The Becker CPA Review Program offers a reliable, no-nonsense approach to preparing for the CPA exam. It’s one of the oldest CPA review courses available and is highly regarded for the quality of its study material. In fact, 94% of enrolled students pass their exams after using this course to study!

But is that all? – No way.

Becker’s CPA prep course stands out from the competition in that the Big 4 accounting firms endorse it. This means that a large number of candidates always use the course to prepare for the CPA exam since the largest and most prestigious firms use Becker.

Essentially, Becker is the best CPA prep course on the market hands-down. And as a CPA review course expert, trust me when I say, you won’t be disappointed with what it has to offer.

But don’t just take my word for it: Learn more about why Becker is the best by reading my review.

Top Rated

Discounts Available

Unlimited Access

Pass Guarantee

Tutoring Available

Becker CPA Review Ratings

Summary

Becker Course Offerings and Details

Becker has four different review program offerings:

- Concierge

- Pro

- Premium

- Advantage

If you’re on the path to becoming a certified public accountant, then you know how challenging it can be to prepare for the CPA exam. That’s why Becker CPA Review has introduced an option called Becker Concierge, which takes CPA exam preparation to a whole new level.

When you sign up for Becker Concierge, you’ll get access to a dedicated Becker team and your own success coach, who will work with you to create a personalized study plan. You can receive up to 25 one-on-one hour-long tutoring sessions to address any areas where you need extra help.

On top of that, you’ll have access to the complete Becker CPA Exam Review course, with free content updates that align with the AICPA’s blueprint, including all CPA Evolution changes. Not sure which Discipline you want?

No biggie! Becker lets you try out all three!

The course includes Becker’s Final Review and bonus 900+ MCQs, along with printed and digital CPA review textbooks, flashcards, a mobile app, and an award-winning game.

Becker Concierge also offers personalized instruction, including online virtual classes and live in-person classes. You’ll have access to 8 simulated exams, 12 mini exams, and unlimited custom practice tests powered by Adapt2U Technology, which adapts to your progress and learning style. This will help you gain the confidence you need to excel on exam day.

And if you still need more help, Becker Concierge offers exclusive access to over 8,500 MCQs and 400+ TBS questions, including exclusive SkillBuilder solution videos. Plus, if you’re Exam Day Ready SM but still don’t pass, Becker will refund up to 100% of the Concierge CPA review purchase price.

As a bonus, Becker Concierge also includes a one-year CPE subscription and CPE certificate, ensuring you stay up-to-date with the latest changes in the field.

How do you rate Becker CPA Review?

Other Course Options

Aside from their top-tier Concierge package, Becker offers several other excellent CPA review options. The Pro package, priced at $3,799, includes unlimited access to over 900 video lectures, a comprehensive question bank with 8,500+ MCQs and 400 TBS, and five one-hour, one-on-one academic tutoring sessions. It also features a one-year CPE subscription and access to Becker’s Final Review course.

The Premium package, available for $3,099, provides the same extensive video and question resources without personalized tutoring sessions. It also includes unlimited access and printed textbooks.

For a more budget-friendly option, the Advantage package is priced at $2,499 and offers 24 months of access to the same video and question resources, along with printed textbooks, but without the additional tutoring and final review.

Becker CPA Course Features

Let’s examine some positive features of the Becker course offerings as a whole.

Content and Dashboard

Becker CPA Review has been at the forefront of adapting to the CPA Evolution changes, making crucial updates to their textbooks and online resources. As one of the first prep providers to align their materials with the new exam structure, Becker ensures that students are well-prepared for the Discipline sections, including Business Analysis and Reporting (BAR), Information Systems and Controls (ISC), and Tax Compliance and Planning (TCP). This proactive approach is essential, especially as some other courses still include outdated materials for exams like BEC, which no longer exist.

One significant update Becker made is the reduction in textbook size, particularly for FAR. This change reflects a shift in their teaching methodology. Previously, lectures involved instructors annotating the textbook directly, which often felt like highlighting entire pages.

