Let’s make something clear right off the bat:

This is NOT financial advice.

That phrase has been said a lot over the past few weeks— especially on Reddit. It’s one of many rallying cries for a new wave of retail investors who have banded together in the pursuit of justice, glory, and “the bag.”

What’s happening right now in the stock market is fascinating, but there is a historical precedent that can help us follow along. There are also implications for the future, both for how we trade and how governments regulate it.

So if you’re feeling FOMO and want to know what’s going on, keep reading to learn the difference between securities and commodities, as well as the subtle nuances of credit default swaps, infinity squeezes, and gamma squeezes. Then you’ll understand what it means to have diamond hands.

“What’s happening right now in the stock market is fascinating, but there is a historical precedent that can help us follow along. There are also implications for the future, both for how we trade and how governments regulate it.”

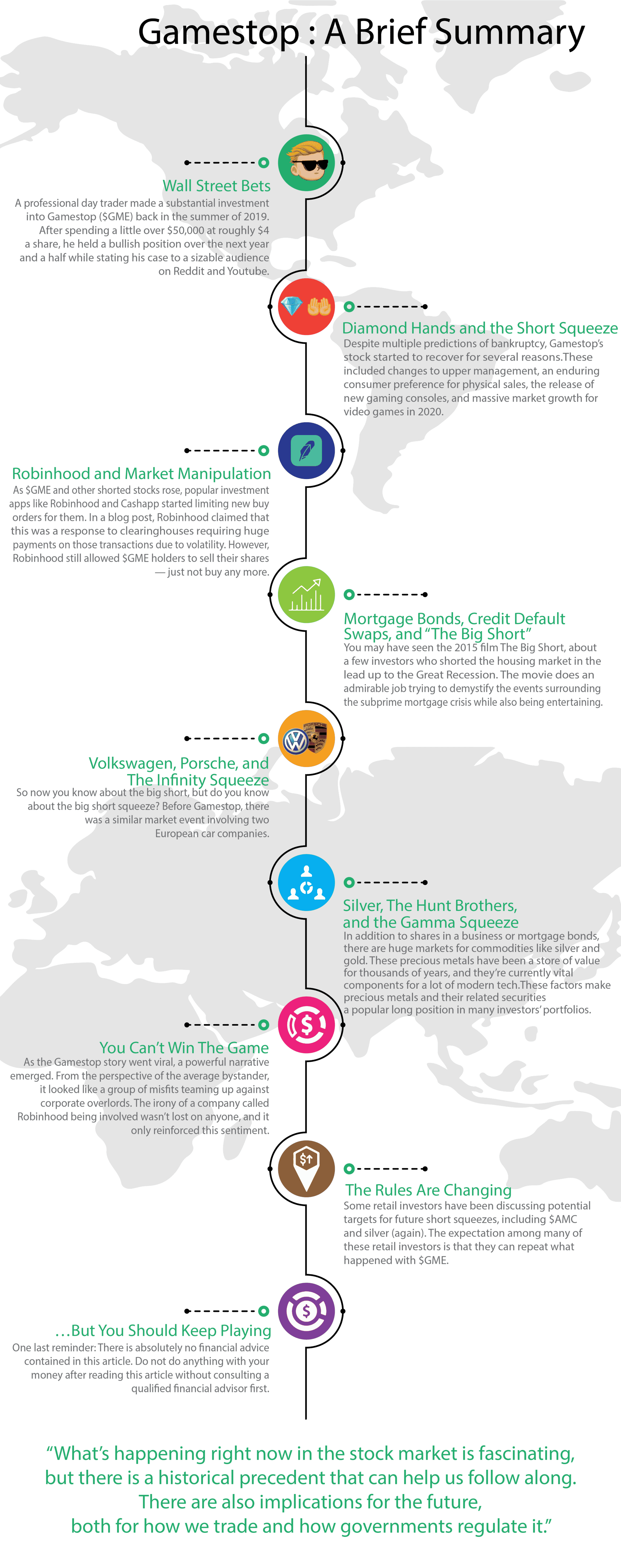

The History of Gamestop, Reddit, and Robinhood: A Brief Summary

Here’s a quick timeline to get you up to speed:

Wall Street Bets

A professional day trader made a substantial investment into Gamestop ($GME) back in the summer of 2019. After spending a little over $50,000 at roughly $4 a share, he held a bullish position over the next year and a half while stating his case to a sizable audience on Reddit and Youtube.

