If you’re a citizen of the USA and you’ve made any amount of money, even while not living in the country, you know about the Internal Revenue Service (IRS).

And the IRS definitely wants to know more about you.

To an ordinary, law-abiding citizen, the lengthy process involved in declaring and paying taxes is a nuisance at its worst. However, those who attempt to circumvent or outright break the rules to avoid paying their dues to Uncle Sam are the ones who truly fear this organization.

You see, the IRS is in the business of enforcing the gargantuan list of rules and regulations that make up our country’s tax code, punishing those who break these rules with fines, liens, and even prosecutions. And according to the most recent release of the IRS Criminal Investigation Annual Report, business is booming.

For the most part, the IRS should leave you alone if you keep track of your income and make regular, accurate tax payments. However, it’s not unreasonable or insane to feel concerned about the power and punitive capabilities this organization has to ruin your life. Therefore, I’ve put together this deep dive to help you understand how the IRS conducts its criminal investigations.

Keep reading to learn more about what the IRS Criminal Investigation (CI) program does, red flags they look for in their investigations, statistics about their operations, and tips for staying in their good graces!

IRS Criminal Investigations

Although the list of activities performed by agents of the IRS are numerous, they all share a common goal: making money for the USA. Every investigation they perform has an end goal of collecting (or seizing, depending on how you see it) more money for the government than they spend in operations.

Furthermore, the IRS has become increasingly more efficient and competent in performing this task. According to Table 29 of the 2017 IRS Data Book, their ratio of money spent vs. money gathered has become smaller and smaller. In 1988, it would cost the government roughly 54 cents for every $100 dollars collected by the IRS; in 2017, that cost had been reduced to around 34 cents.

Source: Internal Revenue Service Criminal Investigations

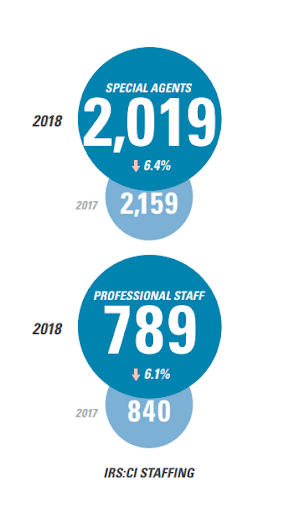

What’s impressive about this statistic is the fact that these efficiencies came about despite the IRS workforce decreasing. According to Table 30 of their Data Book, the amount of realized positions in the agency have decreased by over 10,000 from 2011. On page 4 of their 2018 criminal investigation annual report, IRS Deputy Chief Eric Hylton described this phenomenon as part of a “perfect storm” caused by “agents lost due to retirement” and a “lack of hiring over the past five years.” However, he ultimately concludes that “While we may have fewer agents, we are working bigger cases and we are working smarter.”

But what exactly are these bigger cases that Hylton is referring to? Well, there’s a great deal of them that involve a number of situations and environments, both explicitly and non-explicitly tax related.

Tax-Related Investigations

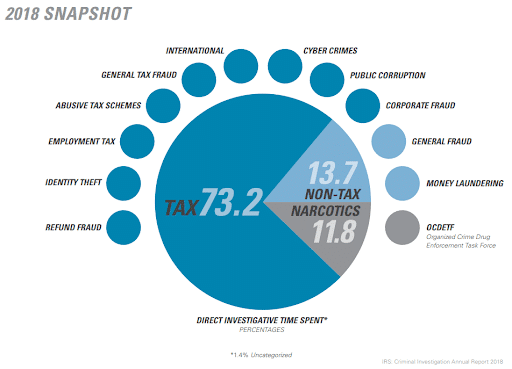

As you may have guessed, the vast majority of time the IRS spent at work centered around tax-related crimes. According to page 6 of their 2018 annual report, 73.2% of their time was devoted to these investigations.

Source: Internal Revenue Service Criminal Investigations

Keep reading to learn more about the different tax-related crimes that the IRS spent their time investigating:

Refund Fraud

This is the kind of tax fraud that is most applicable to your average Joe. Essentially, refund fraud is defined by the IRS on page 9 of their annual report as the act of “[filing] fraudulent tax returns to steal government funds.” If you’ve added entitlements to your return in order to increase your tax refund amount, you’ve committed this form of fraud.

The way the IRS investigates refund fraud is threefold. The first method is through their identity theft investigations, since these two crimes tend to go hand-in-hand (more on that later). The second and third methods are through two criminal investigation programs: the Questionable Refund Program and the Abusive Return Preparer Program.