Now, the lectures are based on slides that relate to the textbook but also cover additional material, requiring students to listen and take their own notes actively. This approach mirrors a more interactive, college-style learning experience, encouraging deeper engagement with the content.

Personally, I find this new method better as it promotes active listening and note-taking rather than just copying annotations. It feels more like how you learn in college, though it does mean students might need a separate notebook for additional notes, given the smaller margins in the textbooks. This is just one of several key changes Becker has implemented to ensure their program remains cutting-edge and effective for the evolving CPA exam.

But it’s not just physical books you get with Becker. Many students prefer the online version. It would definitely be my choice if I were taking the CPA exam all over again.

Video Lessons

“For me I feel like they’re 10x better than what they were before. I feel like I don’t have to read for the most part after watching them.” u/OnThursdayyy

Becker CPA Review has significantly revamped its video lectures to align with the CPA Evolution changes, ensuring students are well-prepared for the new exam format. Previously, Becker’s videos consisted of instructors annotating textbooks, which often felt like highlighting entire pages. Now, the concept videos guide students through slides related to the textbook content but also include additional material. This new format promotes active listening and note-taking, mirroring a more interactive, college-style learning experience.

Some users in this thread noted that while this change means they need to make more annotations on their own, it ultimately results in better engagement with the material. As one user, Baddycoda, mentioned, “The program has had a complete facelift for CPA 2024. Those videos highlighting the text no longer exist.” Another user, MystKun127, shared, “I recommend just downloading the slides and using that instead of the textbook. That’s what I did for new AUD and recently passed.”

However, it’s important to note that not all feedback has been positive. Upstairs-Muffin-7317 shared their frustration: “I remember when their video lectures followed their books and they pointed out the things that were important. When I try to follow along with my book now, I get lost and have no idea where they are at when speaking.” This mixed reception highlights the adjustment period required for students transitioning to the new format.

Overall, Becker’s updated video approach aims to foster a more engaging and comprehensive understanding of the CPA exam content, ensuring students are better prepared for the challenges ahead. Despite some initial frustration from those accustomed to the old format, many find the new method more beneficial for deep learning and retention.

“I always watch them on 1.5 speed. Even if I’m zoned out I’m surprised how much I’ve subconsciously absorbed. I’m a creature of habit so I’ve just continued watching them.” – u/snoopoems1858

Adapt2U Technology

Clearly, Becker provides a large volume of varied study materials for students preparing to take their exams. While these are impressive resources on their own, the way this company applies this material for individual students is unlike any other course on the market.

