also recommend illumeo especially if you need to gain CPE quickly at low cost.”

What’s Included?

- 3,000+ on-demand courses and 120+ annual live webinars

- Premium+ Package includes unlimited CPE credit consumption

- AI-driven assessments and course recommendations

- Professional development resources

- 40+ micro certification programs

Illumeo CPE Promo Code

Save 20% on Illumeo’s CPE subscriptions, including certification programs and a CPE-specific AI chatbot.

Pros

-

Massive Library: Illumeo’s 3,000+ on-demand course options are ideal for independent learners. -

Mini Certifications: Take multiple classes in a certification track for added value. -

Satisfaction Guarantee: If you don’t like Illumeo, you can return it for a full refund within 30 days. -

Backed by Giants: Illumeo clients include Verizon, Cisco, Oracle, Intuit, Yahoo, and Yelp. -

Affordable CPE: Illumeo’s low price makes it a cheap choice for individuals and corporations.

Cons

-

Traditional and Simple: Illumeo lacks unique options such as CPE podcasts and gamified courses. -

Few Live Webinars: Though the on-demand library is massive, the webinar schedule is small.

Bottom Line

Illumeo earns its spot thanks to its sheer volume of quality courses, personalized recommendations, and smart certification tracks. I found it to be one of the easiest platforms to study with—fast, flexible, and tailored to professionals who prefer a streamlined, no-nonsense experience. It may not have the high-production gloss of Becker, but for CPAs who value depth, affordability, and autonomy, Illumeo is an outstanding choice.

3. Surgent: Most Live Webinars

Surgent boasts one of the largest CPE catalogs I reviewed—over 10,000 credits across live and on-demand formats—but quantity doesn’t always equal quality. While the range is wide, I found that several of the more specialized or niche courses felt shallow, almost as if they were rushed to publication. The live options, including their “Expert Hour” webinars, were stronger, though even there the sessions leaned more on timely updates than deep, technical instruction.

I also tested Surgent’s gamified courses (Max the Tax, Surging Auditors, Business Development). They were a clever concept, but in practice, they didn’t add much beyond novelty. The clean interface gets the job done, but it feels dated compared to more modern platforms, and the navigation isn’t as smooth as it could be.

Ultimately, Surgent works best for professionals who want steady access to live tax updates and don’t mind a premium price for that convenience. But if you’re after consistent depth, polished delivery, or a more intuitive learning experience, other providers—like Becker or Gleim—are likely to be a better fit.

“I currently have an unlimited package through Surgent. I like then. Some of their stuff is more broad, but I have found several to be very informative and well worth my time. I took one with a former IRS auditor that I almost skipped last year and it was my favorite.”

What’s Included?

- 10,000+ credits available (8,500 credits from live events and 2,300 from on-demand classes)

- Premium courses cover current topics and breaking news

- Weekly Expert Hours cover updates in the tax world

- Three unique gamified topics, each with a number of credit courses

- Max the Tax, Surging Auditors, and Business Development

Pros

-

Gamified Courses: CPE can be fun thanks to Surgent’s games for credit fulfillment. -

Large Live Library: Surgent offers an impressive 2,300+ live events every year. -

Highest Number of Credits: With over 10,000 credits available, Surgent has the highest quantity.

Cons

-

Priciest Package: The Unlimited Plus package is the most expensive option for one year of access. -

Not Built for Speed: If you want “quick and easy” CPE, Surgent isn’t the best choice. -

Shallow Coverage: Disappointingly, some of the more niche topics are covered at a surface level.

Bottom Line

Surgent stands out for its impressive volume of content and live events, but it’s not the most efficient or affordable choice on the list. While I appreciated the weekly Expert Hours and the creative attempt at gamified courses, I didn’t always feel like I was getting the depth or clarity I got from top picks like Becker or Illumeo. Still, for CPAs who value staying up to date with tax developments and prefer live instruction over fast-track completion, Surgent is a strong—if slightly overpriced—contender.

