Best Annual Filing Season Program (AFSP) Courses Reviewed & Rated in 2024

Setting yourself apart as a tax preparer during filing season can be tough, which is why the IRS has an Annual Filing Season Program (AFSP) available to certify official tax season preparers.

There are many options available to help you pass and obtain this credential. But with so many courses competing for your business, how do you know which is the most worthwhile?

Keep reading to find out the main highlights of some of the top providers for becoming AFSP certified. Check out the in-depth comparison below and decide which would be the best fit for your personal preferences.

These are the Top 5 Best AFSP Courses in 2024:

- Lambers AFSP

- Gleim AFSP Course

- Surgent AFSP

- Fast Forward Academy AFSP Course

- WiseGuides AFSP Course

#1 Lambers AFSP Courses

Having first started business in 1966 at their Boston location with a class of only 6 students, Lambers has expanded their tools to help students succeed for over 50 years. Today, Lambers is used worldwide for a wide range of test prep needs and held in high regard.

In addition to providing an excellent Annual Filing Season Program course, Lambers has also built a reputation for themselves as one of the premier educational providers for the Enrolled Agent and CPA exams. They also provide Continuing Professional Education (CPE) for tax preparers, which can help you maintain your certification after passing the AFSP exam.

Most importantly, Lambers offers a 2021 AFSP Tax Preparer Bundle for less than $100 (through our exclusive discount!) that features online video courses led at a self-study pacing. These courses are officially registered with the IRS and instructed by a college-level professor. And thanks to this partnership, results are immediately submitted to the IRS once you’ve completed the course!

The bundle provides a comprehensive overview of new developments in regard to tax laws and ethics, as well as optimal practices for tax return preparers. These materials are eye-catching and will help you understand intimidating topics with the most up-to-date information available.

Lambers is more than thorough as a refresher course, clocking in at just about 18 hours total. It’s especially helpful because the examples and illustrations within the course explain key concepts in a way that really makes you feel prepared for the exam. If you’re exempt from the AFTR section of the exam, they also offer a 15-hour refresher to save you some time. Alternatively, you can enroll in the far cheaper AFTR Standalone Course if you’re non-exempt and only need help with this section of the exam.

Frequently Asked Questions

Here are some of the biggest questions we get about Lambers:

Q: Does Lambers have mobile access?

A: Yes! Many of the courses offered by Lambers containing video content and live webinars can be accessed on mobile devices. You can also access study materials such as review PDF files from your phone or tablet.

Q: How effective are the instructors with Lambers?

A: Extremely! Lambers does its due diligence to obtain top level talent from throughout the industry— including college professors. It’s also telling that Lambers offers a no pass, no pay guarantee, so you can feel secure in successfully obtaining your AFSP record of completion either way.

Bottom Line

The successful track record, flexible offerings, and dedication to quality and student success make Lambers an easy choice. In fact, it’s currently the best choice for students looking to obtain their Annual Filing Season Program Certificate of Completion.

#2 Gleim AFSP Courses

Ever since writing and releasing their first CPA Review book in 1974, there’s been no slowing down for the folks over at Gleim. They offer clear, affordable, and adaptable package options for a wide range of accountancy certifications, including the AFSP.

With two options available for meeting AFSP requirements, both are well-priced and offer the user multiple study formats, including live online and on-the-go learning.

Although Gleim’s AFSP courses don’t have any particular bells and whistles when it comes to AFSP requirements, their clarity and simplicity is helpful. As a handy alternative, professionals with an Exempt status can also take a low-priced package to complete their 15 hour requirements, which can save you a boatload of time and money. Speaking of price, Gleim offers a fair rate for both Exempt and Non-Exempt status Tax Preparers.

Frequently Asked Questions

Here are some of the biggest questions we get about Gleim:

Q: Can I access Gleim AFSP Review on my mobile device?

A: Yes! Gleim offers multiple mobile-friendly study formats such as mp3 downloads and webinars, allowing you to take your learning on the go.

Q: How are Gleim’s AFSP professors?

A: Gleim was started by college professors and has maintained extremely high standards for their educators. Rest assured— professors of these courses are experts in their field of study.