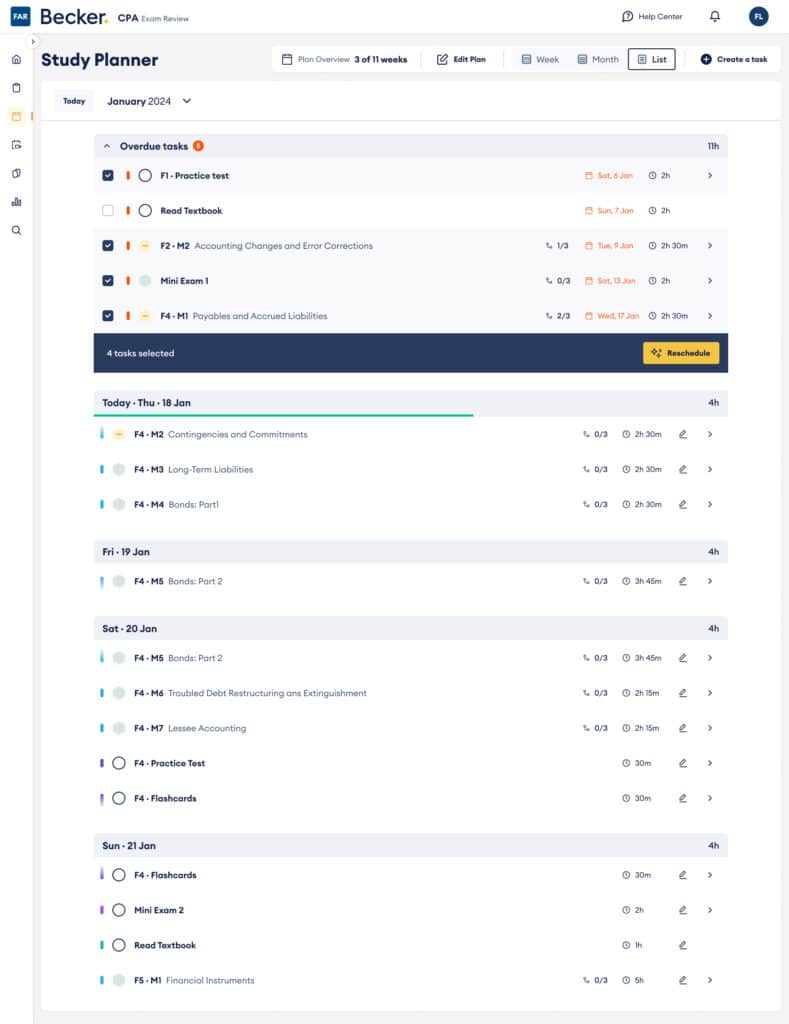

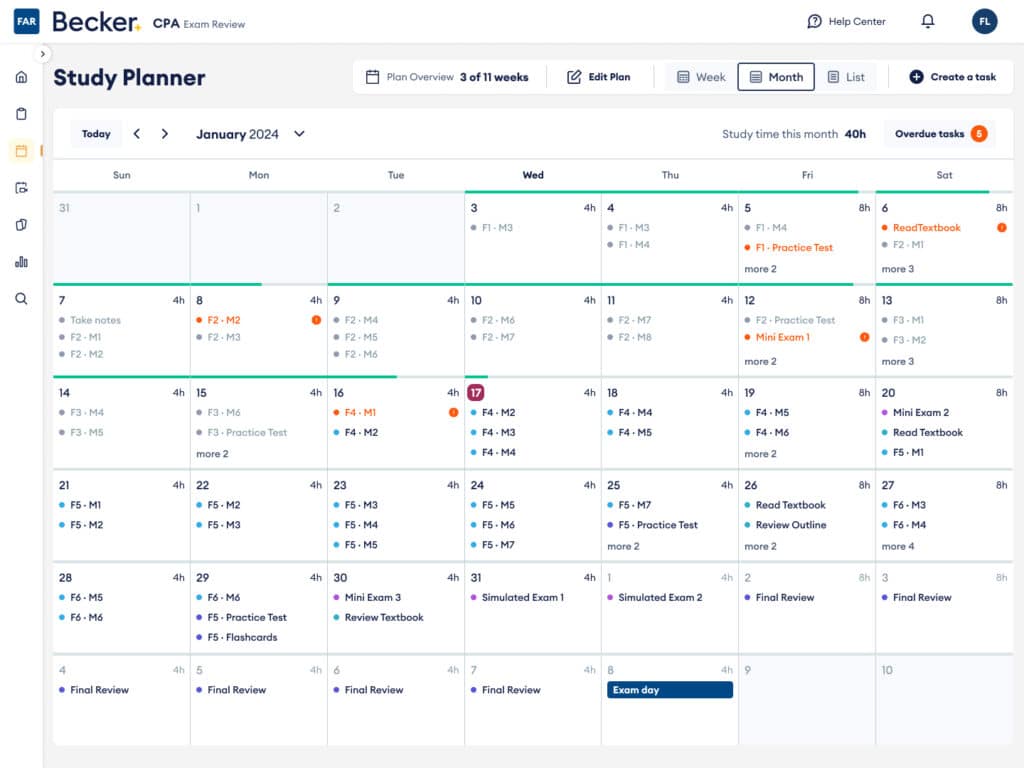

Thanks to a partnership with Sana Labs, Becker CPA Review has powerful adaptive learning technology seamlessly integrated into all of their CPA prep course packages. It’s called Adapt2U, and it can do the following:

