The average CPA salary in the US is $62,410, but it also varies depending on your years of experience, firm size, and industry. That’s the best part about becoming a CPA. Not only do you get more career opportunities in financial services and respect from your colleagues; you also get a pretty sweet bump in your salary and compensation package as well.

There are a number of different things that affect the overall salary range of accountants and CPAs, so it’s difficult to talk about an overall national average annual salary without looking into the numbers and statistics. Let’s take a look at each of these factors and see what you can expect to make as an entry-level accountant, inexperienced CPA, and an experienced CPA.

- 1.Becker CPA Review Course: Rated the #1 Best CPA Review Course of 2024

- 2.Surgent CPA Prep Course: Best Technology

- 3.Gleim CPA Review Course: Largest Question Bank

How Much Do CPAs Make?

Factors that Affect CPA Salaries

Before we can answer the question of how much you can expect to make as an accountant, we need to look at the main four factors that affect accountant salaries.

Experience Level

This is probably the most obvious factor because it’s prevalent in every industry. The longer you work somewhere and the more experience you get as an accounting professional, the more you are able to do and command in compensation. The accounting profession is no different.

There is a huge pay discrepancy between entry-level accountants and experienced CPAs and partners.

Industry

Not all accountants are in the same job market. Some CPAs work as tax accountants while others work as auditors and assurance professionals. All of these professionals fit under the umbrella of public accounting.

Some CPAs choose to work in private or corporate accounting as internal accountants, auditors, and tax experts for a single company. These companies vary in size and in industry.

Public and corporate accounting salaries are much different. Jobs within each of these industries also provide a wide range of salaries as well. For instance, a tax accountant in public accounting can expect to make a different amount than an auditor working for the same firm with the same level of experience.

Company Size

The last main factor is company size. Typically, larger companies pay better than smaller companies because they have more resources and more opportunities for employees. Thus, you can assume that the larger the CPA firm or company, the more the accountants and CPAs working there are getting paid.

Get Discounts On CPA Review Courses!

Take $1,200 Off Surgent CPA Ultimate Pass

Get $1,140 Off Becker CPA Pro

Take $1,110 Off Surgent CPA Ultimate Pass

Enjoy $1,000 Off Gleim CPA Premium Pro

Get $1,000 Off Becker CPA Concierge

Becker CPA: 0% Interest Payment Plan

Becker CPA Advantage Package Now $2,499 – Promo

Get CPA Evolution Ready Content on All Becker CPA Courses

Take $1,500 Off Surgent CPA Ultimate Pass

Sale – Becker CPA Premium Package Now $3,099

Enjoy a 14-day Free Trial on Becker CPA Courses

Save on Becker CPA Single Part Courses

Geographical Location

The region you work will always dictate your pay to some degree. An entry-level accountant will get paid more in New York City than his or her counterpart in Boise, ID.

Now that we have the factors that influence accountant pay out of the way, let’s take a look at the numbers for different industries.

CPA Salaries in Public Accounting Firms

Since Certified Public Accountant Salaries vary so much based on the size of the firm, it’s important to split the salary numbers into categories up by firm size. Let’s take a look at what you can expect to make at all levels of experience and sizes of firms.

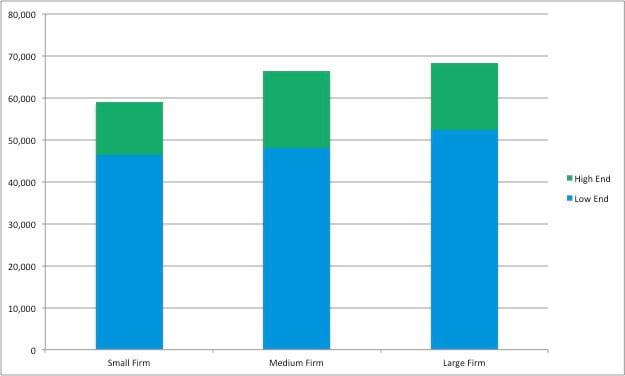

Entry Level CPA Salary

Entry-level CPAs typically have less than one year of work experience and can expect to make between $46,000 and $68,000 depending on the size of the firm they work for.

1 – 3 Year Junior CPA Salary

As CPAs gain experience in public accounting, they are able to perform more duties and gain responsibility. Thus, they are able to grow their salaries as well. As a Junior CPA with 1 – 3 years of work experience you can expect to earn $52,000 to $87,000.