Bottom Line

Gleim offers simple yet comprehensive package options at an affordable price— although they’re not as fully featured as the other providers on this list. If you need the latest tax law updates or you’re simply trying to complete your professional education requirements, Gleim isn’t a bad choice!

#3 Surgent AFSP Courses

Formerly known as Surgent McCoy and CPEnow.com, Surgent has helped CPAs obtain certifications for over 30 years. With a vast array of course options and study materials, Surgent stands out as one of the leaders for Continuing Education, especially for those who need an annual federal tax refresher.

Surgent’s online course catalog has hundreds of options for CPAs, though the appeal of their AFSP offerings lies in their clear and segmented topics. While some providers like to lump their teaching topics together, Surgent has a clear breakdown of course topics; this makes it easier to focus on the specific tax law topics you need to cover. Additionally, Surgent’s AFSP courses offer options for both credentialed and non-credentialed preparers, as well as full-access subscription tiers.

Sometimes it’s the little things that matter. But how does this relate to Surgent? Check this out:

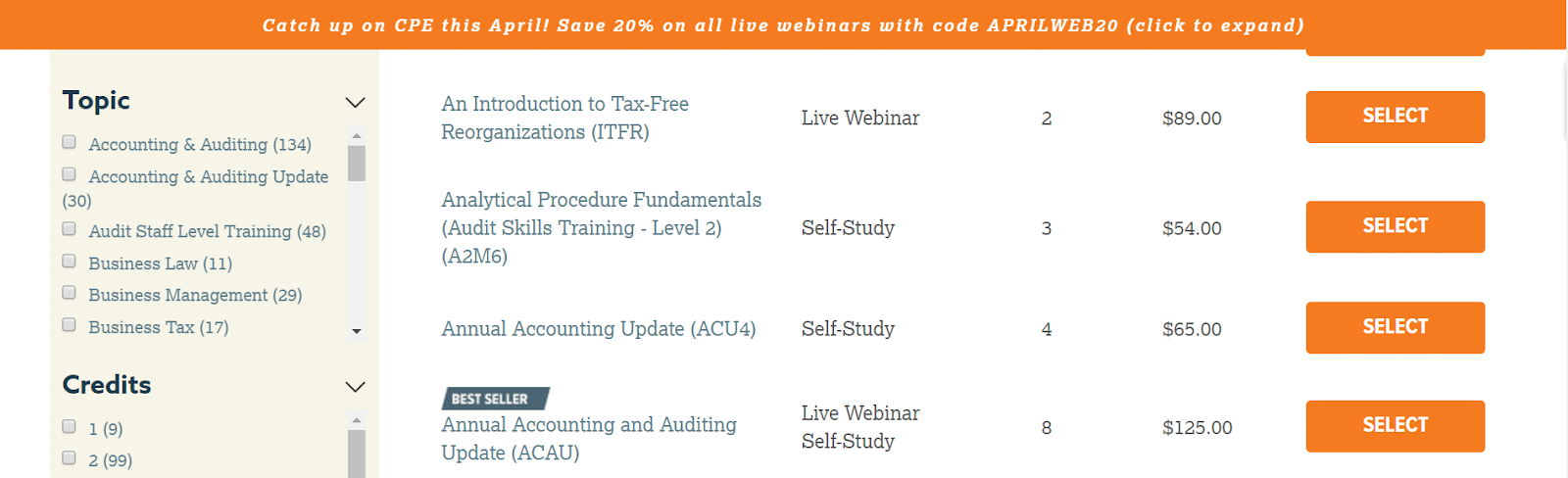

Surgent’s site has many small touches that make for a better user experience overall. Hence, this continuing education course is far more respectful of the average user’s time than many other options. To name one example, Surgent’s search catalog provides you with time-saving filter options such as format, topic, instructor, and even customer ratings.

But this is the best part:

Surgent lists out the course type, credits received, and price right from the search screen with no need to click. This small touch saves you a ton of time when you’re looking for specific credits to meet your requirements. You can even browse a page of Surgent’s instructors with special video introductions to get you a better idea of the skill-level and expertise of their staff. There’s a certain thoughtfulness with Surgent we didn’t see with other providers.