Save $270 on Surgent CPE Unlimited Plus Subscription

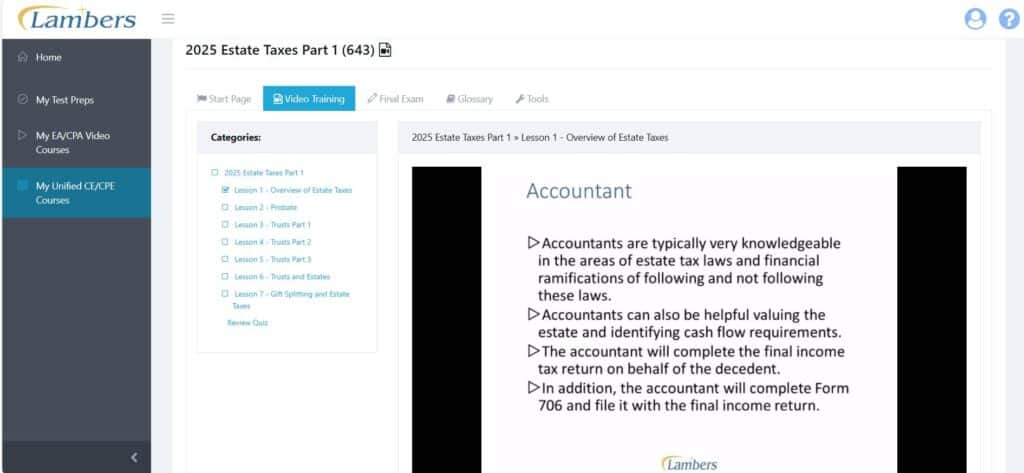

4. Lambers: Most Affordable

Lambers surprised me in the best way—it’s not the flashiest platform, but it’s extremely effective, especially given the price. When I tested the unlimited CPE plan, I expected the content to feel a bit dated, and while the design is old-school, the course quality held up. I completed credits in ethics, tax updates, and Excel, and in each case, the material was clear, well-paced, and easy to digest. I liked that I could choose between video, PDF, and live webinar formats depending on how I wanted to study that day. The PDF option, in particular, was handy when I wanted to skim through content quickly without watching a full lecture.

Where Lambers really wins is affordability and efficiency. I knocked out more credits in a weekend than I expected, simply because the platform made it easy to move from one course to the next without friction. The quizzes were straightforward, and I rarely needed to rewatch anything to pass. There aren’t any podcast features or interactive bells and whistles like you’d find with Becker, but that’s not really the point here—Lambers is about getting compliant, fast, without draining your wallet. For straightforward, affordable CPE that still feels professional, Lambers delivers.

“The customer service I received was excellent, which is always an important factor. The materials and website are easy to use and manage; I especially love the fact that I can do my continuing ed at my convenience. I will be using Lambers for years to come.”

What’s Included?

- One year of access

- 50+ live events

- 250+ on-demand courses and PDF resources

Lambers CPE Promo Code

Save 10% on Lambers for unlimited CPE, featuring on-demand courses and materials at a reduced price.

Exclusive Offer – 10% Off Lambers CPE Courses

Pros

-

Low Price: For a full year of access, Lambers offers one of the most affordable options. -

Simple and Easy: Lambers’ straightforward, no-frills classes make it easy to complete your CPE. -

Unlimited Consumption: Get as much credit as you’d like during your access period. -

Blended Formats: Choose between live, on-demand, and PDF delivery formats for your credits.

Cons

-

Not Modern: Lambers can have an old-school feel, which isn’t as engaging as some providers. -

No Bonuses: Like Illumeo, Lambers lacks unique formats like podcasts and gamification.

Bottom Line

Lambers is an excellent choice for budget-conscious CPAs who want a fast, easy way to fulfill their CPE requirements. I found it refreshingly simple to use, with multiple format options and just enough course variety to keep things moving. While it lacks the modern polish of pricier platforms, it more than makes up for it with value and ease of use. If you care more about cost and convenience than high-end production, Lambers is one of the best deals out there.

