In the dynamic world of accounting, where standards, regulations, and technologies are in a constant state of evolution, staying updated can be a daunting task.

Recognizing this challenge, our team of experts at AIS-CPA has delved deep into the industry to bring you a comprehensive list of over 100 pivotal accounting statistics for 2025. Drawing from authoritative sources like Statista, we’ve curated insights spanning global industry trends, job outlooks, technological advancements, and educational prerequisites.

Reddit users often emphasize the significance of accounting. One Reddit discussion highlights that “Accounting is the grease that runs through the entire economy and keeps it moving.” Another Reddit post points out the critical role accountants play in providing controls for businesses and ensuring transparency and accuracy.

Whether you’re an accountant, finance professional, student, or just someone keen on understanding the financial world better, this article promises to be a valuable resource. Our expert team has sourced each one to help you stay informed and gain a deeper understanding of the ever-evolving accounting landscape.

Top Accounting Firm Statistics

1. In 2022, Deloitte was the largest accounting firm in the United States.

With a revenue of almost 60 billion U.S. dollars, Deloitte leads the Big Four as the largest accounting firm in the U.S. This reflects Deloitte’s continued success in the accounting industry, as well as its ability to adapt to new market trends and challenges.

Source: Statista

2. 2022 was an extraordinary year for Accounting Today’s Top 100 Firms, with a staggering average growth rate of 18.55%.

Technological advancements, innovative strategies, and an increased demand for specialized services fueled this growth. This trend is expected to continue, with firms adapting to changing client needs and market conditions to achieve even greater success in the coming years.

Source: Accounting Today

3. In 2022, PwC had the second-highest number of partners and the second-highest revenue of the leading accounting firms in the United States.

PwC’s success in securing the second spot in both partner count and revenue indicates its strong market presence and client base in the U.S. market.

Source: (Statista)

4. The median cost for an accounting firm to hire a CPA is $1,633.

While this cost may seem high to some individuals or businesses, hiring a certified public accountant can ultimately save money in the long run. This is because CPAs are experts in tax laws and regulations and can help maximize tax savings and avoid costly mistakes.

Source: Zippia

5. Small firms were more likely to expect flat or declining growth in 2023— but were also more likely to expect double-digit growth.

Despite small firms being more likely to anticipate flat or declining growth in 2023, they also exhibited an optimistic outlook, as they were more inclined to anticipate double-digit growth in the future. This suggests that while smaller businesses may face challenges, they remain resilient and optimistic about their potential for significant expansion in the coming year.

Source: Zippia

In 2023, accounting departments likely will face challenges in four areas: budget uncertainty, creating sound estimates in an uncertain environment.

Forbes

6. The accounting industry in the U.S. was forecasted to have produced over $141 billion in revenue in 2022.

This represents a growth rate of 4.9% from the previous year, according to IBISWorld. The growth was driven by increased demand for tax services and consulting services related to mergers and acquisitions and cybersecurity.

Source: Zippia

7. New York, NY, has the highest demand for certified public accountants, with hundreds of job openings.

With its status as a global financial center and home to many large corporations, it’s no surprise that New York City is a hotbed for accounting jobs. But, in addition to job openings at big firms, there are also opportunities for CPAs to work at startups and small businesses in industries such as technology, fashion, and hospitality.

Source: Zippia

8. 76% of staff accountants have a bachelor’s degree.

This highlights the importance of obtaining a college education in the accounting field. Furthermore, many accounting firms and companies require a bachelor’s degree as a minimum requirement for employment, making it a highly competitive field for those without a degree. Additionally, pursuing higher education or accounting certifications such as a CPA or CMA can open up more career advancement opportunities and higher salaries.

Source: Zippia

9. Accountants rate their career happiness 2.6 out of 5 stars, putting them in the bottom 6% of careers.

While accountants may rate their career happiness relatively low at 2.6 out of 5 stars, there is plenty of room for improvement and the potential for job satisfaction to increase with the right opportunities and work environment. By identifying areas for improvement and focusing on creating a positive workplace culture, accountants can work towards achieving greater job satisfaction and overall happiness in their careers.

