The FAR (Financing Accounting and Reporting) section of the CPA exam covers topics like GAAP, financial statements, financial transactions, and reporting for non-profits. Many candidates consider the CPA FAR exam to be the most challenging of the four because of its length and scope of information covered on the test.

The FAR CPA exam is also difficult because it tests your understanding of financial reports, statement presentation, and significant business transactions using GAAP, IFRS, and Governmental Accounting systems. It’s also common to see topics like employee benefits, transfers, compiling operations and research costs, calculating fair value figures, and correcting errors in transactions on the exam as well.

Needless to say, there’s a ton of information covered on this test. Let’s look at how it’s formatted and what you need to do to pass FAR.

- 1.Becker CPA Review Course: Rated the #1 Best CPA Review Course of 2024

- 2.Surgent CPA Prep Course: Best Technology

- 3.Gleim CPA Review Course: Largest Question Bank

What’s on the FAR CPA Exam Section?

How Long is FAR?

The FAR section is a four hour exam.

FAR Topic Areas & Concepts Tested

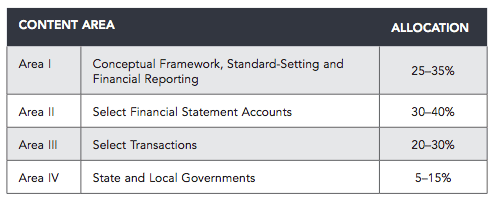

Conceptual Framework and Financial Reporting: 25% – 35% – these topics cover different aspects of standard setting, understanding of financial statements, and several reporting. You should be familiar with the financial reporting process for both nongovernmental and non-profit organizations.

Financial Statement Accounts: 30% – 40% – these topics include the evaluation of balance sheet, income statement, cash flow statement, and statement of retained earnings accounts as well as transactions that affect these accounts.

Transactions: 20% – 30% – will cover computation and recognition of certain operations and items on the statement like contingencies, leases, etc.

State and Local Governmental Accounting: 5% – 15% – these topics typically cover generalized and very non-specific overviews of fund accounting and governmental accounting in general.

FAR CPA Exam Format and Structure

FAR starts with 2 multiple-choice testlets containing 33 multiple-choice questions. After these testlets are completed, you will be allowed to take an optional 15 minute break. This break won’t count against you testing time like if you were to take a break in the middle of your exam. Keep in mind, you don’t have to take this break if you don’t want to.

After the break, you will start the second two testlets containing eight task-based simulations.

FAR Exam Section Structure

| FAR Exam Section | 2016 CPA Exam | 2017 CPA Exam |

|---|---|---|

| Multiple-Choice Questions | 90 | 66 |

| Task-Based Simulations | 7 | 8 |

| Written Communication | 0 | 0 |

Section Format

| Testlets | Question Sets |

|---|---|

| Testlet #1 | 33 Multiple-Choice Questions |

| Testlet #2 | 33 Multiple-Choice Questions |

| Testlet #3 | 2 Task-Based Simulations |

| Testlet #4 | 3 Task-Based Simulations |

| Testlet #5 | 3 Task-Based Simulations |

CPA FAR Exam Tip: Mark the multiple-choice questions you can’t decide on and move on. Don’t spend too much time on one question. You can always review the flagged questions before you submit the testlet.

Get Discounts On CPA Review Courses!

Flash Sale – $1,350 Off Surgent CPA Ultimate Pass

Enjoy $1,200 Off Surgent CPA Ultimate Pass

Enjoy $1,140 Off Becker CPA Pro

Take $1,110 Off Surgent CPA Ultimate Pass

Take $1,050 Off Gleim CPA Premium Pro Course

Get $1,000 Off Becker CPA Concierge

Becker CPA: 0% Interest Payment Plan

Save on Becker CPA Single Part Courses

Take $1,500 Off Surgent CPA Ultimate Pass

Get CPA Evolution Ready Content on All Becker CPA Courses

Sale – Becker CPA Premium Package Now $3,099

Becker CPA Advantage Package Now $2,499 – Promo

Enjoy a 14-day Free Trial on Becker CPA Courses

Multiple-Choice Questions

Ther are two multiple choice testlets in FAR. Each testlet contains 33 multiple-choice questions. The first set of questions will be medium difficulty questions to gauge your understanding of the topics and concepts. If you do well on them, the second set will be more advanced questions. If you do poorly on the first set, you will get an even easier set for the second testlet. It sounds weird, but you want the harder questions. One correctly answered hard question is worth more than several correctly answered easy questions.

