Unless you’re an accountant or auditor, you likely aren’t looking forward to the 15th of April if you’re an American. Just the thought of having to go through your spending records and start filling out forms might send you into an anxiety attack!

That’s because taxes are one of the most frustrating, stressful, and unavoidable obstacles that must be encountered by any citizen of a modern developed nation. It’s the glue that holds these civilizations together; without it, there would be no roads, schools, emergency services, public transit… The list goes on.

No matter who you are or what you do, there’s one thing for certain if you live and work in the United States: Uncle Sam wants his cut, and the federal government is going to get it.

Yet despite how important taxation is for the continued existence of our modern countries, people are always trying to find ways to avoid paying every April. Usually, the way it goes is that people who make more money are the most desperate to evade their taxes since the percentages they are required to pay can be significant. Politicians, CEOs, and activists have all been accused of this practice; many of them have even been caught in the act.

Some of the most interesting cases of federal tax evasion involve celebrities: the actors, musicians, and artists who dominate our magazine covers, Hollywood blockbusters, and late night talk shows.

In order to learn more about the ins and outs of tax evasion (and have a little fun at the expense of rich people), let’s take a deep dive into some of the most interesting cases of celebrity tax fraud in the USA!

Who Uses Internal Auditing Procedures?

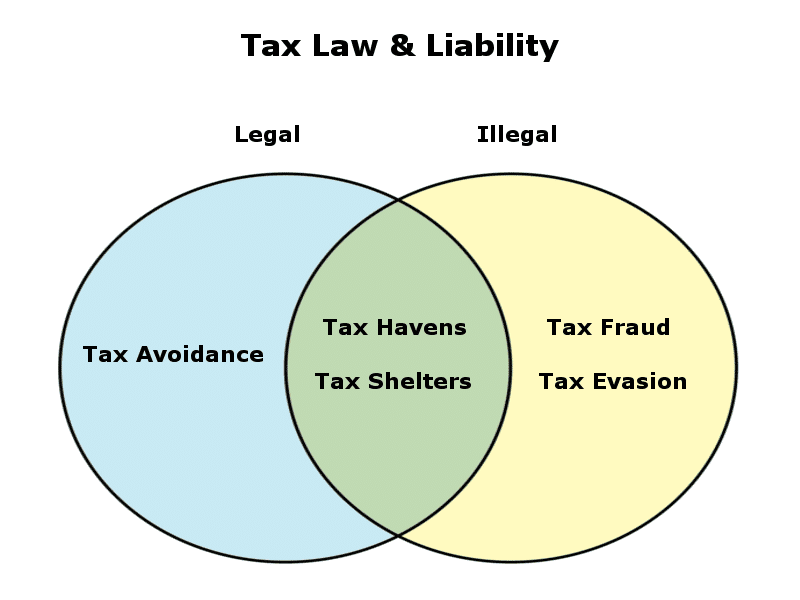

First off, there are a few definitions that we need to clear up. Understanding the meanings behind these terms is important:

- Tax fraud is the act of not abiding by the federal tax code, which most often involves not paying taxes, whether through ignorance, negligence, or a willful intention to evade them. It is a catch-all term that refers to many different methods or actions.

- Tax evasion is a crime and a specific type of tax fraud. It doesn’t involve any negligence; instead, it’s a willful action in violation of the law. Individuals who are caught committing tax evasion can be fined, prosecuted, and even sent to prison.

- Tax avoidance is the intentional minimization of a company or individual’s tax liability. Tax avoidance is not tax fraud; it is a legal and common practice, although it may not be considered moral.

- Tax havens are locations, like countries, cities, and continents, that are used by many companies and individuals to avoid paying taxes. They aren’t necessary illegal and can be used for tax avoidance, but there is also potential for them to be used in committing tax fraud.

- Tax shelters are institutions or methods that can be used to reduce tax liability for an individual or company. Although their legal status (and potential for abuse) are identical to tax havens, they don’t necessarily need to reside in them.

Still confused? Take a look at this diagram:

All of these terms are similar to the point where many people will use them interchangeably; someone may refer to an act of tax avoidance as tax evasion, refer to a tax haven as a tax shelter, or assume that tax avoidance is tax fraud. In reality, however, none of these statements are true.

Got it? Then let’s move on!