Senior CPA Salary

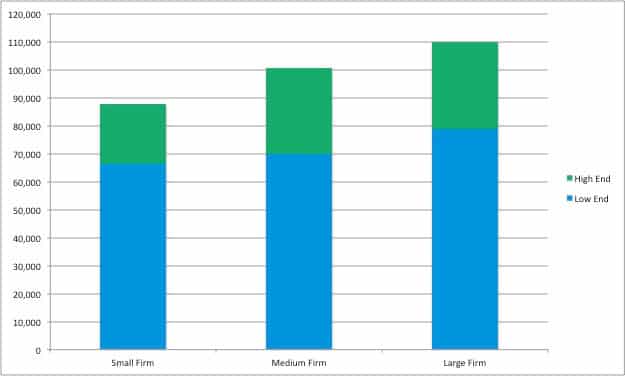

Senior CPAs typically have 4-6 years of work experience and have a good amount of experience in their area of expertise. Most accountants have already chosen a specific career path by this point. For example, most accountants have already chosen whether they want to go into tax or audit by this point in their careers.

This is the point where the difference in firm size really starts to play a role in salary because Seniors at larger firms have much more complex duties and responsibilities than their counterparts in smaller firms. As a Senior-Level CPA salary, you can expect to $66,000 to $110,000 depending on your job description and firm size.

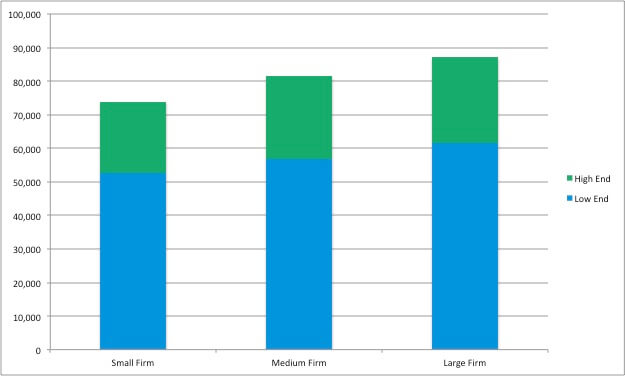

Manager and Director CPA Salary

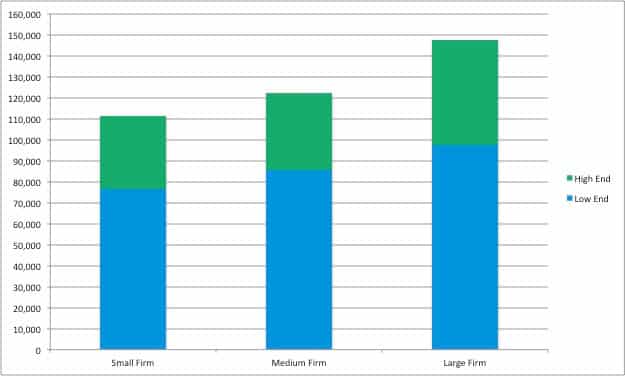

Managers and directors typically have at least 7 years of work experience in their field. Accountants at this level tend to be on the partner track if not already a partner at a CPA firm.

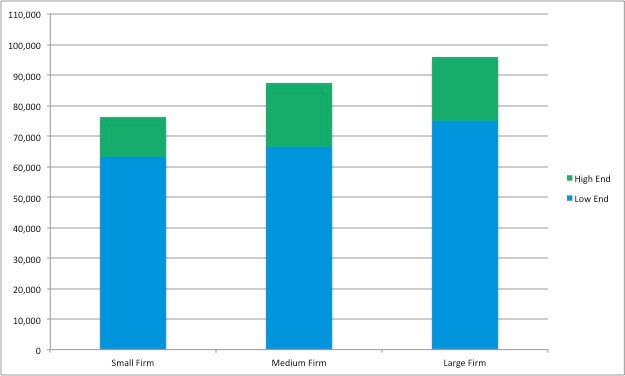

If you are able to stick it out in public accounting for more than 7 years and are able to climb the corporate ladder to the management level, you can expect to make $76,000 to $147,000 depending on the size of your firm. Here’s a chart of the highs and lows of each firm size.

Non-Certified Accountant Salaries in Corporate Accounting

As you can imagine, non-certified accountants don’t make as much as their certified counterparts. They are typically limited to careers outside of public accounting since CPA firms don’t hire accountants past a certain level without being certified.

Here’s how much accountants make on average without having a CPA license or any other certification.

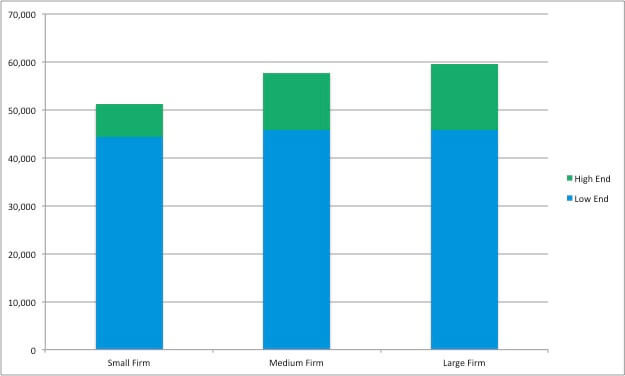

Entry-Level Accountant Salary

Entry-level accountants typically have a starting salary of $44,000 and can earn as much as $60,000 depending on the size of the company they work for and the industry they work in.