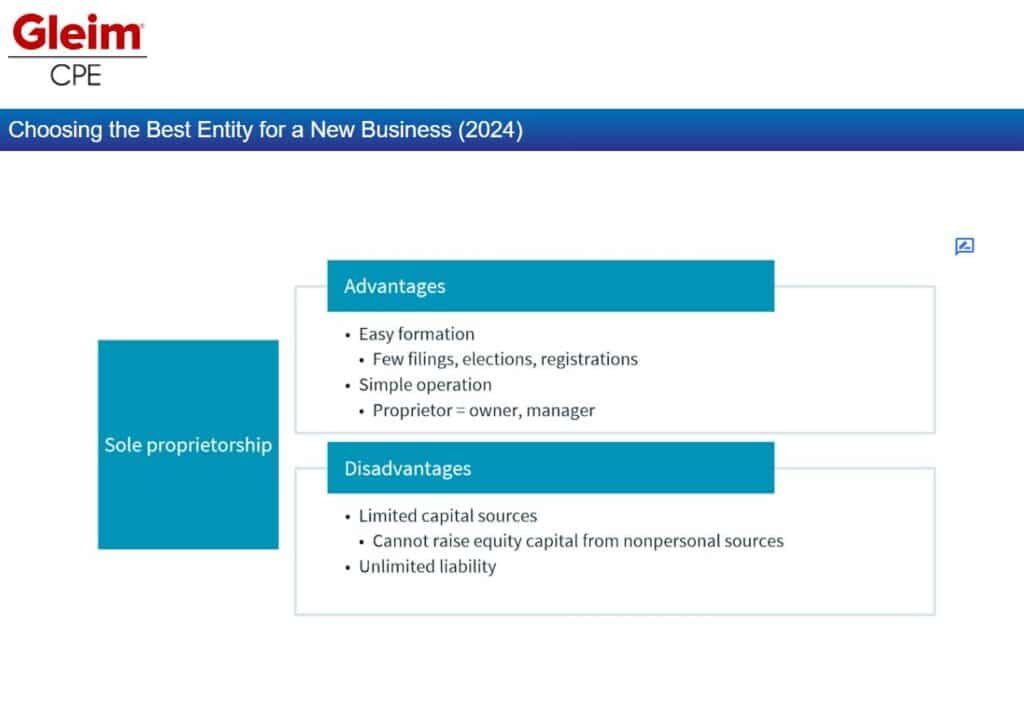

5. Gleim: Best for One-Off Credits

Gleim’s CPE platform is exactly what I expected from a company known for serious, no-frills exam prep: focused, straightforward, and fairly limited. I tested a few of their courses in auditing and ethics, and while the content was well-researched and technically accurate, it lacked the personality or engagement you get from providers like Becker or even Lambers. The presentation was mostly slide narration with quizzes—no live events, no interactive components, and nothing that made it feel like more than a checkbox to tick off. That said, I never had trouble understanding the material, and I appreciated the clarity of instruction.

The best part of Gleim is its à la carte pricing structure. If you only need a few credits to round out your requirements, being able to buy just what you need without committing to a subscription is a major plus. Still, with a course library that barely clears 60 titles, I ran out of topics I cared about quickly. It’s a solid choice for accountants who need a few hours here and there, but if you’re looking to knock out large credit totals or want a more engaging experience, Gleim probably won’t keep your attention for long.

What’s Included?

- Choose between 1, 2, 3, 4, 20, 40, and 100 hours

- A catalog of 60+ on-demand courses

Pros

-

Choose Your Hours: Gleim’s hours-based system ensures you only pay for what you need. -

Strong Reputation: Gleim is known for high-quality study materials and offers them for CPE. -

Free Course: You can try a free course from Gleim before making an investment.

Cons

-

Small Catalog: Gleim offers only ~60 courses, compared to thousands from Becker and Illumeo. -

Pricey for the Value: Gleim is more expensive than courses with more resources. -

Limited Credits: Because you buy by credits, you can’t get unlimited CPE consumption.

Bottom Line

Gleim works well if you want to buy just a handful of high-quality credits without overpaying for a full subscription—but that’s about where the advantages end. I liked the content I took, but the limited catalog, lack of interactivity, and higher cost per hour made it hard to justify for anything beyond occasional use. If you’re just looking to fill a gap in your requirements, Gleim is a reliable—but basic—option.