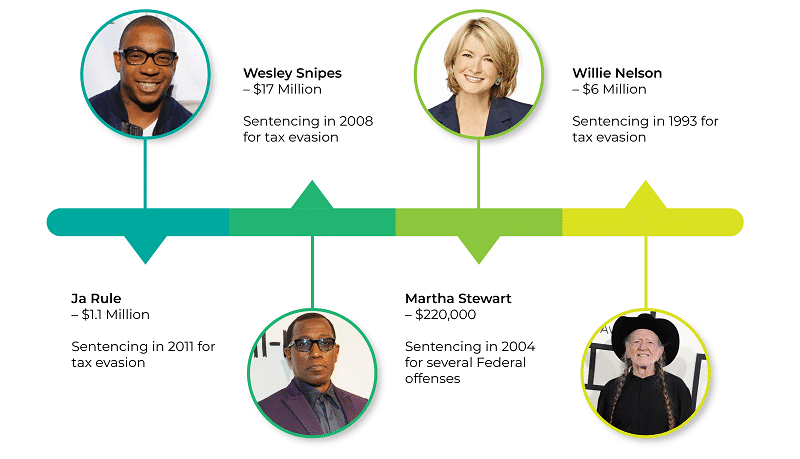

Ja Rule – $1.1 Million

Jeffrey Atkins, better known by his stage name Ja Rule, is a Grammy-nominated hip hop artist who was a big name in the early 2000s. Nowadays, however, he is mostly known for his role in the Fyre Festival: a disastrous live music event that has been the subject of several news stories and documentaries. Although fascinating in its own right, the Frye Festival legal drama involves wire fraud, which is very different from tax evasion.

Before his involvement in said festival, however, Atkins had some other run-ins with the law. The most notable of these run-ins (at least for us) is his sentencing in 2011 for tax evasion. The specific action he took that resulted in this sentence was not filing income tax returns between 2004 and 2006. In his own words, the reason for his tax troubles was that he “was a young man who made a lot of money” but he “didn’t know how to deal with these finances,” nor did he ”have people to guide [him]” in this process.

From his statement, it would appear that Atkins was admitting to having committed tax fraud but not specifically tax evasion. After all, tax evasion according to the IRS “involves some affirmative act to evade or defeat a tax, or payment of tax.” Not knowing how to file a tax return, or even the necessity of filing a tax return in the first place, doesn’t sound like an affirmative act.

So why was Ja Rule convicted of tax evasion? Well, he plead guilty, meaning that neither he or his legal counsel made an attempt to dispute the charge. Although I am not a lawyer, I believe they could have possibly made a case that he acted out of ignorance of tax laws instead of willfully evading them. Ultimately, the reason why they decided not to pursue this path most likely involves another conviction: Atkins’ criminal possession of a weapon in 2007.

As a result of a plea bargain, Ja Rule was able to serve part of his tax evasion sentence while also serving his jail time for criminal possession, as well as avoid paying fines for unpaid taxes in 2007 and 2008 with this deal. Consequently, he served 2 years in a state prison for the weapon charge and was transferred to a federal prison in 2013, where he served 2 of the 4 months remaining on his charge. Finally, the total tax bill he was still required to pay was roughly $1.1 million.

So what’s the lesson to learn from this case of celebrity tax fraud? It’s simple: fill out your tax returns!

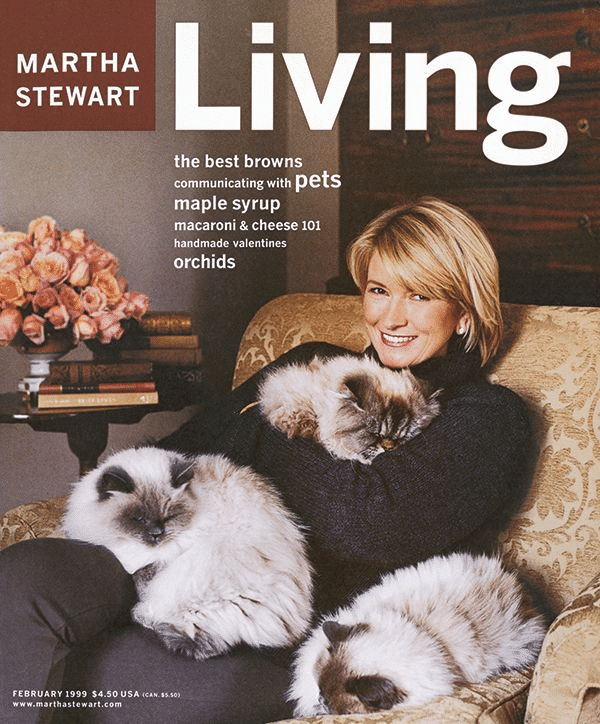

Martha Stewart – $220,000

Although she made her name as a wholesome television personality and chef, the truth is that Martha Stewart has been a shrewd businesswoman for her entire career. Following the publishing of several popular cookbooks in the 1980s, the saccharine chef and homemaker capitalized on her growing success through a magazine, a television show, and retail promotions. As a 1995 profile of Stewart from New York magazine stated, “More than a franchise, more than a ‘lifestyle,’ more than an attitude, she’s a living trademark.”