Source: Career Explorer

10. Although accountants as a whole might rate their happiness low on the totem pole, Indeed Career Guides ranks finance management as one of the happiest careers (with an average salary of $95,798).

Finance managers are considered one of the happiest careers because they often have high salaries and job stability, which can provide financial security and peace of mind. Additionally, they can use their analytical and problem-solving skills to help their companies make informed financial decisions and achieve success.

Source: Indeed Career Guides

11. Over 478,783 certified public accountants are currently employed in the United States, making it a highly competitive field to break into.

However, joining the fold is not out of your reach, even if you’re still working on passing the CPA exam. CPA review programs are crucial for aspiring accountants, as they provide the necessary preparation and knowledge to pass the rigorous CPA exam and enter the field as a certified public accountant.

Source: Zippia

12. 56.8% of all employed certified public accountants are women, while 43.2% are men, indicating a shift towards greater gender equality in the profession.

This increase in female representation is likely due to efforts by accounting firms to diversify their workforce and create a more inclusive workplace.

Source: Zippia

13. The average age of an employed certified public accountant is 43, showing that the profession has a relatively experienced and mature workforce.

This also indicates that the field attracts mid-career professionals who may have pursued accounting later in life or have switched careers.

Source: Zippia

14. The most common ethnicity of certified public accountants is White (64.0%), followed by Asian (12.4%), Hispanic or Latino (10.8%), and Black or African American (8.5%), indicating that the profession still has a long way to go in terms of diversity and inclusion.

Efforts have been made recently to increase diversity in the accounting profession, such as scholarship programs aimed at underrepresented groups and mentorship opportunities for aspiring accountants from diverse backgrounds. The industry needs to continue to prioritize diversity and inclusion to better reflect the communities it serves.

Source: Zippia

15. Washington, D.C. is a hub for certified public accountants, having the highest average annual wage for accountants and auditors at $109,480.

This is due to its high average annual wage, low unemployment rate, and numerous job opportunities within the federal government. Additionally, the area is home to many accounting firms and organizations, making it a hub for the profession.

Source: Zippia

16. In 2021, women earned 92% of what men earned, suggesting that there is still a significant gender pay gap in the accounting industry.

This gap is even wider for women of color, who earn even less on average than their white female counterparts. Therefore, addressing the gender pay gap in accounting and improving diversity and inclusion in the profession should remain priorities for the industry.

Source: Zippia

17. Certified public accountants are 81% more likely to work at private companies than public companies, indicating that most accounting work in the US is done in the private sector.

This trend is likely due to the fact that private companies often have more accounting needs than public ones and may require more specialized services from CPAs. Additionally, private companies tend to offer more competitive salaries and benefits packages to attract top accounting talent.

Source: Zippia

18. The number of accountants remains steady, with 1.3 million people filling roles as accountants and auditors in the U.S.

Despite rapid technological advancements in the accounting industry, the number of accountants in the U.S. has remained relatively constant over the years. As of 2023, the country had approximately 1.3 million accountants and auditors, showcasing the continued demand for accounting professionals in various industries and sectors.

Source: Statista

19. 81,800 is the number of accounting jobs the Bureau of Labor and Statistics estimates to be added to the workforce between 2021-2031.

This projected growth is due to increased demand for specialized accounting services such as forensic accounting, international tax planning, and information technology consulting. In addition, as the economy continues to grow, the need for skilled accountants is expected to rise, making it a promising career path for those entering the job market.

Source: BLS

20. It takes between 36 and 42 days for a firm to fill the average accounting role in the US.

This lengthy hiring process can be attributed to the high demand for qualified accountants and the rigorous screening process companies conduct to ensure they hire the right candidate.

Source: BLS

21. The percentage of minority partners at the top 100 firms increased from 9% in 2019 to 11% in 2020.

This increase signifies a significant stride towards fostering diversity and inclusion within the legal profession, reflecting a collective effort to bridge gaps and create a more equitable landscape for underrepresented communities.

Source: BLS

22. The percentage of firms that offer remote work options increased from 78% in 2019 to 98% in 2020 due to the COVID-19 pandemic.

