Have you ever wondered how the guardians of wealth navigate the complex world of asset management? The answer is they hire an Asset Manager.

The top asset managers set themselves apart from the rest with a blend of sharp expertise and robust professional networks. But how does one acquire such a combination? The answer might be simpler than you think: professional certification with the help of one of the best wealth and asset management courses.

Although not that well-known yet, a certification from the Institute of Asset Management (IAM). is like having an insider’s secret to navigating the complexities of wealth management. Much like a Financial Risk Manager (FRM), Certified Financial Planner (CFP), and other finance certifications, the IAM certification is a testament to your skills and dedication to your craft.

Now, you might be wondering if you have to go through this rigorous process alone. The good news is, you don’t. Our experts have done the legwork for you and compiled a list of the best wealth management courses available. These courses are more than just education; they’re a gateway to a community of professionals and a wealth of resources that can help you succeed.

And we’ve scoured tons of reviews and program highlight pages to determine what makes a great asset management course. Let’s see if we can find one that feels like a good fit for you.

These Are The Top 5 Best Wealth & Asset Management Courses in July 2024:

- Corporate Finance Institute (CFI)

- New York Institute of Finance

- Asset Management Academy

- Asset Wisdom

- Jacobs Wealth Advisor School

| AIS RANKING | #1 | #2 | #3 | #4 | #5 |

|---|---|---|---|---|---|

| COMPANY |  |  |  |  |  |

| ONLINE ONLY? | Yes | No | Yes | Yes | No |

| MOBILE SUPPORT? | Yes | Yes | Yes | Yes | No |

| BUNDLES? | No | No | Yes | No | No |

| LIVE OPTIONS? | No | Yes | Yes | No | Yes |

| GET STARTED | Start Now | Start Now | Start Now | Start Now | Start Now |

1. Corporate Finance Institute Courses

The Corporate Finance Institute (CFI) is renowned for offering in-depth financial education and training to professionals around the globe. With a focus on practical skills and real-world application, CFI’s courses are designed to bridge the gap between academic theory and the demands of the finance industry.

One Reddit user, currently enrolled in CFI’s FMVA program, shares their experience: “It’s very similar to what I learned with my finance degree.” They highlight the program’s effectiveness in enhancing their practical skills, especially noting, “I learned more about Excel through CFI than in college,” and appreciating the industry insights, “as well as some nice industry standards with formatting.”

Course Details

The Corporate Finance Institute (CFI) offers a suite of five certification programs, each tailored to a specific area of finance and analytics. These programs are designed to equip professionals with the skills needed to excel in various sectors of the financial industry. Here’s a brief comparison of each:

- FMVA® – Financial Modeling & Valuation Analyst: This certification is geared towards those who want to excel in financial modeling and valuation. It’s ideal for professionals involved in equity research, investment banking, corporate development, and other areas where financial analysis is crucial.

- CBCA® – Commercial Banking & Credit Analyst: The CBCA® certification focuses on the skills required for commercial banking and credit analysis. It’s suitable for individuals looking to specialize in credit assessment, loan management, and financial risk analysis within the banking sector.

- CMSA® – Capital Markets & Securities Analyst: This program is tailored for those interested in capital markets and securities. It’s perfect for professionals aiming for roles in trading, portfolio management, and financial market analysis.

- BIDA® – Business Intelligence & Data Analyst: The BIDA® certification is designed for those who want to bridge the gap between finance and technology. It’s ideal for professionals who are keen on data analysis, financial forecasting, and business intelligence.

- FPWM™ – Financial Planning & Wealth Management: This certification is targeted at individuals who are focused on financial planning and wealth management. It’s well-suited for financial advisors, wealth managers, and planners who provide clients with long-term financial strategy services.

Each of these certifications provides a comprehensive curriculum that includes practical skills and tools relevant to their respective fields. They are all self-paced, allowing professionals to balance their learning with their work commitments.

The certifications come with a range of resources, including video lectures, downloadable templates, and access to a network of finance professionals. Whether you’re looking to deepen your expertise in a current role or pivot to a new area within finance, CFI’s certifications offer a pathway to enhance your credentials and advance your career.