Source: Refinery29

A huge part of the Martha Stewart brand’s success has to do with her image as a folksy, motherly figure, reminiscent of a gentle housewife. Consequently, it came as a monumental shock to the public when she was convicted of several federal offenses in 2004. But before the insider trading scandal that shattered her sterling brand, Stewart had to deal with tax evasion charges regarding some property she owned in New York. The New Yorker provides a handy summary of the case in question, but you can read our brief summary below:

Martha Stewart owned two properties in New York: a cottage in the Hamptons and an apartment in Manhattan. According to the law, an individual is considered a “statutory resident” in the state of New York, and thus required to pay state income tax, if they have spent over half the year (183 days) in the state and they have established a “permanent place of abode” there. In the eyes of the state, Stewart fit this description in the years 1991 and 1992 due to her owned properties and her numerous TV appearances in the state around that time.

Stewart and her legal counsel attempted to fight this audit by claiming that neither of these facts was true: she hadn’t spent enough time in the state to justify the charge despite the TV appearances, and neither of her owned properties fit the definition of a permanent abode because they were under renovations at the time. Unfortunately, the evidence her legal counsel provided to support the former claim was considered insubstantial. And for the latter claim, the New York court found a smoking gun: a cable TV subscription.

Thanks to a package that included “Family Plus Cable, HBO, Showtime, Disney, MSG and Sports Channel,” Martha Stewart was required to pay over $200,000 in back taxes in 1998. Ultimately, there are a few lessons that can be learned from this story if you have a home in New York and don’t want to pay the state’s taxes: don’t spend more than half a year there and don’t pay for cable!

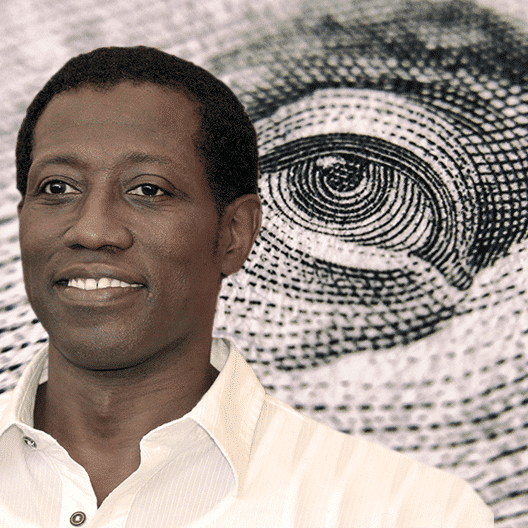

Wesley Snipes – $17 Million

This next case of celebrity tax fraud is a point of extreme contention depending on who you talk to. One side of this story paints Hollywood actor Wesley Snipes as a man who believed that he was above the law because of his clever circumvention of the tax code. However, the other side of the story portrays Snipes as a victim of institutional racism disguised as justice. Regardless of how you see it, it’s clear that this 2008 trial was a significant cultural event and a valuable teaching moment for anyone interested in tax law.

In a nutshell, here’s what happened:

Wesley Snipes acted in 8 movies between 1999 and 2004, earning approximately $38 million dollars according to the New York Times. However, he didn’t pay income taxes for any of this revenue, which led to a tax fraud indictment of 8 different counts: six counts of failing to file tax returns, one count of conspiracy, and one count of fraud. During his trial, Snipes’ legal team made a defense known as the 861 Argument: a common tactic used by people who believe they don’t have to legally pay their taxes.

Source: Barnes Law

There’s just one unfortunate thing about the 861 Argument: it doesn’t work. In all cases since 1993 where this argument has been proposed (which is based on the willful misinterpretation of wording in the IRS tax code), the courts have found it to be frivolous. Snipes’ case was no exception to this rule, and three of the counts held up in court, resulting in a three-year prison sentence and a tax bill of $17 million.