This unprecedented transformation not only demonstrated the resilience of firms but also highlighted their commitment to adapting to extraordinary circumstances, prioritizing employee well-being, and embracing innovative approaches to maintain productivity in an ever-changing world.

Source: Journal of Accountancy

23. In 2023, the top five skills that accounting firms are looking for in new hires are analytical skills, communication skills, technology proficiency, critical thinking skills, and adaptability.

Accounting firms in 2023 are keen on recruiting individuals with a strong foundation in certain skills (not just education), as they play a vital role in providing accurate financial insights and informed decision-making.

Source: Accounting Today

2023 Accounting Statistics from Deloitte’s Global Millenial Survey

50% of millennials believe businesses are not behaving ethically, while 61% believe business leaders have failed to address societal challenges.

Only 33% of millennials believe that their organization is prepared for the challenges of automation and artificial intelligence.

51% of millennials believe climate change is the most pressing global issue, followed by income inequality (27%) and political instability (22%).

Because of economic factors, 37% of millennials have delayed a major life decision, such as starting a family or buying a home.

53% of millennials believe that remote work options provide better work-life balance, while only 40% of Gen Z feel the same way.

45% of millennials feel that the COVID-19 pandemic has negatively impacted their financial situation.

76% of millennials believe that businesses have the power to solve the world’s most pressing challenges, and 85% believe that businesses should prioritize making a positive impact on society over generating profits.

62% of millennials believe that their organization’s purpose goes beyond making a profit.

57% of millennials believe that diversity and inclusion should be a business priority.

More Deloitte Insights

42% of millennials believe their mental health deteriorated during the COVID-19 pandemic.

75% of millennials believe that the government needs to do more to protect the environment.

Only 36% of millennials believe that they are currently paid relatively well.

70% of millennials say they would be willing to take a pay cut to work for a company that shares their values.

49% of millennials believe the pandemic has negatively affected their career progression.

54% of millennials say they have experienced or witnessed bullying in the workplace.

Statistics from KPMG’s Global Business Outlook Survey:

88% of business leaders believe the world economy will improve or stay the same over the next year.

82% of CEOs are concerned about a potential cyberattack on their organization.

64% of CEOs believe climate change presents a significant risk to their organization’s growth prospects.

53% of CEOs plan to increase innovation investment over the next three years.

49% of CEOs are concerned about key skills and talent availability in their industry.

48% of CEOs say talent risk is one of the biggest threats to their organization’s growth prospects.

47% of CEOs plan to increase headcount over the next 12 months.

Finally, 40% of CEOs believe that increasing regulation and scrutiny is the key to their organization’s growth prospects.

36% of CEOs say geopolitical uncertainty is one of the most significant risks to their organization’s growth prospects.

31% of CEOs expect M&A activity in their industry to increase over the next 12 months.

More Accounting Stats

It takes between 36 and 42 days for a firm to fill the average accounting role in the US.

Source: KPMG’s Global Business Outlook Survey

This lengthy hiring process can be attributed to the high demand for qualified accountants and the rigorous screening process companies conduct to ensure they hire the right candidate.

Source: Zippia

Small businesses spend $1,105 per certified public accountant on training each year; large companies spend $658.

This difference in training expenditure between small and large companies can be attributed to various factors, such as the scale of operations, available resources, and the level of expertise required by the certified public accountant. However, investing in ongoing training and development is crucial for ensuring that certified public accountants stay up-to-date with the latest industry trends, regulations, and technologies.

Source: Zippia

A new accounting employee takes approximately 12 weeks to reach full productivity levels.

During these 12 weeks, new accounting employees typically undergo training, get familiarized with the company’s accounting systems, and establish relationships with colleagues and clients. This onboarding period is crucial for setting up new hires for long-term success and ensuring that they can handle their duties and responsibilities effectively.

Source: Zippia

Top accounting executives make a mean hourly wage of $75.22.

Executives in the accounting field are among the highest-paid professionals, earning an average annual salary of over $156,000. However, salaries can vary based on industry, location, and years of experience.

Source: BLS

Financial managers make more than most accounting professionals, earning $177,880 a year on average.

While financial managers’ and accountants’ career paths and day-to-day responsibilities can vary widely, many accountants are shifting to financial management.