Shares for Gamestop were low at the time for several reasons: decreased market share from digital sales, malls declining in popularity, and a tumultuous relationship with its customers, just to name a few. This inspired major hedge funds to purchase a short position on the stock: borrowing shares, selling them, and then re-buying them at a reduced price in order to pocket the price difference before returning them to the original owner.

Shorting is a popular practice among many investment firms; it can be extremely effective both as retribution for poorly-run businesses and a method to make obscene amounts of money. In fact, some traders will even short stocks that are already being shorted by someone else— which is how Gamestop’s float (the number of shares available for trading) ended up at a baffling 140%.

Diamond Hands and the Short Squeeze

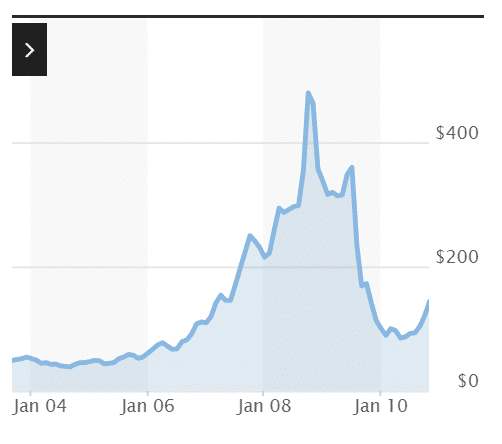

Despite multiple predictions of bankruptcy, Gamestop’s stock started to recover for several reasons. These included changes to upper management, an enduring consumer preference for physical sales, the release of new gaming consoles, and massive market growth for video games in 2020.

The expiration dates for many of these short positions grew closer; this is the time when investors need to cover their shorted stocks in order to return them to the original owners. The problem was that the shares they sold at $4 were now closer to $400.

So margin call arrives and all the surprised short sellers can do is buy back the stocks at exponentially increasing costs. This results in a process known as a short squeeze, where the current holders of a shorted stock drive up the price by refusing to sell at a lower one.

To put it in video game terms, retail investors found a glitch in the stock market that works like an infinite money cheat code. All they have to do is not sell their Gamestop shares— so they grip them in their hands with the strength of diamonds.

Market Manipulation and the Robinhood Scam

As $GME and other shorted stocks rose, popular investment apps like Robinhood and Cashapp started limiting new buy orders for them. In a blog post, Robinhood claimed that this was a response to clearinghouses requiring huge payments on those transactions due to volatility. However, Robinhood still allowed $GME holders to sell their shares— just not buy any more.

When one of the most popular apps for trading only allows one form of transactions on a security, it has a substantial effect on that security’s price. These investors are only able to sell, which causes the share value to decrease. This is exactly what happened to $GME, which conveniently made it easier for hedge funds to cover their positions.

Understandably, just about everyone called out Robinhood’s actions as market manipulation. Now, both Robinhood users and the United States government are pursuing legal action against the company, accusing them of participating in a short ladder attack for the benefit of large financial institutions.

“When one of the most popular apps for trading only allows one form of transactions on a security, it has a substantial effect on that security’s price.”

Biggest Short Squeezes in History

Short selling is a longstanding tradition in securities trading. In fact, its history is longer than America’s; it originated in Amsterdam during the 1600s.

This controversial practice has endured since the 15th century, but not without heavy regulation— both from the government-run Securities and Exchange Commission (SEC) and the privately run Financial Industry Regulatory Authority (FINRA).

In America, short selling was heavily scrutinized during the Great Depression without being entirely outlawed. This resulted in the creation of an “uptick rule” in 1938, which prevented traders from executing short sales on securities that were already on a downward trajectory. However, this rule was overturned by the SEC in 2007— just in time for the second biggest economic disaster in American history.

Mortgage Bonds, “The Big Short”, and Credit Default Swaps for Dummies

You may have seen the 2015 film The Big Short, about a few investors who shorted the housing market in the lead up to the Great Recession. The movie does an admirable job trying to demystify the events surrounding the subprime mortgage crisis while also being entertaining.

But if you’re still confused and don’t feel like reading the book, here’s a quick breakdown of what happened:

When a bank has enough mortgages from homeowners, they bundle them together to create securities for investors. These are commonly referred to as mortgage backed securities, but they may also take the form of mortgage bonds. In the early 2000’s, banks were giving out a lot of mortgages so they could create and sell more of these securities— many to people with no conceivable way of actually paying them.