Corporate Finance Institute Features:

- 14 Courses: A comprehensive curriculum spanning 14 different courses.

- 340+ Lessons: Over 340 lessons provide in-depth knowledge on various topics.

- 60+ Interactive Exercises: Engage with more than 60 interactive exercises for hands-on learning.

- Guided Simulations: Practical experience through guided simulations that reinforce ‘learn by doing.’

- Expert Instructors: Courses taught by industry experts with a wealth of knowledge and experience.

- 500,000+ 5-Star Ratings: Join a large community of satisfied learners with best-in-class training.

Corporate Finance Institute Pros and Cons

- Designed for All Levels: The program is structured to cater to learners regardless of their prior knowledge in finance or accounting, ensuring ease of understanding and mastery of concepts for beginners and experts alike.

- Accessible and Engaging Video Tutorials: The FMVA program’s video tutorials are frequently praised for their clarity and brevity, making complex concepts accessible to all learners, regardless of their background. This approachable format is ideal for those new to finance or accounting, as it breaks down intricate topics into digestible segments. Enthusiastic feedback from students, such as “short and clear! Amazing content!”, underscores the effectiveness of these tutorials.

- Continual Content Refresh: The addition of new courses each month ensures that learners have access to the latest information and trends in the industry. This commitment to updating content means that students are always at the forefront of the field, equipped with the most current knowledge and practices. It’s an invaluable feature for professionals who need to keep up with the fast-paced changes in finance and technology.

- Peer-Endorsed Quality: With thousands of 5-star ratings, the course’s quality is endorsed by a vast community of learners. This peer validation is not just about the numbers; it reflects the collective satisfaction and the positive impact the course has had on the careers of many professionals. It’s a testament to the course’s ability to deliver on its promises and help students achieve their learning goals.

- Career Readiness and Advancement: The FMVA program is tailored to meet the real-world requirements of the financial job market, particularly within the private sector. It prepares students for career advancement by teaching the practical skills and tools that employers value. The program’s focus on applicable knowledge and job readiness equips learners with a competitive edge, fostering confidence as they progress in their professional journeys.

What Professionals Are Saying About CFI Certifications:

“The FMVA is pretty cool. I would highly recommend it if you want to become more confident at financial modeling.” – Reddit

“The courses at CFI are really good, especially for beginners – intermediate users. It is an excellent resource for those outside of the traditional accounting/finance role…” – Reddit

“I have the FMVA and it got me a role in corporate finance for a Fortune 500. They wanted someone with an accounting background who could speak finance and perform valuations.”

Get 40% Off Corporate Finance Institute Course

2. New York Institute of Finance Courses

The New York Institute of Finance (NYIF) offers a versatile and comprehensive wealth management course designed to suit a variety of learning preferences. With a legacy rooted in the New York Stock Exchange since 1922, NYIF has established itself as a beacon for finance professionals worldwide. The course aims to equip students with the knowledge and skills necessary to excel in the field of wealth management.

Course Details

- Flexible Learning Options: Courses are available in classroom settings, live online, or through self-study to accommodate different learning styles and schedules.

- Comprehensive Modules: The curriculum includes 11 modules, each ranging from 3 to 9 hours, covering all facets of wealth management.

- Extended Access: Students receive one full year of access to the course materials, including:

- 75 Hours of Video Content: Engaging video lectures that explain wealth management concepts in detail.

- Expert-Led Instruction: Courses are designed and taught by professionals with real-world asset management experience.

- Interactive Q&A Sessions: Direct interaction with experts to discuss course material and real-world applications.

New York Institute Pros and Cons

- Adaptability to Learning Styles: The variety of course formats is a testament to NYIF’s commitment to educational accessibility, recognizing that one size does not fit all in professional development.

- Depth of Expertise: The instructors bring a treasure trove of industry experience, translating complex financial concepts into actionable knowledge that can be immediately applied in the workplace.