Normally, these accountants have less than two years of work experience and no specialization. Basically, they are right out of college.

1 – 3 Year Junior Accountant Salary

Accountants are typically promoted to the junior level within the first two years of being hired. Some even reach this level during the first year of employment. As a junior accountant without a CPA license in corporate accounting, you can expect to earn between $50,000 and $75,000 based on the size of your company.

Senior Accountant Salary

Senior accountants in corporate accounting typically have at least 4-6 years of work experience and earn a little less than their counterparts in public accounting.

This obviously depends on the industry as well. The faster growing and more profitable industry will always pay their senior level accountants more. On average, you can expect to make between $63,000 and $95,000. See the chart above.

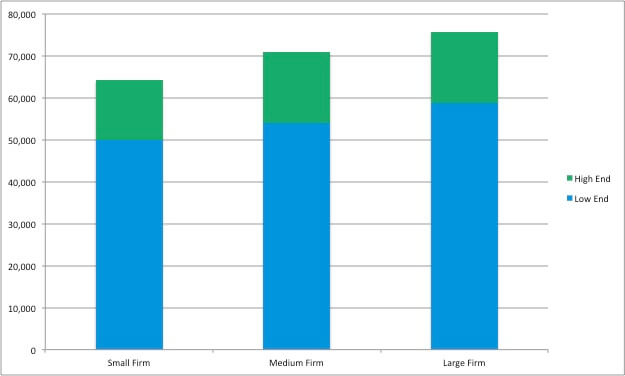

Manager and Director Accountant Salary

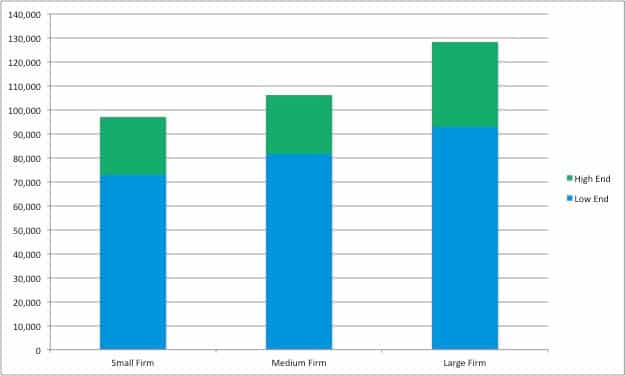

Managers and directors are high-level executives in corporate accounting with more than 7 years of work experience. These professionals can expect to make an average salary of $73,000 to $128,000.

Here’s a chart showing the differences in salaries between company sizes.

Accountant and CPA Salary Summary

Accountant and CPA Salaries in Large Companies with $250M+ in Revenues

| Position | Non-Certified Accountant Salary | Licensed CPA Salary |

|---|---|---|

| Entry-Level | $50,000 – $60,000 | $52,000 – $68,000 |

| Junior | $59,000 – $76,000 | $62,000 – $87,000 |

| Senior | $75,000 – $96,000 | $79,000 – $110,000 |

| Manager | $93,000 – $128,000 | $110,000 – $133,000 |

Accountant and CPA Salaries in Mid-sized Companies with $25M – $250M in Revenues

| Position | Non-Certified Accountant Salary | Licensed CPA Salary |

|---|---|---|

| Entry-Level | $46,000 – $58,000 | $48,000 – $66,000 |

| Junior | $54,000 – $71,000 | $57,000 – $82,000 |

| Senior | $66,000 – $88,000 | $70,000 – $101,000 |

| Manager | $82,000 – $106,000 | $86,000 – $122,000 |

Accountant and CPA Salaries in Small Companies with < $25M in Revenues

| Position | Non-Certified Accountant Salary | Licensed CPA Salary |

|---|---|---|

| Entry-Level | $42,000 – $51,000 | $46,000 – $59,000 |

| Junior | $50,000 – $64,000 | $53,000 – $74,000 |

| Senior | $63,000 – $76,000 | $66,000 – $88,000 |

| Manager | $73,000 – $97,000 | $77,000 – $112,000 |

A CPA License is Worth It

As you can see, there is a huge difference in non-certified accountant and licensed CPA salaries. On average, CPAs earn 10% more than their non-certified counterparts. If you are thinking about becoming an accountant, it’s definitely worth becoming a CPA.

The first step to becoming a CPA is to get a proper CPA review course and start studying for the exam. I reviewed all the top courses that are out there right now, so you can easily find one that matches your learning style and works for your study process and budget.

Check out my reviews and start your growing your salary today.