A handful of financial analysts and hedge fund managers noticed that this was creating an economic bubble. With little ability (or desire) to correct this issue, they decided to make an obscene amount of money instead by shorting these securities through credit default swaps.

This was a risky move, because it involves paying millions in premiums so long as homeowners didn’t default on their mortgages. But once the housing market finally burst, these swaps started paying dividends instead. As the global economy entered a recession, these lucky few managed to close their short positions and walk away with billions.

Porsche, and The Infinity Volkswagen Short Squeeze

So now you know about the big short, but do you know about the big short squeeze? Before Gamestop, there was a similar market event involving two European car companies.

In 2005, Porsche announced their intention to obtain a majority stake in Volkswagen. This was despite speculation among investors and hedge funds that the company was in decline, with a large percentage of the company’s float being shorted at the time. Cue the market panic and global recession just a few years later.

Now traders are trying to cut their losses, causing a run on the market as stocks rapidly went down. But Porsche kept purchasing Volkswagen shares, uninterested in generating a profit; they were only interested in a majority stake in order to maintain their close manufacturing relationship to the German company.

And since they were essentially the only ones buying at that time — and they’re only buying one stock — it caused VW’s price to rise while all the other stocks tanked.

Investors quickly notice that VW is bucking the downward trend and decide to pile on, believing that there was some special reason the company was apparently recession-proof. The share price began to rocket upwards as more investors scrambled to buy and short sellers scrambled to close, making it the most valuable stock on the market for a short time.

This was an unprecedented event in the market that absolutely no one saw coming, and it was referred to as an Infinity Squeeze after the fact. This was in reference to the infinite potential losses to the short sellers— without a limit on the maximum price of a stock, the cost can keep going up as long as short sellers need to cover their positions.

The Hunt Brothers, Gamma Squeeze and The Silver Short Squeeze

In addition to shares in a business or mortgage bonds, there are huge markets for commodities like silver and gold. These precious metals have been a store of value for thousands of years, and they’re currently vital components for a lot of modern tech. These factors make precious metals and their related securities a popular long position in many investors’ portfolios.

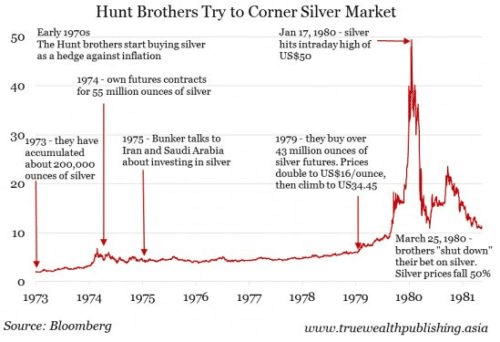

But in the 1970’s, two brothers went really long on the silver market, leading to a monumental squeeze that required intervention from the government to resolve.

Oil baron Nelson Bunker Hunt is the son of H.L. Hunt, one of the richest men in the world. With Bunker’s inherited wealth — as well as that of his siblings, Herbert and Lamar — he steadily purchased a large volume of silver over a decade. The brothers claimed that this was an attempt to protect themselves from inflation, but many brokers saw this move as an attempt to corner the market.

As the Hunt brothers bought thousands of ounces in futures contracts, the price began to rise. They also requested that most of these contracts were delivered, keeping roughly 100 million ounces of the metal in Switzerland.

The actions of the Hunt brothers caused this historically stable commodity to sharply increase in volatility. This is measured as the Greek letter gamma(γ) in the Black-Schole-Merton Model, a Nobel prize-winning risk management model used heavily in commodities trading. Hence, the term gamma squeeze was coined to explain what happened next.

By holding a huge physical cache of silver, it became more difficult for manufacturers to obtain the metal for non-speculative uses. And when they continued purchasing a ton of silver futures, many traders were entitled to sell them more silver at the highest price— even if the value was lower on the date of delivery. This volatility resulted in a historic market correction referred to as Silver Thursday. Silver prices dropped and the Hunt brothers failed to meet their margin call, leading one of the richest families in the world to declare bankruptcy.

Key Takeaways

So with the added context, what are some lessons we can learn from $GME? Here are a few that stand out to me:

You Can’t Win The Game

As the Gamestop story went viral, a powerful narrative emerged. From the perspective of the average bystander, it looked like a group of misfits teaming up against corporate overlords. The irony of a company called Robinhood being involved wasn’t lost on anyone, and it only reinforced this sentiment.

Influential figures in the media, politics, and business fed this narrative — as did the current richest man in the world — but it fundamentally misinterprets the nature of this issue. Now the issue has transformed from a market anomaly to a cultural battleground, with hedge funds like Melvin Capital and Citadel as the enemy.