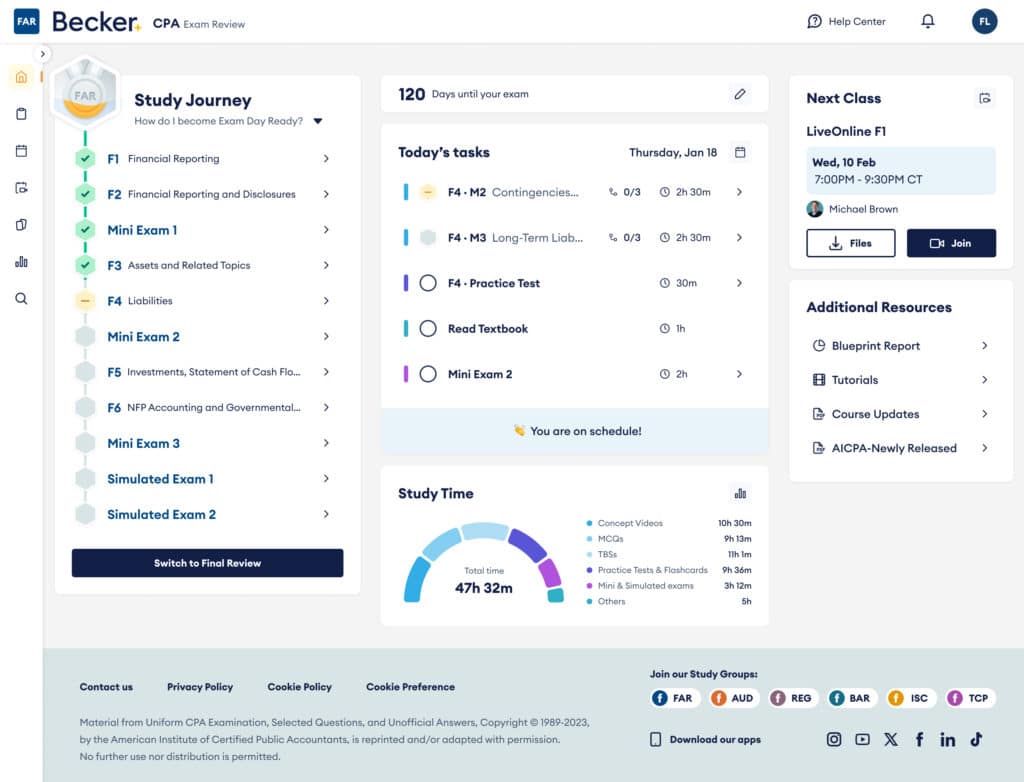

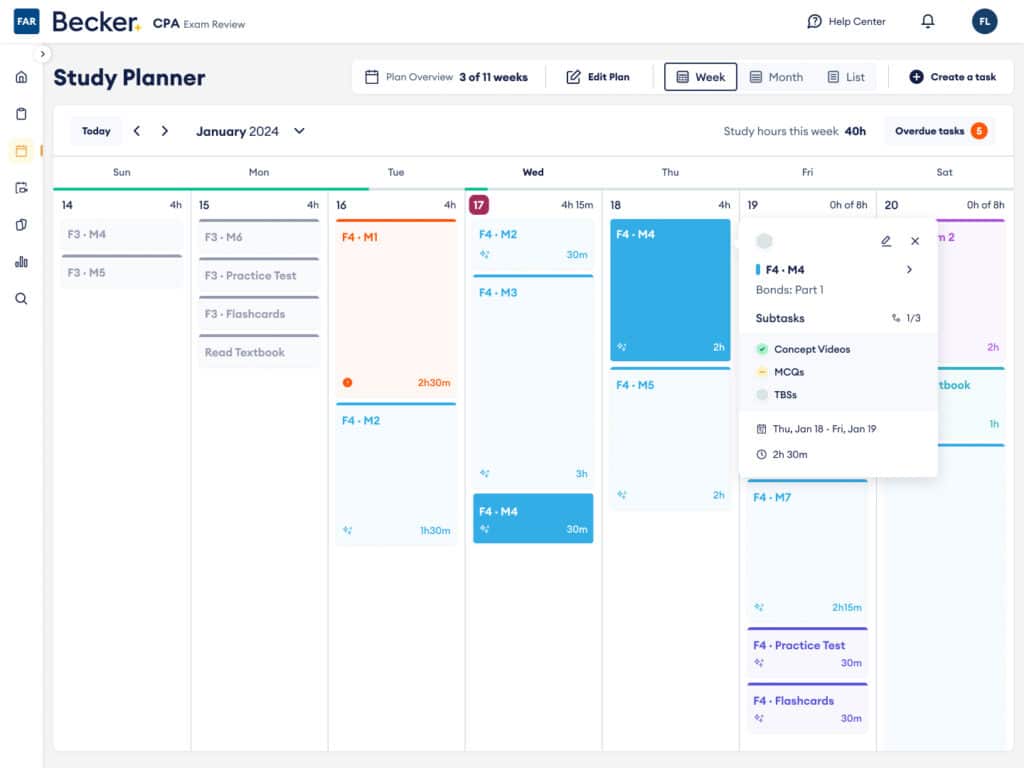

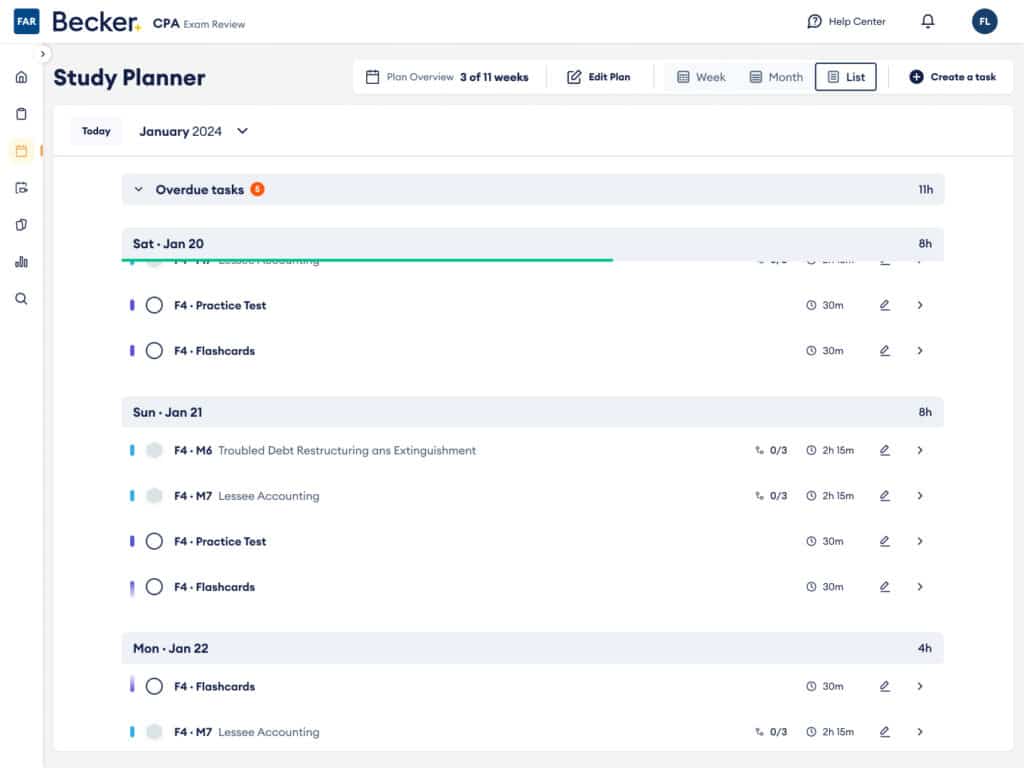

- Generate custom study schedules for each student

- Track your progress with simple graphics that are easy to understand

- Correlate specific questions with passages in study text and clips from video lectures

- Eliminate knowledge gaps and reinforce memorization of important concepts

- Form custom exam simulations based on content relevant to each student

- Create an effective and unique Final Review for last-minute cramming

Essentially, every aspect of Becker’s course is combined into one dynamic and highly effective study program that’s catered entirely to each student’s specific study needs. Adapt2U is often imitated but never duplicated: it’s the biggest draw to their course by far!