Source: BLS

Many finance majors are also becoming financial analysts as their yearly average grows to $95,570 with just a Bachelor’s Degree.

As the finance industry grows, financial analysts are in high demand, with an estimated 5% job growth rate from 2021 to 2031. Additionally, financial analysts with a Master’s degree or higher can earn even higher salaries, with an average yearly salary of $130,000 or more.

Source: BLS

Pipeline Transportation and Crude Oil remain one of the top-paying industries for accountants, with $123,000 being the average annual salary.

This indicates that accountants with expertise in this industry are in high demand. It also suggests that companies in this sector recognize the value of financial expertise and are willing to invest in top talent.

Source: BLS

Securities and Commodities is another industry where finance professionals excel and bring in 108k on average.

This high average salary in the Securities and Commodities industry reflects the complex nature of financial instruments and the demand for skilled professionals who can navigate this landscape. Moreover, it is expected that, with the growth of digital financial assets and the rise of fintech, the demand for accounting professionals in this industry will continue to increase in the coming years.

Source: BLS

Salaries have increased by 8% for certified public accountants in the last five years.

This salary increase may reflect the demand for skilled accounting professionals as businesses continue to grow and expand. Additionally, it could also reflect the increasing complexity of financial regulations and tax laws, which require specialized knowledge and expertise from certified public accountants.

Source: BLS

Employment of actuaries is projected to grow 21 percent from 2021 to 2031, much faster than the average for all occupations.

This growth is driven by the increasing need for businesses and organizations to manage financial risk and uncertainty. As a result, actuaries will be in high demand for data analysis and insights to help companies make informed decisions about managing their risks.

Source: BLS

AI is infiltrating accounting, recently achieving the 93rd percentile in an accounting hiring test and acing Wharton’s MBA exam as well.

While AI is undoubtedly impacting the accounting field, it’s worth noting that it doesn’t completely replace the need for human accountants. AI may excel in certain areas, such as data analysis and automation, but it still requires human oversight and interpretation.

Source: Accounting Today

ChatGPT failed the CPA Exam, which was put to the test by Accounting Today in April 2023. Its average score came in at 42%.

Although ChatGPT is taking most industries by storm, it’s important to note that ChatGPT is an AI language model and not a human being, so it has a different ability to study and prepare for the exam than human candidates do. So CPA candidates will still need to invest in CPA prep courses for now.

Source: Accounting Today

The majority of accountants (54%) provide clients with a faster service thanks to technology,

This statistic highlights the importance of technology in the accounting industry and its impact on client satisfaction. With the help of technology, accountants can automate mundane tasks and focus on providing value-added services to their clients, such as financial analysis and strategic planning. This is something we have to embrace.

(Devesh Jain, LinkedIn): “Automation and AI have been transforming the accounting industry for several years now, and this trend is only going to continue in 2023.” Source

Source: Sage research

8% of firms expect growth in the high single digits in 2023

Source: Accounting Today

Accounting Today 2021 Top 100 Firms Survey

63% of AP (Accounts Payable) teams surveyed consider automation and process improvement as their top priorities for 2022.

60% of respondents say their AP workload has increased in the past year.

54% of AP teams surveyed said their companies had been affected by the pandemic-related supply chain disruptions.

52% of AP teams report challenges in managing invoice exceptions.

47% of AP teams surveyed consider compliance to be a top challenge.

43% of AP teams consider managing vendor relationships as a critical challenge.

38% of respondents said their organizations experienced increased fraud or attempted fraud in the past year.

35% of AP teams are looking to implement or expand electronic payments to vendors.

31% of respondents said their organization experienced cash flow challenges in the past year.