You may be wondering: if Wesley Snipes’ argument didn’t work, why was he only charged with three of the eight counts? The answer to that question is the other side of the story. From the perspective of Snipes’ defense, there were multiple glaring problems with the trial itself that necessitated a lengthy appeals battle. The way Robert Barnes, one of Snipes’ tax lawyers, phrased it on his website, the 2008 trial was “Fathered by a corrupt financial advisor” with “an all-white jury pool in a community known for racial hatred.”

The corrupt financial advisor in question was Kenneth Starr, who formerly worked for Snipes and testified against him in the trial. Starr would later be convicted of federal fraud, essentially proving Barnes right. As for the location; the trial was held in Ocala, Florida, for an arguably tenuous relation to the actor. This was disputed by Barnes due to fears of racial bigotry influencing the jury, citing a survey that found “[a] greater level of racial bias and prejudice toward Snipes” in the city.

Ultimately, Barnes was able to have Snipes acquitted on the felony charges of conspiracy and fraud, resulting in a much more lenient misdemeanor. Their strategy for success in this scenario was to claim that Snipes’ beliefs regarding his tax liability were “kooky, crazy, and dead wrong,” meaning he didn’t intentionally evade taxes. Essentially, Snipes thought he was practicing tax avoidance when he was really committing tax evasion.

Let’s quickly go through the lessons that can be learned from this entire ordeal:

- The 861 Argument will not work. Don’t ever use it.

- One man’s tax avoidance is another man’s tax evasion (the other man being the IRS).

- Jury selection in a tax trial is extremely important.

- Fill out your tax returns!

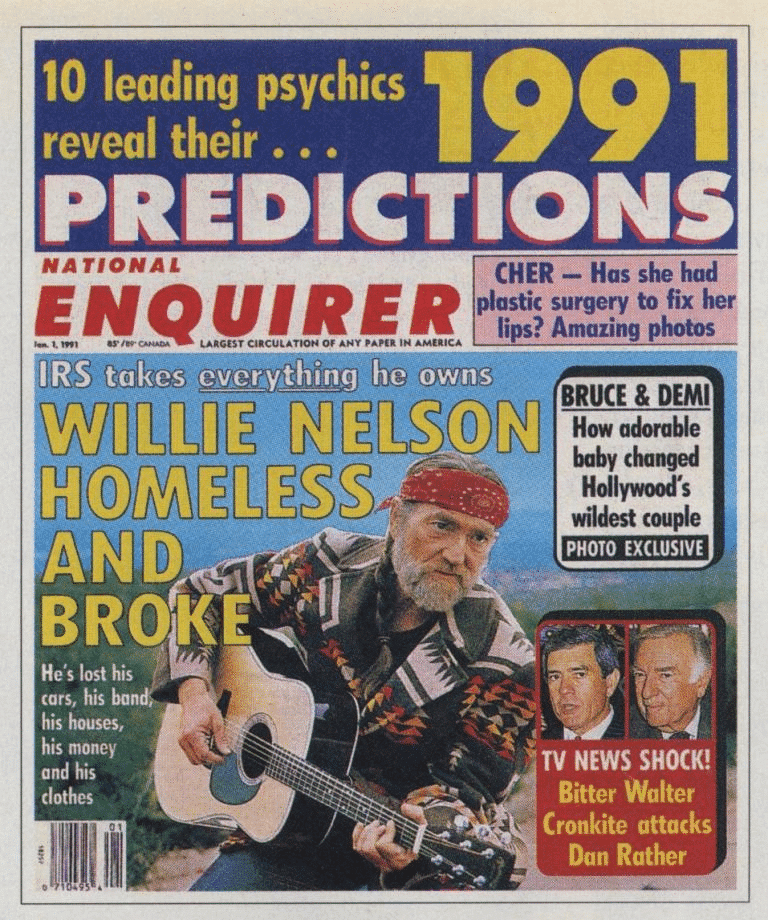

Willie Nelson – $6 Million

Nowadays, there are two things Willie Nelson is most well-known for: his impressive career as a country music singer and his advocacy for marijuana. However, in the 1990’s he was involved in a lengthy dispute with the IRS that almost destroyed his career and life. But with some clever negotiations and overwhelming support from his fans, this is one of the few celebrity tax evasion stories that have a happy ending.