6. MYCPE ONE: Best for Mobile CPE Courses

MYCPE ONE looks great on paper—15,000+ hours of content, hundreds of compliance packages, and a mobile app—but when I actually used it, the experience didn’t quite live up to the numbers. I tried a few courses in ethics, taxation, and Excel, and while they technically met the requirements, the content felt flat. Most lessons were just narrated slides with minimal depth, and I found myself zoning out more than once. The certification tracks sounded appealing, but the few I explored felt like bundled CPE hours rather than truly distinct or career-advancing programs.

That said, the sheer variety is impressive. If you’re someone who likes browsing through hundreds of topics and picking out new things to try, MYCPE ONE has more than enough to keep you busy. The mobile app worked fine for me during testing, but I did notice lag during video playback and saw plenty of app store reviews mentioning login issues and bugs. One Redditor explains,

“The website is slow as **** and glitches at every possible step. No way ya’ll use this for your 80 hours.”

The platform isn’t broken, but it lacks the polish, instructional quality, and user experience that you get with higher-ranked options like Illumeo or Becker. It’s more quantity over quality—and for some users, that might be enough.

What’s Included?

- 15,000+ hours of continuing education content

- 500+ subjects to choose from

- 250+ compliance packages, which include pre-selected courses

- Over 100 expert-led certification programs

- Credit-tracking tools

- Mobile app availability on iOS and Android

Pros

-

15,000+ Hours: With so many hours of content, you’ll never run out of new classes to take. -

Mobile App: Take your credits on the go with MYCPE ONE’s mobile app for Apple and Android. -

Certification Programs: Earn real-world credentials while meeting your requirements.

Cons

-

Lower Quality: The classes aren’t as engaged or involved as those from other providers. -

Glitch Reports: Though I didn’t experience them, some students report website glitches. -

Shallow Coverage: MYCPE ONE doesn’t cover topics with much depth or insight. -

Poor App Reviews: Reviewers report app issues like failed logins and slow loading times.

Bottom Line

MYCPE ONE offers an overwhelming number of courses but struggles to match that volume with depth or quality. I appreciated the range of subjects and the convenience of the mobile app, but the courses themselves felt forgettable, and I wouldn’t rely on them for anything beyond fulfilling credit requirements. If you care more about cost, convenience, and sheer variety than a refined or engaging learning experience, MYCPE ONE might be worth considering. However, options like Becker and Illumeo are better options if you want to actually learn something while you’re earning CPE.

7. Sequoia CPE: Best Reading-Only Platform

Sequoia CPE is about as bare-bones as it gets. When I tested their platform, the entire experience revolved around downloadable PDFs—no videos, no audio, and no interactive features. I completed a few tax and ethics courses to get a feel for the format, and while the content was technically accurate, it felt like reading an old textbook. The process is simple: read the document, answer a set of questions, and get your certificate instantly. It’s efficient in theory, but in practice, I found the materials dry and the quizzes more difficult than expected. Unlike other providers, there’s no real support system built in, and I had to wait nearly two days for a reply to a basic customer service question.

That said, I can see the appeal for CPAs who want a no-frills, completely self-directed experience. The instant grading and certificates do make it easy to track your progress and move on, and Sequoia does give you unlimited access to their library once you subscribe. But without video content, structured courses, or even basic tracking tools, the platform feels dated, especially at a price point that doesn’t quite match what you’re getting. If you’re used to more engaging CPE environments, Sequoia will probably feel like a step backward.

What’s Included?

- 900+ credit hours available

- Includes instant grading/certificates for PDF self-study courses

- Unlimited access to the CPE library

- State ethics courses are not included, but are available separately

Pros

-

Simple Certificates: Instant grading and certificate delivery streamlines the process. -

Straightforward Simplicity: Read the materials, answer some questions, and get your credits.

Cons

-

PDFs Only: Paying hundreds of dollars for digital documents doesn’t deliver much value. -

Time-Consuming: Because you’re reading, not watching videos, it may take longer to complete. -

Slow Support: The customer service team could be slow, unresponsive, and unhelpful at times. -

Difficult Questions: Many students have complained that the questions are too tough to answer.