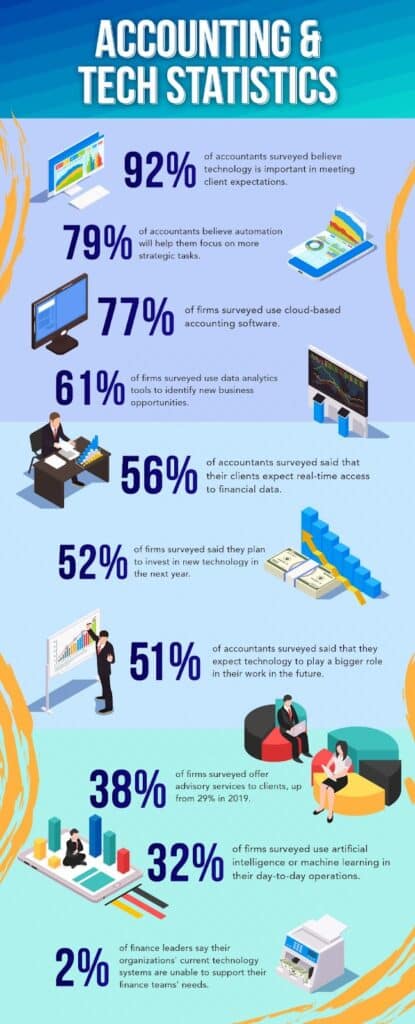

Stats from the Sage Research Report: The Practice of Now 2020

- 92% of accountants surveyed believe technology is important in meeting client expectations.

- 79% of accountants believe automation will help them focus on more strategic tasks.

- 77% of firms surveyed use cloud-based accounting software.

- 61% of firms surveyed use data analytics tools to identify new business opportunities.

- 56% of accountants surveyed said their clients expect real-time access to financial data.

- 52% of firms surveyed said they plan to invest in new technology in the next year.

Case Study: The Rise of Data Analytics in Accounting

Background: In recent years, the accounting industry has seen a significant shift towards data-driven decision-making. With the increasing complexity of financial transactions and the vast amount of data generated, accountants are now leveraging advanced data analytics tools to provide more valuable insights to their clients.

Situation: A mid-sized accounting firm, ABC Accountants, was struggling to keep up with the demands of their clients. Their traditional methods of analyzing financial data were time-consuming and often led to missed opportunities for their clients.

Action: ABC Accountants decided to invest in sophisticated data analytics tools. They trained their staff on these tools and integrated them into their daily operations. This allowed them to analyze large datasets quickly, identify patterns, and provide actionable insights to their clients.

Result: Within a year, ABC Accountants saw a 25% increase in client satisfaction. Their clients appreciated the timely and valuable insights provided, which helped them make informed financial decisions. The firm also saw a 15% increase in revenue as they were able to take on more clients due to the efficiencies gained from using data analytics tools.

Conclusion: The case of ABC Accountants highlights the importance of embracing technological advancements in the accounting industry. By leveraging data analytics, accounting firms can provide more value to their clients and stay competitive in the market.

More Sage Stats:

- 51% of accountants surveyed said that they expect technology to play a bigger role in their work in the future.

- 38% of firms surveyed offer advisory services to clients, up from 29% in 2019.

- 32% of firms surveyed use artificial intelligence or machine learning in their day-to-day operations

- 54% of finance executives believe their organization’s IT infrastructure is not ready to support their future needs.

- 57% of finance executives say they are investing in new technologies to enable better real-time reporting and analysis.

- 49% of finance executives say they are investing in new technologies to improve data accuracy and completeness.

More Stats From the Sage Report

- 84% of finance leaders say their organizations will continue to invest in digital transformation in response to the COVID-19 pandemic.

- 86% of finance leaders say their organization’s digital transformation initiatives have accelerated over the past year.

- 59% of finance leaders say their organizations are experiencing a skills gap in finance due to the industry’s changing landscape.

- 52% of finance leaders say their organizations’ current technology systems cannot support their finance teams’ needs.

- 57% of finance leaders say they believe their organizations can benefit from adopting artificial intelligence (AI) and machine learning technologies.

- 63% of finance leaders say their organizations have implemented or plan to implement automation technologies in the finance function.

- 70% of finance leaders say their organizations have increased their focus on data analytics to drive business decisions.

- 83% of finance leaders say their organizations can benefit from improving collaboration between finance and other departments.

- In 2020, the top three concerns of CPA firms were: talent management (26%), keeping up with technology (23%), and keeping up with tax laws and regulations (22%).

- In the same survey, 74% of CPA firms reported using data analytics in their work.