Practice Questions and Tests

If you opt for the Becker CPA Prep Course, you can be sure that you will have access to an adequate number of practice questions. Furthermore, the program includes more than 8,500+ multiple-choice questions (MCQs).

Becker also has a strong bank of task-based simulations (TBSs). There are 400+ of these in the program, and reviewing them on a regular basis will help in your exam preparation as well as boost your confidence.

“If you’re using Becker, I realized how priceless the practice tests are because unlike before, the new questions that you need to practice are actually in the practice test bank NOT in the module itself…The MCQs in the module itself are just a preview, but the more comprehensive practice that tests your mastery of knowledge is in the practice tests, so we have to do them to get exposed to new questions daily. Hope this helps a fellow studier like myself!” – Becker User

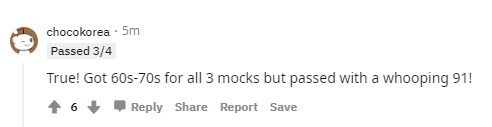

Additionally, you get mock exams as well. Most candidates speak highly about these and say that they offer an excellent opportunity to understand what you will go through on the day of the test. In fact, most students find that they earn higher scores on the actual CPA exam than they do on Becker’s mock exams!

Flashcards and Other Resources

In addition to their updated video lectures, Becker CPA Review offers a range of resources to support students through their CPA exam preparation. One notable feature is their online flashcards, which provide an excellent method of learning and retaining critical information. Becker has moved entirely to online flashcards, ensuring students have convenient access to study materials on the go.

Another unique offering from Becker is their one-on-one tutoring sessions. Included in the Pro package, these sessions provide personalized guidance from experienced instructors, helping students tackle challenging concepts and improve their exam readiness. This personalized support is especially beneficial for those who need extra help in specific areas.

Additionally, Becker provides access to their final review course, which is included in some of their packages. This final review helps students focus on the most critical areas and refine their exam strategies, boosting their confidence and preparedness.

Value and Access

Becker CPA review course costs range from $2,499 to $5,499, depending on the package you choose. Becker CPA Review is among the more expensive review courses that you can currently buy. Usually, accounting firms will subsidize or completely cover the costs for this course when training their employees. But if you’re not able to get your company to sponsor your education, another way to save some money is to try one of Becker’s financing options.

If you select Concierge or Pro, you’ll have a much higher price tag, but you’ll also get more Becker benefits. If you opt for the Premium package (one step above Advantage), you’ll pay even more than the base cost for a truly premium educational experience. Whether or not you want to pay that price is up to you, but it’s not a bad investment in your future career if you do!

Course Access Period

The study material obtained through the Becker CPA prep course has unlimited access for students. This means that in the worst-case scenario where you fail to pass all CPA exam sections in time, you won’t have to repay Becker’s Premium or Pro courses in order to study your problematic exam sections.

Course Updates

Although this wasn’t always the case, Becker has listened to criticism from students (and from us) and corrected one of their biggest problems. Now, students who enroll in any of Becker’s packages will receive all updates to their study materials free of charge!

Becker Frequently Asked Questions

Still unsure whether Becker CPA Review is the right course for you? Here are the answers to some questions that candidates commonly ask:

Will I get enough practice with this course?

Becker provides hundreds of hours of video lectures, 8,500+ MCQs, and 400+ TBSs. That should be more than enough to give you all the practice you need. Of course, you need to put in the time and effort that is required to complete the entire course material.