Bottom Line

Sequoia CPE is an ultra-simplified option best suited for CPAs who are comfortable reading lengthy PDFs and don’t need instructional support or interactive features. I appreciated the straightforward format and instant certificates, but overall, the experience felt outdated and overpriced for what you’re getting. With limited engagement, no included ethics courses, and a lack of meaningful course design, this one’s hard to recommend unless you really just want to get your hours done and don’t mind doing it the old-fashioned way.

Other CPE Subscriptions Studied

- American CPE

- Center for Professional Education

- CPEdge (formerly Checkpoint Learning)

- CPE Think

- MasterCPE

- WebCE

- Wolters Kluwer

My Ranking Strategy

To rank these CPE providers, I personally tested each one—logging in, taking courses, exploring features, and evaluating how well the content held up across formats. Rankings were based on how each course performed across the criteria below, with extra weight given to providers that offered well-rounded value, thoughtful design, and an easy-to-use learning experience.

Instructional Quality & Course Relevance

Becker consistently delivered the highest-quality instruction across both live and on-demand formats. The instructors brought clarity and personality to the material, which made earning credits feel like less of a chore. Illumeo also impressed me here, especially with its wide variety of professional development topics, while Lambers offered surprisingly clear and focused lessons despite its more traditional setup.

User Experience & Interface

Becker’s compliance tracker and dashboard made it easy to see exactly what I needed to take next. Illumeo’s platform was clean and intuitive, with helpful recommendations built in. While MYCPE ONE had the largest catalog, I found it took a bit more effort to navigate—but the mobile app was a convenient addition for on-the-go users. Surgent’s dashboard stood out for live learners, particularly with its searchable event schedule.

Learning Format Options

Becker led the pack here again with its podcasts, live webinars, and on-demand video—all of which gave me a lot of flexibility depending on how I felt that day. Lambers gave me options to switch between video and PDFs, and Surgent stood out for its gamified courses and robust live calendar. Even more text-based platforms like Gleim and Sequoia offered value for learners who prefer self-paced reading over scheduled sessions.

Catalog Depth & Special Features

MYCPE ONE offered the largest number of credit hours by far, with 15,000+ available. Illumeo came next with strong certification programs and micro-learning paths, while Becker’s frequent updates and ethics coverage across all jurisdictions added real value. Surgent’s “Expert Hour” series provided timely content, and Gleim’s à la carte model made it easy to purchase only what I needed. Sequoia, though simpler in format, offered instant grading and fast certificate delivery, which is helpful if you’re up against a deadline.

Value for Money

Lambers and Illumeo stood out for cost-efficiency—both delivered a lot of learning for a relatively low price. Becker is on the higher end, but I felt the quality justified it. Gleim’s pay-by-hour model was convenient for small requirements, and Sequoia’s flat pricing worked well for those who prefer PDF self-study. MYCPE ONE and Surgent both cater to professionals who want quantity and variety, with pricing that reflects their larger catalogs.

Make the Best Continuing Professional Education Investment

Not every CPE course works for every learner. Whether you’re looking for maximum flexibility, structured learning, or affordable access, the best course for you will depend on your personal learning style, schedule, and CPE goals. Here’s what to consider—and where each provider shines.

Learning Style: Structured vs. Self-Paced

If you prefer structure, Surgent offers one of the largest libraries of scheduled live webinars each year, while Becker also includes frequent webinars and instructor-led sessions. On the other hand, if you’re more independent, Illumeo, Lambers, and Gleim are ideal—they focus on self-paced learning through on-demand videos or reading-based formats. I personally found Illumeo especially easy to navigate on my own schedule.

Course Format Variety

Becker leads here, with a blend of videos, webinars, and even CPE-eligible podcasts for learning on the go. Surgent mixes in gamified modules like Max the Tax, while MYCPE ONE includes mobile access and a massive range of topics. If you prefer simple reading-and-quiz formats, Sequoia CPE and Gleim offer a more straightforward, text-based approach. Lambers splits the difference with both video and PDF options.