It’s worth mentioning that the package options from Surgent — while ranging in price from a few hundred dollars to just under $800 — won’t grant you access to any of the study materials outside of webinars. Additionally, the lowest-priced options only provide you with a limited number of these. Consequently, not everyone’s budget will allow for Surgent’s highest-priced option, despite this being the most effective at teaching you important lessons on federal tax law. Keep that in mind when weighing your options.

Frequently Asked Questions

Here are some of the biggest questions we get about Surgent:

Q: Does Surgent have mobile access?

A: Surgent’s courses are designed to be mobile friendly and have dedicated support for Android and iOS. CPAs can also utilize Surgent’s flash cards available on digital storefronts like Google Play.

Q: How effective are Surgent’s AFSP instructors?

A: Surgent is clearly proud of their well-curated staff, and with good reason. On their site you will see numerous mentions of their impressive professional experience and speaking awards for their instructors. Naturally, this means that you’ll get a high-quality education from these teachers!

Bottom Line

If you’re looking for a provider that really cares about helping you become a registered tax return preparer, Surgent is a great choice. This platform is well-designed with the student’s point of view always being the main focus. It’s clear they have put a lot of thought into their catalog and you can get a ton of value from their higher tiered access levels.

#4 Fast Forward Academy AFSP Courses

Fast Forward Academy helps tax and accounting professionals further their education with an adaptive online learning platform.

What does that mean for you?

For students, this means that FFA provides you with a simplified, tech-forward approach at an affordable price point.

