The AUD (Attestation and Auditing) section of the CPA exam focuses on the examination of an entity’s financial statements, compliance, and processes. This section evaluates the candidates’ understanding of proper auditing procedures, gathering evidence, fundamental principles, and internal controls.

Many candidates feel the AUD CPA exam is closely related to FAR because there is some overlap in GAAP reporting requirements tested on both exams. Although there is some overlap, I wouldn’t say it’s significant enough to base your entire CPA exam schedule on this fact.

Let’s take a look at what’s on this exam, how it’s graded, who it’s easiest and hardest for, and how to pass the AUD section and become a Certified Public Accountant!

- 1.Becker CPA Review Course: Rated the #1 Best CPA Review Course of 2024

- 2.Surgent CPA Prep Course: Best Technology

- 3.Gleim CPA Review Course: Largest Question Bank

What is the AUD CPA Exam Section?

How Long is the AUD CPA Exam?

AUD is a 4-hour exam, but you don’t have to use all of the time allocated. There also is no individual time restraints on each individual testlet.

AUD Topic Areas & Concepts Tested

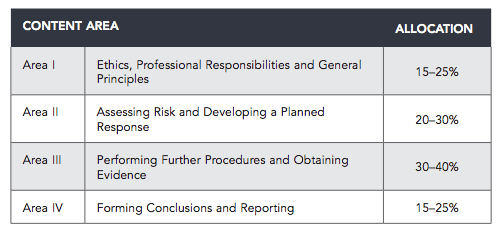

Professional Responsibilities, Standards, and Fundamental Principles: 15%-25% – consists of going over accepted conduct, requirements for documentation, internal control, the nature and scope of engagements, and communication with other parties.

Assessing Risk and Developing Planned Processes: 20%-30% – covering topics like how to analyze different environments, preparing for an engagement, learning about the entity in question, and identifying the risk/value associated with misstatements.

Performing Procedures and Obtaining Evidence: 30%-40% – involves the importance of independence, evidence, and sampling techniques.

Reaching a Conclusion and Compliant Reporting: 15%-25% asking questions about engagements for both auditing and attestation, reviewing service engagements.

AUD CPA Exam Format and Structure

The AUD exam begins with 2 multiple-choice question testlets containing 36 multiple-choice questions each. The first testlet is always moderate or medium difficulty to gauge your understanding of the topics. The second testlet changes depending on your performance in the first testlet. If you perform well, the second testlet will move from moderate to more difficult questions. If you perform poorly, it will move to easier questions.

After both MCQ sections are finished, there will be a third testlet comprised of 2 task-based simulations. After this section, you will be allowed to take an option 15-minute break that doesn’t count against the 4-hour time frame. Lastly, you will have two more testlets containing 3 task-based simulations each.

Section Structure

| AUD Exam Section | 2016 CPA Exam | 2017 CPA Exam |

|---|---|---|

| Multiple-Choice Questions | 90 | 72 |

| Task-Based Simulations | 7 | 8 |

| Written Communication | 0 | 0 |

Section Format

| Testlets | Question Sets | Suggested Time |

|---|---|---|

| Testlet #1 | 36 Multiple-Choice Questions | 60 Minutes |

| Testlet #2 | 36 Multiple-Choice Questions | 60 Minutes |

| Testlet #3 | 2 Task-Based Simulations | 30 Minutes |

| Testlet #4 | 3 Task-Based Simulations | 45 Minutes |

| Testlet #5 | 3 Task-Based Simulations | 45 Minutes |

AUD CPA Tip: Questions within each testlet don’t have to be answered in order; however, the testlets must be given in the order stated above.

Multiple-Choice Questions

The multiple-choice questions are divided into 2 testlets. Each testlet contains 36 questions, making a total of 72. Each question’s value depends on the difficulty, with the most difficult questions having the most value. Thus, it’s much better to get more difficult questions in the second testlet because you need to get less of them right in order to pass the exam. One correctly answered and difficult question is worth more than several correctly answered and easy questions.

60 of the 72 multiple-choice questions are operational while the remaining 12 are pretest. This means 12 of the questions are there simply because the AICPA is testing whether they should include them on future exams. They don’t count against you.

AUD CPA Tip: Once an MCQ testlet is submitted, it can’t be reopened or reviewed. Make sure you review your questions and answers before you submit each testlet; after it’s submitted, it’s gone.

Task-Based Simulations

There are 8 task-based simulations in total. Seven of them are operational and 1 a pretest simulation. Each task-based simulation may have 2 tabs: informational and work.