Catalog Depth & Subject Coverage

If you want lots of course options, MYCPE ONE has the largest number of hours available, followed by Illumeo and Surgent. I was able to browse hundreds of topics with Illumeo, which made it easy to find something relevant. Becker focuses more on quality over quantity but still offers hundreds of useful and regularly updated courses. Gleim and Sequoia have smaller libraries, but cover the basics.

Certification Tracks & Career Development

Illumeo stands out with more than 40 micro-certification programs, which I found helpful for building specific skillsets. MYCPE ONE offers over 100 certification programs as well, with topics ranging from tax to Excel. If you’re looking for credits and career growth, these are strong options.

Ease of Use & Navigation

If you’re someone who gets overwhelmed by clunky dashboards, Becker and Illumeo offer the cleanest, easiest-to-use interfaces. I especially appreciated Becker’s compliance tracking tool, which helped me monitor my progress by jurisdiction. Surgent also made it simple to register for live webinars. Simpler platforms like Lambers and Sequoia are more basic, but also less distracting.

Budget

Lambers is one of the most affordable options and still gives you unlimited access. Illumeo offers strong value for its price, especially given the size of its catalog. If you only need a few hours, Gleim lets you pay by the credit. Becker and Surgent are on the higher end of the pricing scale, but you’re paying for premium features like podcasts, gamified tools, or live expert sessions.

Credit Tracking & Certificates

For compliance tools and certificates that are easy to manage, Becker, Illumeo, and Surgent are the best picks. I liked how Sequoia delivered instant grading and certificates for self-study—great if you’re working against a deadline.

CPE Subscriptions Stacked: How Do They Compare?

Becker vs. Illumeo

Becker was the strongest all-around platform I tested. The courses were clear, engaging, and surprisingly entertaining—especially the live sessions, which felt more like expert-led roundtables than lectures. I also loved the variety: live webinars, on-demand classes, and podcast episodes gave me flexibility depending on my energy and schedule. Becker’s compliance tracker made it easy to stay on top of state-specific requirements, and I appreciated being able to browse by topic, jurisdiction, or CPE type without much friction.

Illumeo had a different appeal. Its self-paced model and massive on-demand library are perfect for learners who want to control their pace without scheduling around webinars. The micro-certification programs stood out to me—I completed a mini-track on finance leadership and found it surprisingly practical. While it doesn’t have the podcast content or visual polish of Becker, Illumeo delivers a ton of value for its price. If you’re an independent learner who wants depth without distractions, it’s a great alternative.

Becker vs. Surgent

Becker felt like the more comprehensive platform during testing. Between live webinars, on-demand video, and the CPE podcast library, I never felt like I lacked format variety. I especially appreciated the instructors’ teaching style—they made technical topics feel easy to follow without oversimplifying them. I also found the interface easier to navigate, and the built-in tracker helped me avoid second-guessing which credits I still needed.

Surgent had strengths too, especially for live learners. Their Expert Hour sessions and sheer volume of live events (2,300+ per year) make it ideal for people who enjoy scheduled sessions. The gamified modules—like Max the Tax—were genuinely more fun than I expected and broke up the monotony of credit chasing. That said, the content sometimes felt more surface-level compared to Becker’s. I’d recommend Surgent for CPAs who prefer live instruction and want some unique course types, but Becker is better if you value instructional depth and format diversity.

Illumeo vs. Lambers

Illumeo is ideal for people who want a lot of content at a great price. The platform includes more than 3,000 on-demand courses and mini-certification programs, and I found the course recommendations surprisingly helpful. When I wasn’t sure what to take next, Illumeo’s interface suggested courses based on my progress. It’s not flashy, but the platform is organized, smooth, and quietly efficient. I liked having so many professional development options alongside my compliance courses.

Lambers takes a different approach. It’s less about volume and more about ease. The layout is stripped-down, the courses are simple, and everything just works. I took a handful of tax courses with Lambers and appreciated how straightforward they were—no unnecessary bells or whistles. That said, the experience didn’t feel as dynamic or current as Illumeo. If you just want a no-fuss, low-cost way to get your credits, Lambers is great. But if you want something more interactive or career-oriented, Illumeo is the better choice.