Out of the 66 total MCQs, 54 will be count toward your score and 12 will be pretest questions that won’t count against you.

FAR CPA Tip: Don’t second guess your answer. More times than not, your first thought or gut reaction is correct. Second guessing yourself can lead to changing correct answers. Trust your gut!

Task-Based Simulations

The second two simulations are consist of 8 task-based simulations. These simulations are formatted in several different ways from matching to fill-in-the-blank. There will also be one research question where you will be required to cite the authoritative literature to answer a questions.

Most simulations are graded by computer and may involve the test-taker completing journal entries but can involve an array of tasks based on example case studies. Seven of these simulations are operational and 1 is pretest.

Testlet and Simulation Time Length

You have to manage your own time while completing their exam. Thus, you could spend the entire four hours doing the first testlet and run out of time for the rest of the exam. The rule of thumb is to leave around 2 hours for the task-based simulation. This gives you about 110 seconds to answer each multiple choice question!

How is FAR Weighted and Graded?

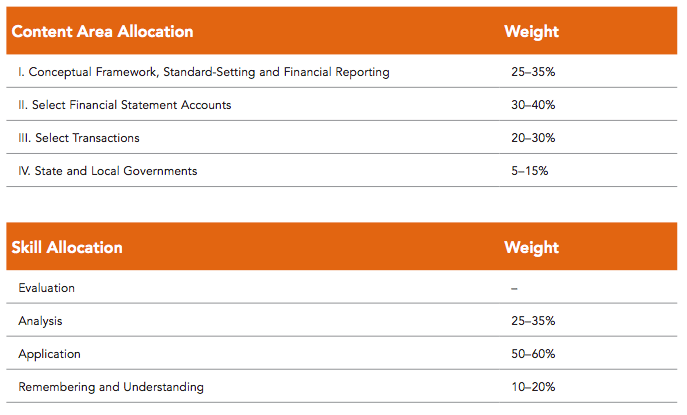

The MCQs and the TBSs are weighted the same. Thus, 50% of your score will be based on the multiple-choice questions and 50% will be based on the simulations. Here is the FAR content area allocation by topic and weight. This table also shows the skill level allocation that the new CPA exam blueprint uses to test your knowledge of the topics.

MCQ and Simulation Grading Percentage and Distribution

What Percentage of the Grade is Given to MCQ and Simulations? In conclusion, 50% of the grade comes from the 66 MCQs and the other 50% comes from the 8-9 TBSs.