The work tab has a gradable response, while the informational tab has things like directions, resources, and authoritative literature that aids in solving the simulation.

Testlet and Simulation Time Length

You have a total of four hours to complete the entire exam. No one section or testlet has a time requirement on it. Thus, you have to properly allocate your own time. I’d suggest about 35-45 minutes be allocated to answers the multiple-choice questions in each testlet and 15-25 minutes be allocated to reviewing MCQ answers for each testlet. This gives you about 106 seconds for each multiple-choice question.

I would also recommend about two hours for the simulations in total. A simulation commonly calls for candidates to complete up to 7 audit engagement tasks using information provided.

Get Discounts On CPA Review Courses!

Enjoy $1,400 Off Becker CPA Pro+

Take $1,110 Off Surgent CPA Ultimate Pass

Get $1,000 Off Becker CPA Concierge

Take $875 Off Gleim CPA Premium Pro Course

Becker CPA: Interest-Free Payment Plan – Deal

Becker Deal: Save on CPA Single Part Courses

Take $1,500 Off Surgent CPA Ultimate Pass

Get CPA Evolution Ready Content on All Becker CPA Courses – Deal

Becker CPA Advantage Package Now $2,499 – Promo

Enjoy a 14-day Free Trial on Becker CPA Courses

How is AUD Weighted and Graded?

The MCQs and the TBSs are weighted equally. As mentioned before, MCQs values differ based on their difficulty on a numerical basis for correct answers. Incorrect answers have no value. It is speculated that partial credit can be awarded for TBSs if it is non-research.

Simulations are graded positively meaning that wrong answers don’t count against your score. This means that you should answer as many as possible even if you think you are just guessing. Most simulations are graded by computer.

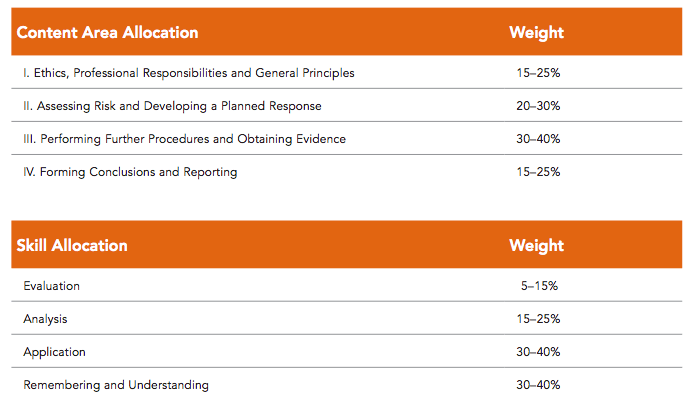

Here’s a breakdown of the content area allocations and weights for the AUD exam. The table also shows how the AICPA tests each skill allocation by their distribution of weights.

MCQ and Simulations Grading Percentage & Distributions

What Percentage of the Grade is Given to MCQ and Simulations? In short, 50% of the grade comes from the 72 MCQs and the other 50% comes from the 8 task-based simulations.