Lambers vs. Gleim

Lambers offered a lot more than I expected for the price. The unlimited access model gave me freedom to explore different topics, and I liked being able to choose between video and PDF formats. The courses were simple and easy to complete, and while not the most modern, they got the job done efficiently. For learners who want quick, easy access without spending much, Lambers hits the mark.

Gleim, by contrast, offers more structure—but at a higher cost per credit. You choose your subscription based on the number of hours you need, which could be great if you’re only looking to meet a specific requirement. I appreciated the reputation Gleim has for quality, but I found the limited catalog a drawback during testing. I ran out of topics I was actually interested in pretty quickly. If you only need a few hours and prefer a trusted name with focused content, Gleim works—but Lambers gives more breathing room for the price.

MYCPE ONE vs. Sequoia CPE

MYCPE ONE is all about volume. With over 15,000 hours of content and 100+ certification programs, it’s easy to see why it stands out. I liked being able to switch from a tax update webinar to a soft-skills course on leadership without changing platforms. The mobile app is another win—it worked smoothly on my phone, which made it easy to complete shorter courses while commuting. It wasn’t always the deepest instruction-wise, but the variety is tough to beat.

Sequoia CPE is a better fit for people who prefer text-based, self-study formats. All the content is PDF-based, and while I initially found that limiting, I eventually appreciated how efficient it was. You can read, take the quiz, and get your certificate almost immediately. However, the lack of videos, webinars, or format flexibility made it feel more utilitarian than engaging. MYCPE ONE is a better all-purpose tool, while Sequoia serves a very specific type of learner who just wants to read, test, and move on.

| Feature |  |  |  |  |  |

|---|---|---|---|---|---|

| Price Range | $329 to $1,429 | $99 to $399 | $549 to $899 | $250 | $12 to $600 (Ranges by Hours) |

| Financing | Yes(2-Year Prime Only) | N/A | N/A | N/A | N/A |

| Discounts | Save $715 | Save 20% | Save $270 | Save 10% | |

| Package Options | EssentialsSelectPrimePrime (2-Year) | Team CPEOn DemandPremiumPremium+ | Unlimited Self-StudyUnlimited WebinarsUnlimited Plus | 1 Year All Access | 1-Hour2-Hour3-Hour4-Hour20-Hour40-Hour60-Hour |

| Live Webinars | (2,300+ Events) | N/A | |||

| On-Demand Courses | 700+ Courses | 3,000+ Courses | 2,300+ Credits | 250+ Courses | 60+ Courses |

| Unique Features | CPE Podcasts50+ State-Specific Ethics CoursesCritical Update, Current Event, Hot Topics Courses | Course Recommendation EngineProfessional Reporting ToolsOptions for Teams | Gamified Courses | Unlimited Credit ConsumptionOptions for Teams | Hour-Based Packages |

| Get Started | Start Now | Start Now | Start Now | Start Now | Start Now |

Final Thoughts

Choosing the right CPE provider can be tricky when you might have to spend dozens of hours every year on a single platform. However, I hope this guide has given you some insights and honesty to guide you toward the right decision.

To recap, Becker is a great overall choice, with well-balanced materials and engaging classes. Illumeo offers thousands of self-study options and micro certifications, all at a low price. Lambers is one of the cheapest available, especially with discounts, and it’s an easy way to quickly complete your credits.

Whichever you choose, you have to do CPE; that part isn’t a choice. But you can make a choice of whether you try to learn something from your continuing professional education, or just try to grind through the materials. Make the right decision for you and your future.

FAQs

Becker offers the best all-around CPE experience, with engaging instructors, a wide variety of formats, and strong compliance tracking tools.

Look for providers with on-demand videos, podcasts, or PDF self-study options—like Becker, Illumeo, and Sequoia—for the most convenient credit.

Short programs in areas like forensic accounting, tax strategy, and leadership from platforms like Illumeo and MYCPE ONE add strong value to your CPE.

No—other accounting professionals like CMAs, EAs, and CIAs often have CPE requirements too, depending on their designation and state rules.

Most states require 40 CPE hours per year or 80 every two years, but it’s best to check your state board’s specific renewal requirements.