- Interactive Learning Experience: The interactive elements of the course, including Q&A sessions, are designed to mimic the dynamism of the financial sector, preparing students for the kinds of engagements they will encounter professionally.

- Credentialing and Continuing Education: The credentials offered by NYIF are not just educational achievements; they serve as a beacon for professional stature and are recognized across the financial industry.

- Access Duration: The one-year access period may require efficient time management from students to ensure they can complete and review the course within the allotted timeframe.

- Inconsistent Course Materials: Some of the NYIF courses may not include video content, which has led to disappointment among students who expected a uniform multimedia experience. This lack of consistency in course materials has left some reviewers feeling misled, as they anticipated a more interactive learning format across all offerings.

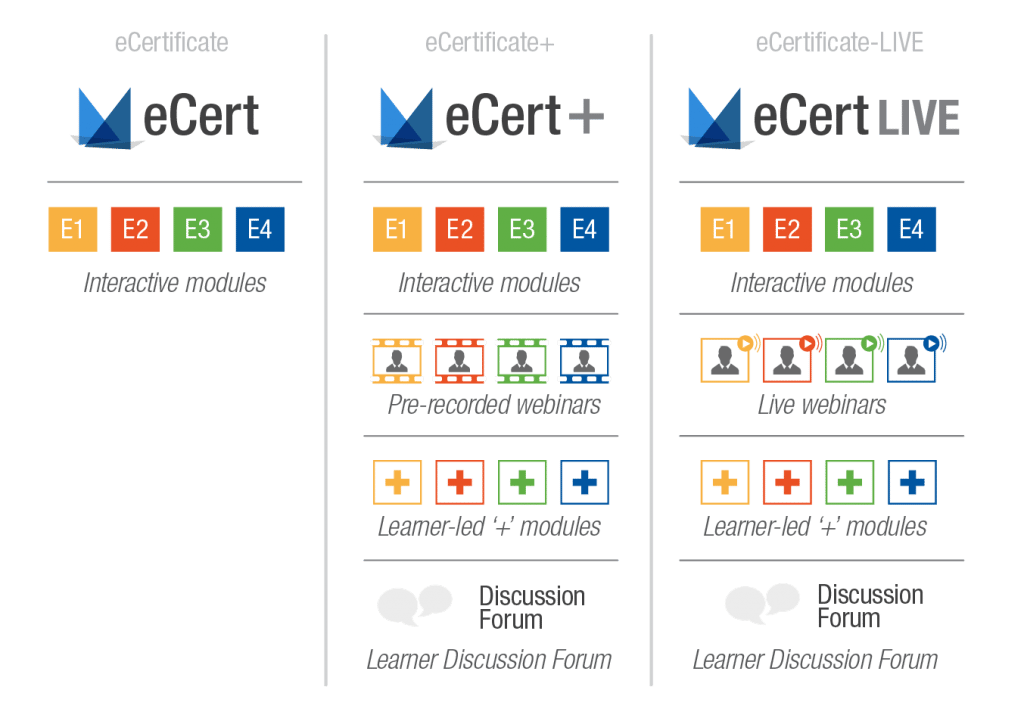

3. Asset Management Academy IAM Certification Courses

The Asset Management Academy’s Institute of Asset Management (IAM) Certificate course stands as their flagship offering, drawing widespread participation from those eager to delve into the world of asset management. Esteemed for its comprehensive coverage of asset management theory, the course is meticulously crafted to ensure that participants emerge fully equipped to embark on a successful asset management career, armed with the coveted IAM Certificate qualification.

Echoing its popularity and effectiveness, the academy boasts a TrustScore of 4.6 out of 5 stars on Trustpilot, with an impressive 80% of reviews at 5 stars. A notable testimonial from a satisfied learner, Jane M, highlights the course‘s well-structured and expertly delivered content, recommending prompt examination following the course to capitalize on the fresh, in-depth knowledge and the utility of the practice questions provided.

Course Details

This wealth management training program includes a number of study materials to help you prepare for your IAM Certificate exam.

Asset Management Academy Features:

- Comprehensive Curriculum: The program covers all essential asset management principles across 22 sessions and 4 eLearning modules.

