Historically, the average CPA exam passing rates for each section have been around 50 percent. According to the AICPA, at least half of the CPA candidates who take the Certified Public Accountant exam each quarter fail their exam part.

This isn’t an encouraging statistic by any means if you are looking to take the exam, but don’t give up. There’s hope!

Let’s look at the passing rate for all four sections of the CPA exam and shed some light on the trends!

- 1.Becker CPA Review Course: Rated the #1 Best CPA Review Course of 2024

- 2.Surgent CPA Prep Course: Best Technology

- 3.Gleim CPA Review Course: Largest Question Bank

Overview

Latest CPA Exam Pass Rate

2019 Pass Rates by Exam Section

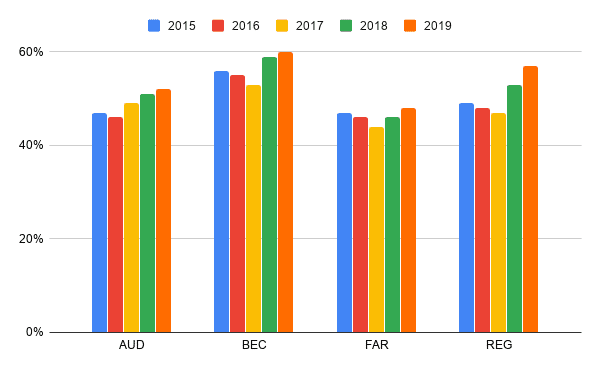

| Section | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

| AUD | 48% | 55% | 52% | 48% |

| BEC | 58% | 59% | 63% | 59% |

| FAR | 44% | 49% | 50% | 41% |

| REG | 50% | 58% | 58% | 56% |

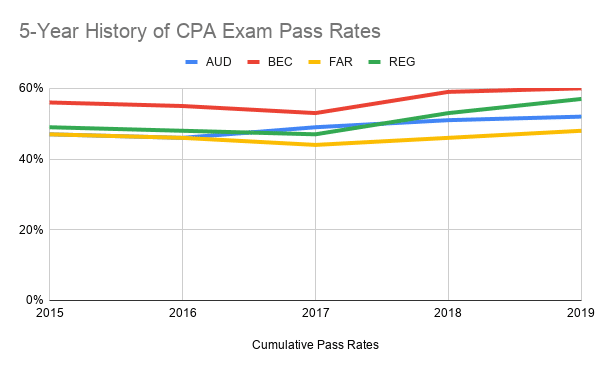

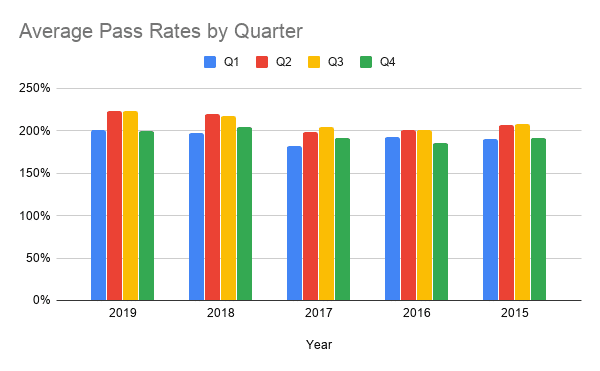

Here’s an overview of all the sections’ scoring for the last seven years. You can see that there have been some ups and downs, but the overall it has been pretty consistent.

Takeaway: The FAR is the hardest part of the CPA exam.

Takeaway: Pass rates for each of the sections has increased (great news!). The improvement in CPA review courses over the years is definitely a factor in this increase in pass rates.

With the new 2017 exam changes and the updates to the Exam Blueprint, there’s bound to be a slight decrease in score release results over the next few quarters until CPA exam candidates get the hang of the new testing layout.

Let’s look at each individual exam section.

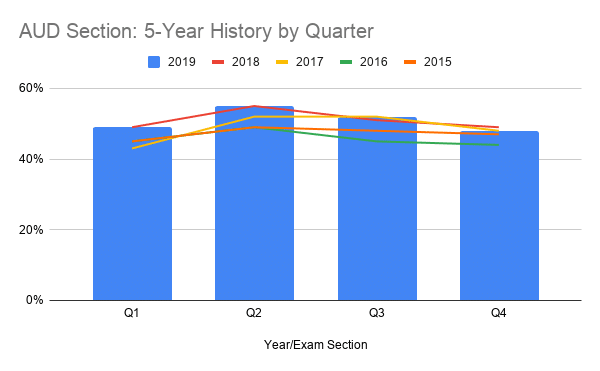

AUD Passing Rates

Here’s a graph of the Audit exam passing rates for the last 5 years.

As you can see, there is a slight downward trend in AUD scores over the past several years. Surprisingly, AUD is the lowest scoring exam section out of the four. This might have to with the theoretical and vague nature of most auditing and attestation questions compared with other subjects.

Auditing tends to be more judgment based instead of clear-cut like other exams. For instance, there is only one correct tax deduction amount of REG. It’s not debatable. Whereas, AUD answers can be misinterpreted and misunderstood.

Get Discounts On CPA Review Courses!