| Exam Section | 2016 CPA Exam | 2017 CPA Exam |

|---|---|---|

| AUD | 60% MCQ 40% TBS |

50% MCQ 50% TBS |

| BEC | 85% MCQ 15% WC |

50% MCQ 35% TBS 15% WC |

| FAR | 60% MCQ 40% TBS |

50% MCQ 50% TBS |

| REG | 60% MCQ 40% TBS |

50% MCQ 50% TBS |

FAR Exam Pass Rates

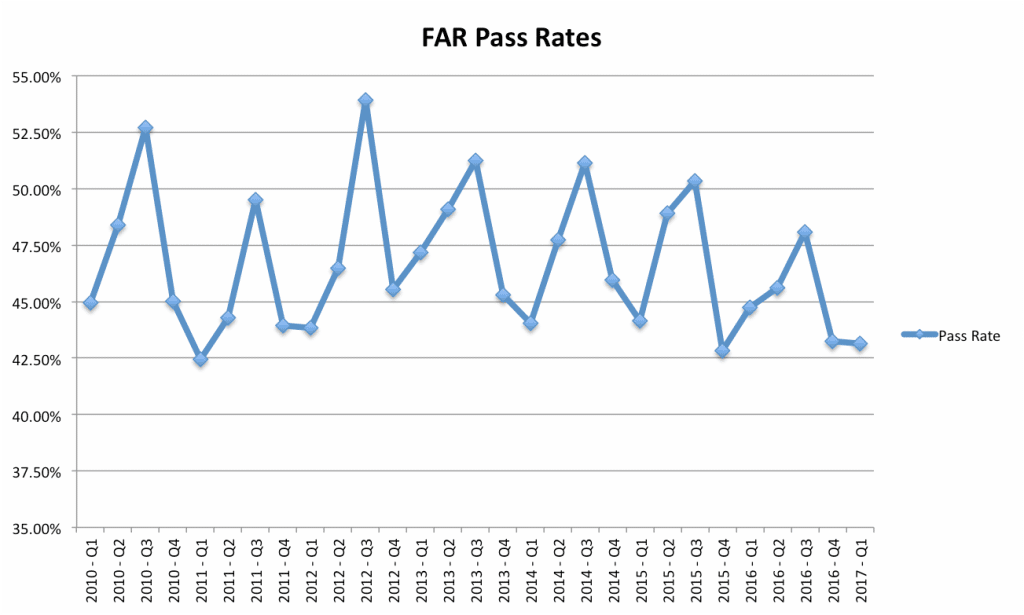

Since the introduction of the new FAR exam and the emphasis of IFRS, the FAR pass rate has declined over the past six years. In 2010, the pass rate reached a high of 52.71%. The high of 2016 was only 48.07%.

This trend is likely to subside as more candidates get used to the new testing model and the exam blueprint. This info is published by the AICPA.

FAR CPA Exam Study Tips

Study Everything: FAR is HUGE. The FAR exam covers so much information. There’s no way you are going to be able to memorize everything. The important part is that you make it all the way through your CPA exam review materials and brush up on all the topics covered. You know how it goes. The one subject you skip over in your review course will be the one that is covered extensively on the exam. Cover everything!

Give Yourself Enough Time: Too many candidates schedule their FAR exam too close to their other exams. You need at least 7-8 weeks to properly prepare for this test. Don’t try to squeeze it in. It won’t turn out well.

Know Your Journal Entries: There are tons of journal entires on this test. Make sure you understand how to record transactions both physically and conceptually. A lot of the questions might not actually ask you to make entries, but the concepts involved in the question can be easily answered by making an AJE on a scrape of paper. Know your entries.

Practice MCQs to Death: Keep working through your MCQs in your CPA review course. This is the best practice you can get. Do as many as possible.

Should I Take FAR First?

Normally, I would not recommend this for people. FAR is a huge exam and can be pretty daunting to study for. If you take it first, you might get discouraged and stop studying altogether. Or worse, you might fail it and give up on the exam.

I wouldn’t recommend this one first unless your knowledge of financial accounting is extremely strong going into it. Here’s which exam you should take first.

Should I Take FAR Last?

I think choosing to take FAR last depends on your time frame. Are you running up against the 18-month window? If you are, FAR might not be a good choice for the last exam. If you fail it, your first exam will expire. Then you have to take FAR and your first passed exam again. I’d say FAR is best taken as your second or third exam.

This way it won’t push you up against the window and you will have one or two successful sections behind you to encourage you through the beast. 🙂

Who is FAR Easiest For?

FAR tends to be easier for candidates who have a good understanding of GAAP and financial accounting in general. Candidates who have recently taken advanced financial accounting courses in college and still have the information fresh in their minds also tend to do well. Don’t get me wrong though. A few recent college courses will not prepare you for FAR. You’ll need to study.

FAR is also easier for people working in the real world with GAAP. Thus, tax accountants might want to brush up on their GAAP skills.

Who is FAR Hardest For?

The FAR is the long CPA exam section and it also covers the most information. Up until the new AICPA blueprints and 2017 changes, FAR used to be the longest test. Now all the exams are 4 hour exams. I have to be honest. FAR is hard for everyone. A lot of candidates say it’s the hardest out of the 4 CPA exam sections. I don’t know if I would say it’s the hardest, but it definitely requires the most work to get through all of the information. Most FAR study guides are twice as thick as the other sections. Yikes!

Typically candidates who have issues effectively scheduling their study sessions and don’t stick to a routine struggle with FAR. It’s a lot to cover and you have to dedicate yourself to this test almost more so than the other ones. If you don’t think you will be able to fully dedicate yourself to studying for FAR, I would suggest picking a different section to sit for next. You don’t want to slouch on this one. It’s either all or nothing in my opinion.

Other CPA Exam Sections

Do You have the Right CPA Review Course?

Have you started studying yet or did you fail FAR once? Either way, you’ll need a review course that actually works for you and matches your learning style. I compared all of the top courses side-by-side, so you can see which on is right for you. Check it out.