- Interactive Learning: Students can engage with recorded webinars that complement each module and participate in a community through the school’s Discussion Forum.

- Flexible Study Options: With a 1-year access period, the course accommodates various learning paces and styles.

- CPD Hours: Completing the course grants 40 hours of Continuing Professional Development (CPD).

Asset Management Academy Pros and Cons

- Options: From individual learning to corporate group learning, this wealth management education company has you completely covered. There’s even an option for wealth advisors who already have some work experience. This can save you time and prevent having to sit through information that may be redundant to the seasoned professional.

- Pricing: Asset Management Academy allows you to take advantage of all that their courses have to offer for just over $500.

- Expert-Led Webinars: The pre-recorded webinars are led by experts, ensuring high-quality, actionable insights.

- Live Webinars for Corporate Only: While you can still view recorded webinars, the live webinar option is reserved only for corporate groups. This is only disappointing because the live webinars have a more conversational bent, allowing you to ask questions in real time with instructors.

- Lack of Audio Accompaniment: One immediate observation from students beginning the course is the absence of audio on some slides. While this may align with certain learning preferences, the general consensus suggests that an audio narrative would greatly enhance the understanding and engagement with the course material.

- Need for Conciseness and More Video Content: Some learners have noted that the course can be somewhat verbose and would benefit from a more succinct presentation style. Additionally, there is a call for an increase in video content to break up the text-heavy modules and provide a more dynamic and visually engaging learning experience.

Bottom Line:

The Asset Management Academy’s IAM Certificate course offers a solid foundation in asset management principles at a competitive price, making it accessible to a wide audience. However, the course’s lack of audio in some modules and the desire for more concise, video-rich content suggest there is room for improvement in delivering a more engaging and modern educational experience.

4. Asset Wisdom Wealth Management Courses

The Asset Management Academy offers IAM Certificate training courses that are designed and taught by experts and experienced practitioners in the field. They provide a comprehensive preparation for the IAM Principles of Asset Management exam, including full examination preparation materials, assessments, and a mock examination. The academy boasts a high pass rate exceeding 90% and commits to quality with ongoing feedback and product development cycles. They also offer a unique opportunity to take the IAM Principles of Asset Management examination immediately following the course.

They have a strong track record with positive client testimonials, which you can download from their website to read more about past students’ experiences. Additionally, the academy offers a quality commitment—if you don’t pass your exam, they provide access to CPD-certified eLearning modules to improve your knowledge before retaking the exam.

For more detailed reviews and feedback from students, you can visit their testimonials page. Unfortunately, the specific testimonials are not directly accessible through the provided content, but they are available for download on the Asset Management Academy’s website.

Course Details

The Asset Management Academy offers a dynamic and interactive online learning experience, designed to be as flexible as it is informative. Here’s what you can expect:

- Modular Design: The course is segmented into manageable modules, allowing for a structured yet flexible learning journey.

- Comprehensive Learning: With 22 sessions spread across four eLearning modules, learners are thoroughly prepared for the IAM Certificate exam.

- Interactive Webinars: Recorded webinars complement the modules, providing a recap and deeper understanding of the material.

- Community Engagement: A discussion forum is available for learners to engage with peers and experts, enhancing the learning experience.

Asset Wisdom Features:

- Practice MCQ’s

- Animated Videos

- Interactive Exercises

- 14 modules (40-60 min each)

- Mobile and PC Access

- Earns 25 CPD credits

Asset Wisdom Pros and Cons

- Welcoming to Beginners: Not quite ready to get your certificate? Asset Wisdom makes room for beginners with their Asset Management Foundation Award course, which is designed as a solid introduction for wealth management professionals.

- Convenience: Asset Wisdom is very up front with their students— from pricing to presentation. They also offer options to purchase your IAM Certificate Exam once you’ve completed their school.

- Lack of Uniform Style: While Asset Wisdom does provide plenty of content to use while learning their material, it can sometimes feel like the different styles clash. It’s great at keeping your attention, but it might also be distracting or counterintuitive if you have a single-minded focus when studying.