Despite the metaphor I made earlier, it’s important to realize that the market doesn’t actually work like a video game. And despite terminology around risk and reward, it’s also not a casino where you’re supposed to gamble your money. Keep in mind that before the Gamestop story went viral, WallStreetBets was known for the guy who got severely punished trying to exploit a Robinhood glitch and outsmart the market.

For a lot of people who decided they wanted to be a day trader as soon as the $GME story broke, this should be a harsh wake-up call.

If you’re lucky, reckless trading can cause you to instantly lose your life savings. If you’re unlucky, it can put you in a tremendous amount of debt that you have no chance of paying off— even if you’re the son of the richest man in the world.

This happened to a trader in 2009 because of the VW squeeze, driving him to suicide. Before $GME, it almost happened to a Robinhood user but was stopped by the app. Unfortunately, they stopped it too late, and the user committed suicide as well.

These are the consequences of impressionable people approaching the stock market like a game— which is why a lot of people are working very hard to prevent these situations from ever happening again.

“If you’re lucky, reckless trading can cause you to instantly lose your life savings. If you’re unlucky, it can put you in a tremendous amount of debt that you have no chance of paying off— even if you’re the son of the richest man in the world. “

The Rules Are Changing

Some retail investors have been discussing potential targets for future short squeezes, including $AMC and silver (again). The expectation among many of these retail investors is that they can repeat what happened with $GME.

I can’t see into the future, but it seems extremely unlikely that either of these strategies are going to work. Here’s why $GME is lightning in a bottle:

- $GME was a gamma squeeze like what happened to silver in 1980. This means it happened as a result of volatility, which is closely tracked by market analysts. It only worked because none of them saw it coming; if it had appeared in their complicated chart data, they would have adjusted their valuations accordingly.

- $GME was also an infinity squeeze, which means there was no limit to the potential losses incurred. This is similar to what happened with VW in 2008, and it was a symptom of a much larger issue in the market. If actions aren’t taken by governments and regulators, it could lead to another financial crisis.

Gamma squeezes and infinity squeezes are the exception, not the norm. Market stability is the goal, and keeping things boring is in the best interest for hedge funds and banks. Governments are also big fans of the status quo, since it makes their jobs much easier and helps to prevent a massive financial crisis.

The SEC announced that they are monitoring the current stock market situation, as did the U.S. Treasury Secretary Janet Yellen. Without the ability to fly under the radar, all these future plans will be easily anticipated by the markets and monitored by regulators. You can expect these institutions to react quickly in case this starts to happen again.

(By the way, that guy I mentioned at the beginning of this article who started this whole $GME run? He lost his FINRA license. Maybe he should check out my list of the best FINRA certifications and try again.)

…But You Should Keep Playing

One last reminder: There is absolutely no financial advice contained in this article. Do not do anything with your money after reading this article without consulting a qualified financial advisor first.

Let’s go back to our video game metaphor one more time:

The $GME situation was a glitch that players thought was a cheat code. The developers noticed this glitch and are going to fix it in a future update. Does that mean you should stop playing the game?

Absolutely not!

You won’t get rich quick, but it’s still extremely important to become financially literate. Understanding securities, commodities, and their regulations will improve your prospects and help you achieve financial security.

If you’re ambitious, finance and trading are extremely valuable to learn— whether you want to build a business or change the world. You’re not going to start a revolution just by trading meme stocks on your smartphone. But learning more about the economy can help you fix many of its nagging issues, including naked short selling.

So if you’ve got nerves of steel and hands of diamond, you might still want to play the stock markets at your own “acceptable level of risk.” If so, just keep some of these non-financial tips in mind:

- Businesses aren’t meant to be traded like commodities; when you hold a share, it’s intended to represent a genuine belief in the value of that organization equivalent to the price you paid.

- If a group of traders coordinate purchases of securities in order to boost its price, governments see that as a clear-cut case of securities fraud. This is sometimes referred to as a pump and dump scheme.

- There have been many attempts to anticipate the stock market with charts, algorithms, and methodologies. When evaluating these methods for yourself, look out for the sunk cost fallacy or the gambler’s fallacy.

Shine on, you crazy diamonds— and thanks for all the memes!

“If you’re ambitious, finance and trading are extremely valuable to learn— whether you want to build a business or change the world. You’re not going to start a revolution just by trading meme stocks on your smartphone.”