Nelson’s troubles started in the early 1970s when he hired Neil Reshen as his manager. Although Reshen was instrumental in Nelson’s career comeback with the release of albums like Red-Headed Stranger and Shotgun Willie, he allegedly mishandled Nelson’s tax payments through excessive use of tax extensions. For reference, this is the tax evasion equivalent of an ostrich burying its head in the sand to hide from predators. Because of this, and because of a situation involving a package of cocaine being mailed to his office, Reshen was fired by Nelson.

Now with a tax bill of roughly $2 million, Nelson met with representatives from the then-Big Six (now Big 4) accounting firm Price-Waterhouse to discuss handling this debt. According to a 1991 article in Texas Monthly, he was advised by Price-Waterhouse to invest his money into First Western Government Securities, a tax shelter based in San Francisco. However, what the firm failed to disclose to Nelson was that “other First Western investors had been questioned by the IRS in 1981.”

Here’s a quick tip: if people who invest in a tax shelter are questioned by the IRS, it’s probably not a very good tax shelter!

Source: Texas Monthly

When this bogus tax shelter eventually crumbled, Price-Waterhouse became involved in multiple lawsuits from Nelson and many other wealthy clients. However, in Nelson’s case, the firm managed to reach a settlement outside of court. According to a New York Times article from 1995 detailing the suit, the settlement was due to the fact that “even if the tax shelter was invalid, Mr. Nelson was better off because the I.R.S. settled with him for $3 million less than he would otherwise have owed in taxes.” A settlement was also reached with Neil Reshen around this time as well, although the nature of this case is unknown due to the records being sealed.

Through the course of these financial mishaps, Willie Nelson’s tax debt grew and shrank rapidly until finally being negotiated down to $6 million. Unfortunately, Nelson was still unable to pay this amount due to his near-bankruptcy as a result of these disastrous financial decisions. So he came up with a brilliant scheme, the first and only one of its kind: create a compilation album called The IRS Tapes and share the profits with the IRS. With the help of his many fans and friends, he was able to successfully pay off his debt and reclaim most of his seized assets through this revenue-sharing scheme and other successful business ventures.

Let’s quickly go through the important lessons to be learned from the case of Willie Nelson:

- Extending the deadline for turning in tax forms doesn’t extend the deadline for paying them.

- A tax shelter being investigated by the IRS is not a good tax shelter.

- If you’re in a bind, the IRS may be willing to work out a deal to get their money!

Key Takeaways

As you can see, there are many interesting ways that rich and famous people have tried to avoid paying their fair share of taxes. But at the end of the day, none of the influential people listed above managed to avoid paying the price. A lucky few, like Willie Nelson, manage to get away with only paying off their debts; the unlucky ones, like Ja Rule and Wesley Snipes, end up with prison time. But even those who do manage to avoid sentencing for their tax evasion, as in the case of Martha Stewart, may still find themselves behind bars due to further scrutiny from law enforcement.

One of the most important lessons you should take away from this article is to fill out your tax returns. It doesn’t matter how much you made and it doesn’t matter what kind of excuse you have; you simply need to do this in order to avoid being accused of tax evasion. Ja Rule and Wesley Snipes believed they were simply practicing tax avoidance; one out of ignorance into the proper methods of paying taxes, and the other under the mistaken belief that they could subvert the rules. You cannot play dumb or outsmart the IRS in these ways, which is why talking to a professional accountant is highly recommended if you have any questions about the taxpaying process.

If you make a lot of money and you want to lessen your tax bill, be extremely careful. Once again, talking to a professional accountant or financial advisor is highly recommended. There are legal ways of reducing your tax bill, even if they may seem immoral. However, you have to make sure that you are doing everything right, because if you make even one small mistake while engaging in tax avoidance, federal auditors will jump on you like sharks at the sight of blood. Willie Nelson and Martha Stewart both believed they were in the clear, and both of them learned the hard way that they weren’t.

There’s another uncomfortable lesson that can be learned from these celebrity tax evasion stories, which is that the law doesn’t treat everyone the same. In the case of Willie Nelson, the IRS and courts were willing to work with him to reduce his tax obligation and engage in a revenue-sharing album. In the case of Wesley Snipes, however, the legal system gave no ground and required his legal team to fight tooth and nail to reduce his prison sentence. The best advice I can give in this situation is this: no matter who you are, the less interaction you have with the IRS, the better.

The Bottom Line: if you want to avoid trouble, remember to speak to trusted tax professionals, carefully study the law and any legal precedents before attempting to reduce your tax bill, and most importantly… Fill out your tax returns!