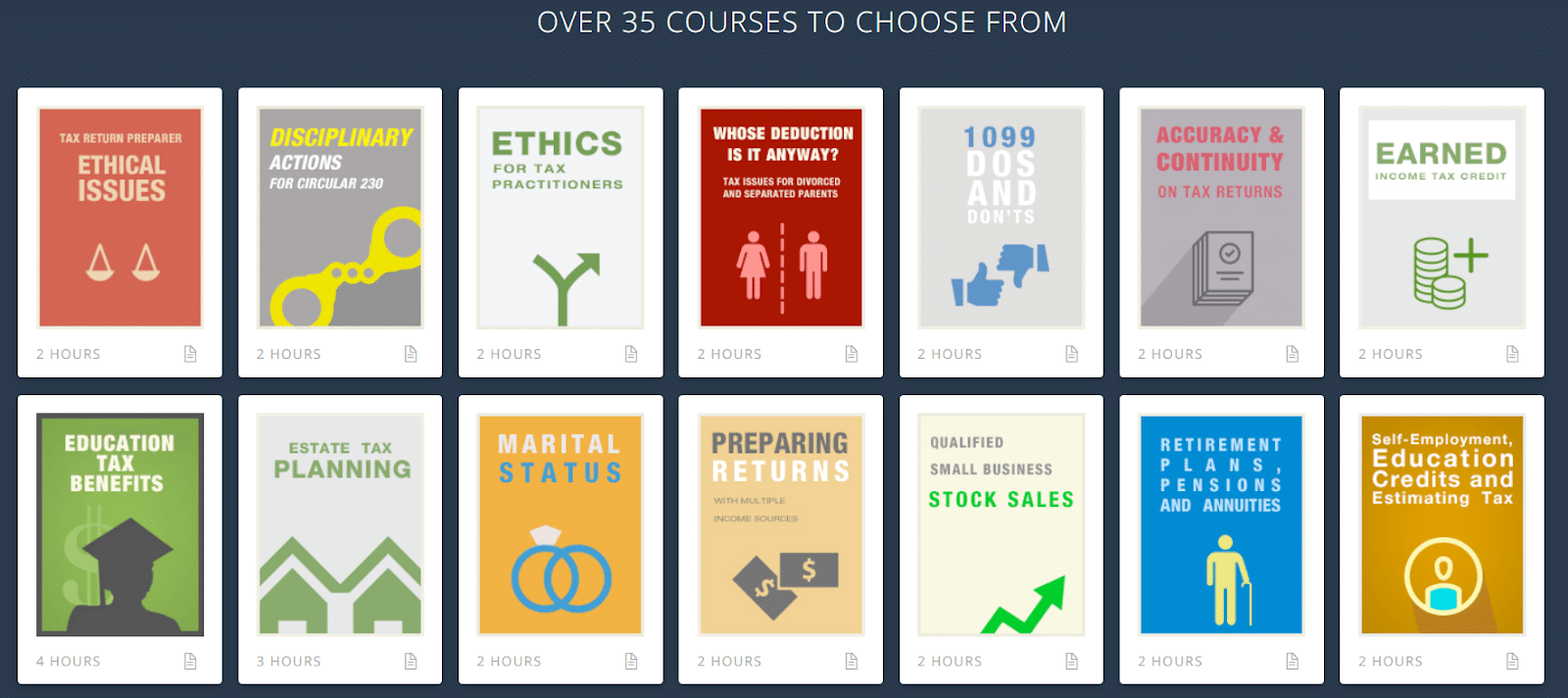

This AFSP education platform doesn’t offer quite as many courses as others listed here. Instead, they focus more on quality over quantity, with about 35 courses in their AFSP Program as well as some enticing add-ons.

How each AFSP package meets your needed requirements to receive your Certificate of Completion is clearly stated front and center. This is just one way that Fast Forward Academy provides fair pricing. Furthermore, they also stand out from the pack by offering a neat graphical representation of each course as opposed to a boring wall of text.

Unfortunately, Fast Forward Academy doesn’t offer as many courses as their competitors. This is because their approach to the IRS Annual Filing Season Program is to be as efficient as possible for their students. However, this means that you might not be able to find an ideal option for your educational needs with FFA.

With packages on their site automatically discounted at the time of writing, you’re looking at a price range of less than $90 if you sign up for one of their AFTR courses. Adding a printed book to your order would run you up to another $60— but even with this added cost you’re still looking at an extremely affordable asking price.

Frequently Asked Questions

Here are some answers to common questions asked about Fast Forward Academy:

Q: Does Fast Forward Academy have mobile access?

A: No. Although they don’t offer a mobile app, you can get a physical study book for on-the-go AFSP review with their highest tier package.

Q: Does Fast Forward Academy have a money back guarantee?

A: Yes! in addition to their access until you pass guarantee, Fast Forward Academy also offers a full refund on all courses within 30 days of your initial purchase.

Bottom Line

If you’re running on a tight budget, Fast Forward Academy is a fantastic option that will get you the materials you need. Check out their carefully curated collection of quality courses to help get your AFSP Certificate of Completion!

#5 WiseGuides AFSP Courses

WiseGuides is an IRS Continuing Education provider with similar options to Fast Forward Academy. What’s neat about them is that they offer a level of customization and personalization for AFSP students at a tempting price point.

Keep reading to see what I mean:

Wiseguides offers a decent selection of courses— although determining which courses apply to which packages can be a bit confusing when you first visit their site. Just remember to scroll all of the way down to the individual courses on offer and then cross-reference them with the packages listed toward the top to ensure your preferred course is included.

In addition to their AFSP courses, WiseGuides also offers Tax Form Workshops.These are created as interactive videos for you to follow as you study. Essentially, these serve as an excellent resource to keep your tax refresher course interesting.

Pricing for these courses range from around $40 on the low end to about $400 on the higher end. Compared to Surgent or Lambers, the high end bundles that grant unlimited access are helpful but excessive; you can get a sufficient education for a reduced rate with those other providers.

Frequently Asked Questions

Curious about WiseGuides and their finer details? Here are some answers to your burning questions:

Q: Does WiseGuides offer additional AFSP study materials?

A: Yes! WiseGuides has a plethora of practice materials in addition to their hours of video content.

Q: Does WiseGuides offer a money back guarantee?

A: Yes. WiseGuides promises that you’ll pass the AFSP test or you’ll get your money back.

Bottom Line

WiseGuides has an appealing combo of affordability and customization. Their Bundle options are highly convenient, but their site is a little cluttered and makes it hard to determine what you’re paying for. Still, this is a solid option for those who don’t mind an extra bit of planning.