- Limited Website Information: Asset Wisdom’s online presence could be more robust. The current website is somewhat lackluster, providing scant details about the courses and offerings, which may leave potential students seeking more comprehensive information before making a decision to enroll.

- Sparse Online Reviews: There is a noticeable absence of reviews for Asset Wisdom on popular platforms like Trustpilot and Reddit. This scarcity of feedback could make it challenging for prospective students to gauge the quality and effectiveness of the courses based on the experiences of past learners.

Bottom Line:

While Asset Wisdom offers a range of wealth management courses that may appeal to learners at various levels, the lack of detailed information on their website and the scarcity of user reviews on platforms like Trustpilot and Reddit make it difficult to assess the value and quality of their offerings. Potential students might find themselves hesitant to commit without a clearer picture of the learning experience and outcomes provided by Asset Wisdom.

5. Jacobs Asset Management Training Courses

The Jacobs Asset Management Training course is a comprehensive program launched in 2015, which has been delivered to over 1,600 participants globally. It consists of five modules that cover various aspects of asset management, aligning with ISO 55000, PAS 55, and the IAM’s learning framework. The course is designed for individuals with some asset management experience and incorporates adult learning techniques, including presentations, theory, real-world stories, and practical exercises.

Feedback from participants indicates a high level of satisfaction with the course. One participant from TransCanada, US Pipeline Integrity, praised the course for its high-quality material and engaging exercises, facilitated by experts with real-world experience. Another review from the Region of Peel, Canada, commended the comprehensive nature of the training, recommending it to anyone involved in Asset Management.

Jacobs’ Course Includes:

- Global learning

- 5 Learning Modules

- 3 Day Course

- Presentation and Theory

- Real World Applications and Stories

- Working Practice Exercises

Jacobs Pros and Cons

- 3 Day Course: Unlike other courses, Jacobs doesn’t want to waste any time— so all of their courses take place over just 3 days. Doing so ensures that you know the essentials without being bogged down with extra useless info.

- Modular Learning: Each of the 5 course modules tackles important information in an easy-to-understand manner. The modular teaching style allows the teacher to focus on specific aspects without having to worry about incorporating everything at the same time. Instead, they can build off of previous modules as they move forward.

- Minimum Attendance Requirement: Jacobs Asset Management Training stipulates a minimum of 15 attendees to conduct a course, which could be a significant limitation for smaller organizations or groups that cannot meet this threshold. This requirement may delay training opportunities for interested individuals and could pose a challenge for those seeking to organize a session in less populated or remote locations.

- Variable Relevance to Job Roles: The Jacobs Asset Management Training course, while comprehensive, may not align perfectly with the specific needs and challenges of every participant’s current role. The broad scope of the course content might not address the unique asset management issues faced by individuals in specialized or niche areas, potentially leading to a mismatch between course material and practical applicability in one’s day-to-day job functions.

- Lack of Post-Course Support: Once the course is completed, participants may not have ongoing support or resources to help apply what they’ve learned in their work environment.

Staying Current: Our Commitment to Regular Updates

At AIS-CPA, we are dedicated to providing our readers with the most current 2024 and comprehensive information on wealth and asset management courses. We understand that the financial industry is dynamic, with frequent updates to course offerings, certification requirements, and industry standards. That’s why we diligently monitor these changes and regularly update our content to reflect the latest developments. Our goal is to ensure that our users have access to the most up-to-date knowledge and resources, enabling them to make well-informed decisions about their education and careers in asset management.

IAM Certificate FAQs

This is an online exam that is made up of 60 multiple choice questions. The exam is broken down into 5 modules that cover principles, policy, planning, the life cycle, risk management, and other topics related to wealth advisors and understanding financial markets.

The current price for the exam within the United States is $325. If you decide to take a course to prepare for the exam, be sure to check with your provider to see if the exam fee is included within your respective course before paying separately at full cost.

You’ll need to get an overall score of 65%, while also not getting less than 50% in any of the 5 modules.

IAM recommends that you study for at least 150 hours prior to taking the exam.