- According to the AICPA’s 2020 Trends in the Supply of Accounting Graduates and Demand for Public Accounting Recruits report, enrollment in undergraduate accounting programs increased by 3% in 2019, the highest increase in five years.

- However, the same report found that public accounting firms’ demand for new accounting graduates declined by 5% in 2019, the first decline in six years.

- The 2020 AICPA National CPA Financial Literacy Commission survey found that 62% of American adults couldn’t pass a basic financial literacy test.

- In a 2020 survey of CPA financial planners, 61% reported increased clients seeking retirement planning advice due to the COVID-19 pandemic.

Growth and Revenue in the Accounting Industry

- Rise of the Big Four: In recent years, the Big Four accounting firms have seen substantial growth, with Deloitte leading the pack in the U.S. with a revenue nearing 60 billion U.S. dollars.

- Industry Revenue: The U.S. accounting industry was projected to generate over $141 billion in revenue in 2022, marking a 4.9% growth from the previous year.

- Growth Predictions: The Bureau of Labor and Statistics anticipates the addition of 81,800 accounting jobs between 2021-2031.

- Firm Growth: In 2022, Accounting Today’s Top 100 Firms experienced an impressive average growth rate of 18.55%.

- Small Firm Outlook: While small accounting firms had reservations about growth in 2023, many remained optimistic about potential double-digit growth.

Employment and Demographics in Accounting

- Gender Distribution: The accounting profession is seeing a shift towards gender equality, with 56.8% of all employed CPAs being women.

- Ethnicity Breakdown: While the majority of CPAs are White (64.0%), there’s a growing representation of Asian (12.4%), Hispanic or Latino (10.8%), and Black or African American (8.5%) professionals.

- Age Factor: The average age of an employed CPA is 43, indicating a mature and experienced workforce.

- Job Demand: New York City stands out as a hotspot for accounting jobs, given its status as a global financial hub.

Technological Advancements in Accounting

- AI in Accounting: Recent tests have shown that AI, while advanced, still has a way to go in the accounting field. For instance, AI scored in the 93rd percentile in an accounting hiring test.

- Impact of Technology: 54% of accountants have reported that technology has enabled them to provide faster services to their clients.

- Automation and Process Improvement: 63% of Accounts Payable teams have identified these as their top priorities for the upcoming year.

Education and Training in Accounting

- Educational Background: A significant 76% of staff accountants possess a bachelor’s degree, emphasizing the importance of higher education in the field.

- Training Costs: Small firms spend an average of $1,105 annually on training for each CPA, while larger companies spend around $658.

- Onboarding Time: A new accounting employee typically takes about 12 weeks to achieve full productivity.

Challenges and Opportunities in Accounting

- Remote Work Trend: The COVID-19 pandemic saw a surge in remote work options, with 98% of firms offering this flexibility in 2020.

- Gender Pay Gap: In 2021, women in accounting earned 92% of what their male counterparts earned, highlighting an existing gender pay disparity.

- Diversity Efforts: The percentage of minority partners in the top 100 firms increased from 9% in 2019 to 11% in 2020.

Commitment to Current Information: At the Accounting Institute of Success, we understand the dynamic nature of the accounting industry and the importance of staying abreast with the latest trends and data. To ensure our readers always have access to the most recent and relevant statistics, we are committed to updating this page on a regular basis, either annually or bi-annually. This dedication not only guarantees that you’re always equipped with up-to-date information but also underscores our promise to be a reliable and trusted resource. We encourage you to bookmark this page and revisit it periodically to stay informed and ahead in the ever-evolving world of accounting.

Additional Resources:

- American Institute of Certified Public Accountants (AICPA): A professional organization for certified public accountants in the U.S. They often publish research and statistics related to the accounting profession.

- Bureau of Labor Statistics (BLS): The U.S. government’s principal fact-finding agency for labor market activity, working conditions, and price changes in the economy. They provide detailed statistics on the accounting profession.

- Financial Accounting Standards Board (FASB): An independent organization that establishes financial accounting and reporting standards in the U.S.

- National Association of State Boards of Accountancy (NASBA): An organization that serves as a forum for the U.S. Boards of Accountancy, which administer the Uniform CPA Examination. They often release data and trends about CPA exam takers.