One important feature of the program is that it is specifically designed to match your need to pass the CPA exam. As a result, this means that the time that you spend studying helps you in two ways: you learn new topics and concepts, and you receive training on the skills and techniques needed to pass the exam.

What if I can’t understand a topic or I need an explanation that isn’t covered by the study material?

Don’t worry, Becker’s program takes care of that. Buying the program entitles you to access their Message Board as well as phone and email support. You can post your query to a professor and get a response within 48 hours. Furthermore, there’s one more major advantage for Becker Pro subscribers: five 1-on-1 academic tutoring sessions live over Webex. With Concierge, you get even more support with up to 25 tutoring sessions.

What is Becker’s Adapt2U technology?

Every exam candidate has strengths in certain areas and requires additional study time in others. For example, you may be confident about the AUD section but may find it FAR more challenging. Consequently, it doesn’t make sense for everyone to follow a common pattern of study.

Keeping this in mind, Becker’s program has developed its proprietary Adapt2U technology. When you start the course, an assessment will be carried out of your current level of knowledge. You will then be required to follow a study program that caters specifically to your strengths and weaknesses. Consequently, this will ensure that your time will be spent in the most optimum manner. It will also raise your chances of passing the exam!

Why should I choose Becker over less expensive review courses?

Even though Becker is the most expensive course, it is also highly popular. Why is that? One reason is that all the top 100 accounting firms, including the Big 4, use this program to help their employees pass the exam. Over 2,000 firms, government bodies, universities, and other organizations use Becker, and they trust its ability to prepare students for a career in public accounting. You can actually leverage the fact that you’ve trained with Becker to land a great job! Remember, Becker frequently offers discount codes on their courses as well.

Final Recommendation

All in all, Becker is an excellent course, and you won’t go wrong by giving it a shot. But if you’re still unsure, here’s what you should do: Examine the features of Becker’s and the other review programs that you have shortlisted. If you think that a course that costs much less than the Becker CPA Review Program has everything that you need, then maybe it’s a better choice for you!

But what if you have the money to spend on Becker, or your company is willing to cover your costs? Here’s my advice:

Becker more than justifies its course costs through its many excellent features. For example, you may consider the live classes to be a deciding factor since they’re so hard to find at any other CPA prep company. Many candidates also think very highly of video lectures.

And honestly, when considering something as important as your future career prospects, can you really spend too much?

Becker CPA Coupon Codes & Discounts

Enjoy $1,141 Off Becker CPA Pro+

Take $1,140 Off Becker CPA Pro

Get $1,000 Off Becker CPA Concierge

Becker CPA: Interest-Free Payment Plan – Deal

Becker Deal: Save on CPA Single Part Courses

Get CPA Evolution Ready Content on All Becker CPA Courses – Deal

Becker CPA Advantage Package Now $2,499 – Promo

Enjoy a 14-day Free Trial on Becker CPA Courses

Becker CPA Frequently Asked Questions

🤔 Is Becker CPA good?

Yes! For 60 years, Becker’s CPA exam review courses have helped more than one million CPA exam candidates prepare for and pass this challenging exam. Although its asking price is high, recent additions to its already impressive and comprehensive review courses ensure that you really do get what you pay for.

💲How much is Becker CPA Review?

Becker offers two CPA review course bundles for students to choose from. The Advantage option currently costs $2,499, while the Premium option comes in at $3,099. If you want to upgrade to the super popular Pro plan, that will run you around $3,799. Concierge, the most elite CPA review program to ever exist, carries a price tag of $5,999.

⌚️How long does the Becker CPA Review last?

Becker’s Premium, Pro, and Concierge memberships are unlimited, so you can access your study materials up to your exam and long after you pass. However, their Advantage course only provides 24 months of access.

1️⃣ Which CPA review course is the best?

Surgent, Becker, and Roger all offer compelling benefits depending on what is most important to your study (video content, practice questions, scheduling technology, exam simulations, etc). Every student is different, so use our comparison charts to choose the strongest provider in the most important area to you.