| Exam Section | 2016 CPA Exam | 2017 CPA Exam |

|---|---|---|

| AUD | 60% MCQ 40% TBS |

50% MCQ 50% TBS |

| BEC | 85% MCQ 15% WC |

50% MCQ 35% TBS 15% WC |

| FAR | 60% MCQ 40% TBS |

50% MCQ 50% TBS |

| REG | 60% MCQ 40% TBS |

50% MCQ 50% TBS |

AUD Exam Pass Rates

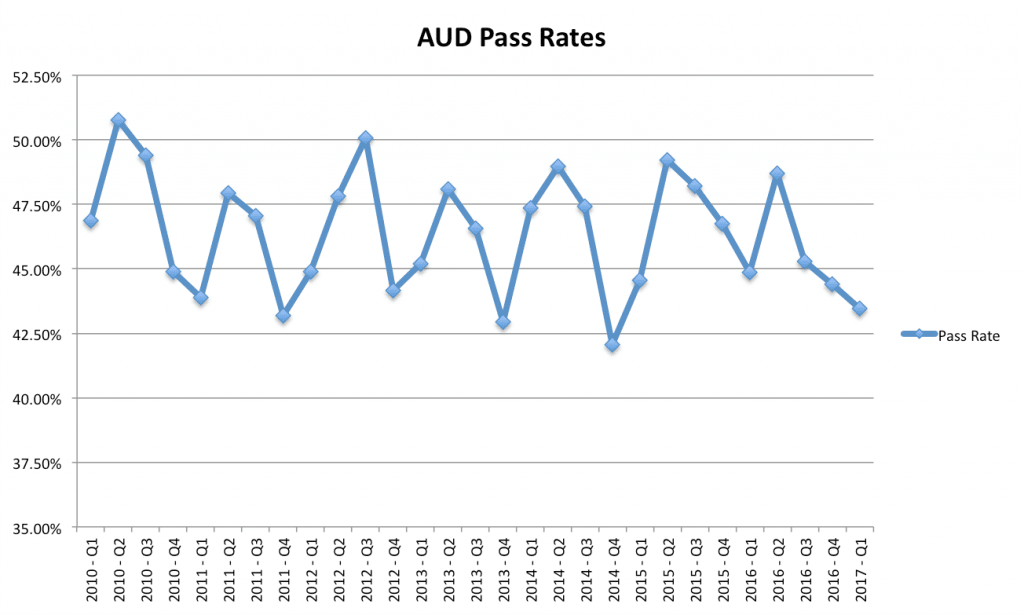

The AUD pass rates have fallen slightly in the past six years but has remained about the same overall. The 2010 high of 50.77% hasn’t been reached again since. With the exception of 2nd quarter scores, 2016 and 2017 are below the average of the last seven years.

It’s expected that this slight downward trend will continue as the AICPA introduces the new CPA blueprint in 2017. The increased emphasis on higher-order skills and simulations might bring scores and pass rates down temporarily until candidates get used to the new testing model. This info is published by the AICPA.

AUD CPA Exam Study Tips

Memorize Everything: This test involves so much rote memorization it’s not even funny. Use your review course and develop your own mnemonics to memorize the next two study tips.

Memorize the Audit Opinion Letter: This isn’t a suggestion. Seriously, memorize the unqualified audit opinion letter word-for-freaking-word. You have no idea how many questions there are on the exam about this letter or the concepts covered in it. If you have the entire thing memorized, it will be so easy to answer these MCQs and TBSs. I wouldn’t worry too much about the qualified opinion letters. Just make sure you are familiar with those.

Know Your Internal Controls: There are so many questions about internal controls on this exam. Know them all, what they do, and what type of fraud they are put in place to prevent.

Practice MCQs to Death: Keep working through your MCQs in your CPA review course. This is the best practice you can get. Do as many as possible.

Should I Take AUD First?

Audit is a great choice for your first exam if you have experience with auditing or feel strong with the topics covered on this test. This is the section that I took first and I did just fine. 🙂

If you hate auditing and find this topic to be really hard, I wouldn’t recommend it as your first section them. Here’s which exam you should take first.

Should I Take AUD Last?

Audit would also be a great last exam to take. Like I said earlier, many people tend to link Audit with FAR because they have some overlap in subject matter. I don’t see that there is a strong enough connection between the two exams to warrant taking them side-by-side.

Personally, I think you are way better off taking exams based on your strengths and weaknesses rather than on the exams’ loose subject matter overlaps. Consequently, I think AUD would make a great last exam to finish up your CPA journey. 🙂

Who is the AUD CPA Exam Easiest For?

The AUD tends to be easier for individuals who have experience with auditing or recently took an auditing class. For instance, if you work as an auditor or auditing was the last class you took in college, this exam part might be fairly straightforward for you.

People with a profession in auditing should be well acquainted with most of the material and the AICPA Professional Standards. Their application and knowledge should help them be well prepared for the task-based simulations.

Keep in mind that this is an academic test, however. There is a big difference between what is on the exam and what you may be used to in the real world. Too many auditors go into this exam thinking they are going to do well because they do this for a living. This is a theoretical and academic test–not a real life job.

Who is AUD Hardest For?

The AUD part has very little computation or math problems in it, so who rely on their math skills to answer questions won’t get a lot of help on this section. By the same token, students with limited or no experience in auditing may have difficulty mastering the AUD concepts and procedures because they don’t relate to many of the other exam sections.

Candidates with difficulty seeing the big picture or restating material in their own words may also find it is hard to understand the AUD material because pure memorization isn’t a good technique for this section.

Other CPA Exam Sections

Do You have the Right CPA Review Course?

Have you started studying yet or did you fail AUD once? Either way, you’ll need a review course that actually works for you and matches your learning style. I compared all of the top courses side-by-side, so you can see which one is right for you. Check it out.