Flash Sale – $1,350 Off Surgent CPA Ultimate Pass

Enjoy $1,200 Off Surgent CPA Ultimate Pass

Enjoy $1,140 Off Becker CPA Pro

Take $1,110 Off Surgent CPA Ultimate Pass

Take $1,050 Off Gleim CPA Premium Pro Course

Get $1,000 Off Becker CPA Concierge

Becker CPA: 0% Interest Payment Plan

Save on Becker CPA Single Part Courses

Take $1,500 Off Surgent CPA Ultimate Pass

Get CPA Evolution Ready Content on All Becker CPA Courses

Sale – Becker CPA Premium Package Now $3,099

Becker CPA Advantage Package Now $2,499 – Promo

Enjoy a 14-day Free Trial on Becker CPA Courses

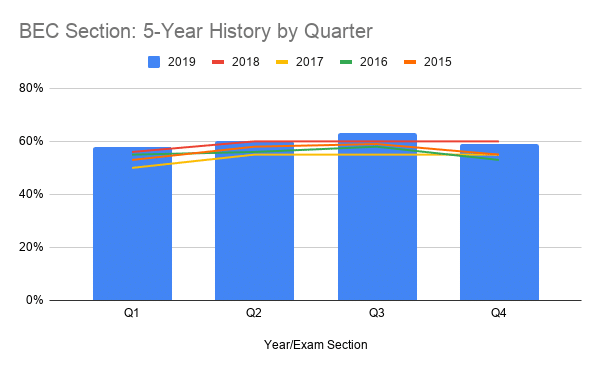

BEC Passing Rates

Here’s a graph of the Business Environment and Concepts exam passing rates for the last 5 years.

In the past 5 years, candidates have performed better on BEC than any other exam. This is somewhat surprising in that many candidates tend to struggle with the written communication simulations on BEC. This CPA exam section is the least technical, however.

This increasing trend is a great morale booster for candidates getting ready to sit for BEC. It has the highest pass rates since 2010!

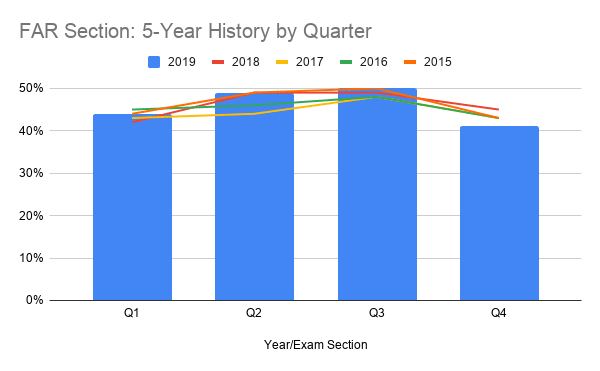

FAR Passing Rates

Here’s a graph of the Financial Accounting and Regulation exam passing rates for the last 5 years.

There’s a slight downward trend, but nothing that is too serious. FAR is the longest and most technical of all the exams, so you would expect it to have somewhat of a negative scoring trend. The high score in 2016 was only 48%. This is the lowest high in the past seven years.

The 2017 FAR exam will probably show some changes, however. Since the AICPA is moving away from multiple-choice questions, candidates will have to practice the simulations more. Unfortunately, this is bad news for a lot of candidates who are good at MCQs.

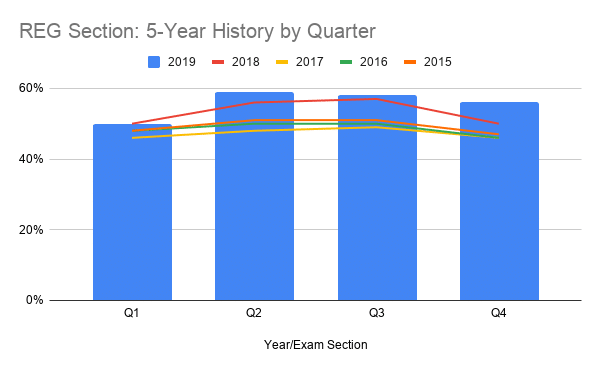

REG Passing Rates

Here’s a graph of the Regulation exam passing rates for the last 5 years.

Regulation scores have been pretty stable over the past several years. This trend might be explained by the lack of information changes in the exam. Unlike FAR where additional IFRS information keeps creeping into the exam, REG consistently focuses on federal taxation.

Conversely, the tax code is always changing. Thus, the material covered on the Regulation section is always changing as well. Many candidates also find this section difficult because it involves a lot of memorization with very little logical connections. For example, there is no reason why the standard deduction is its current amount. You just have to know it.

Why is There a Seasonal Trend?

I’m sure you have noticed that all of these graphs look similar with a huge drop in the fourth quarter scores. No, the AICPA doesn’t make the exam really hard in the 4th quarter and easier in the 2nd and 3rd quarters. Nor is there some conspiracy from the National Association of State Boards of Accountancy (NASBA) to lower CPA pass rates at the end of the year. The exam is the same all year.

I think the difference in scoring is simply because people are busier during the holiday season in the 4th quarter and don’t put in enough time to study, so they perform poorly.

I passed FAR and BEC in the 4th quarter. My passing score letter was the best Christmas present I could have asked for that year. 🙂

Exam Schedule and Pass Rate Trends

Should I schedule my exam based on the pass rate trends? The obvious answer to that is, no. The exam is the same all year. You should schedule exams based on your own personal schedule and ability to put in the study time.

For instance, if you work in public accounting, the first quarter might not be a good quarter to take a section. You’ll be too busy during tax season to study. It would be a better idea to wait until the summer down months to knock out a few sections.

Trends don’t matter. You need to focus on yourself and what you are able to do.

How to Increase Your CPA Exam Score and Pass Rate

The best piece of advice I can give you to increase your score and CPA exam passing rate is to get a proper CPA review course and stick with it. The easiest and fastest way to pass the exam is the get a CPA study guide that matches your learning style and simply go through it.

Stay dedicated and work through your materials and you will be prepared on your exam day. If you haven’t picked out a review course yet, look at my reviews. I review all the top-rated courses, so you can find one that will work for you.