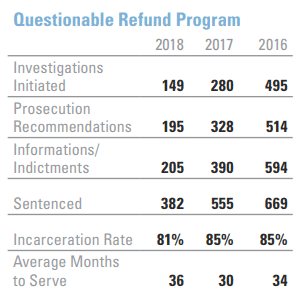

The QRP is a program that seeks to identify potentially fraudulent tax returns, prevent them from being paid out, and then refers them to other departments for criminal investigation.

Source: Internal Revenue Service Criminal Investigations

The RPP, on the other hand, focuses more on investigating the individuals and organizations that help prepare tax returns for others. According to recent statistical data regarding these particular investigations, the vast majority of their investigations lead to indictments, and the vast majority of indictments lead to incarceration.

Identity Theft

As was previously mentioned, identity theft is a big deal to the IRS. They devote a considerable amount of time and resources to the investigation of these cases, which page 10 of their annual report defines as someone using the “Name, Social Security Number, address,” or other forms of Personally Identifiable Information (PII), “to commit fraud or other crimes.” This seems pretty cut and dry; if you use any personal information from someone who isn’t you (with or without their permission) for tax purposes, then this applies to you.

As previously mentioned, the QRP plays a large role in helping the IRS identify and investigate potential cases of identity theft as they relate to refund fraud. However, in cases of identity theft that aren’t identified through QRP, the IRS has four Scheme Development Centers dedicated solely to this crime. According to statistical data, the amount of initiated identity theft cases has decreased over the last few years. However, what hasn’t decreased is the overwhelming rate at which these investigations have led to indictments, which then lead to incarceration. In fact, these conversion rates are even higher than those for refund fraud!

Cyber Crimes

As technology has advanced and become more and more integrated into daily life, the potential for technology-based crime has also increased. Hence, the IRS has built a Cyber Crimes Unit to address this issue. On page 10 of their 2018 annual report, they state that the purpose of the CCU is to investigate “internet-based technologies that enable criminals to engage in illegal activity with anonymity and without a defined physical presence.

In addition to a dedicated Office of Cyber Crimes, the IRS and the CCU accomplish this by placing cybercrimes coordinators with key positions in all other department field offices. This way, cyber-related cases identified in departments dedicated to more specific cases of tax crime, such as the aforementioned QRP and RPP, can be passed along to the CCU and their tech-savvy team.

Other Investigations

Although these are some of the most common and high-profile tax-related investigations performed by the IRS, several more categories fall under this umbrella. These include:

- General Tax Fraud: Similar to refund fraud, this category involves more specific behaviors such as omitting income from your tax returns, making false bookkeeping entries, and obscuring taxable assets.

- Abusive Tax Schemes: This category investigates schemes, both foreign and domestic, to circumvent tax laws. It can include the use of shell corporations, trusts, or illicit partnerships.

- Employment Tax Fraud: Any situation where an employer attempts to circumvent their payroll taxes, unemployment taxes, federal income taxes, or other business-related taxes falls into this category.

Non Tax-Related Investigations

Although the primary purpose of the IRS and their Criminal Investigation team is to investigate tax-related crimes, a portion of their teams and work hours are also devoted to crimes that aren’t directly related to taxation. However, these crimes are all related to money and are often identified during the investigation of a tax-related crime.

Money Laundering

Technically, money laundering is a form of tax evasion. However, this crime prioritizes obscuring the source of the money in question rather than attempting to avoid paying taxes on it. Due to these similarities, it should come as little surprise that the IRS is highly competent at investigating this crime. As page 12 of their annual report attests, “CI special agents are experts in following the money trail.”

Many of the IRS’s money laundering investigations also cross over with those related to narcotics (more on that later). However, another program this agency runs ensures compliance with the Bank Secrecy Act: anti-money laundering legislation that encourages transparency in bank-related financial report. This act requires businesses to report any foreign bank accounts or cash payments greater than $10,000, among other things.

Electronic Crimes

You might be wondering: what’s the difference between electronic crimes and cyber crimes? After all, any cyber crime would also be an electronic crime by definition.

Yes, it’s true that cyber crimes are also electronic crimes by their nature. However, an overwhelming amount of criminal activity in the modern age would also count as an electronic crime simply due to the highly tech-based nature of our modern society. On page 16 of their annual report, the IRS attests that every investigation they conduct “involves digital and multimedia evidence of some type.”

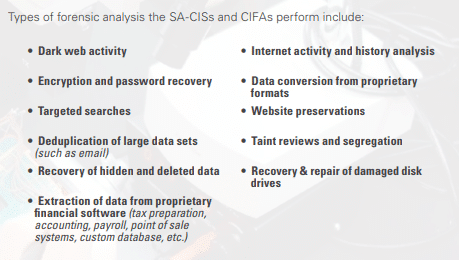

Hence, the Electronic Crimes division of the IRS is comprised of the following:

- Computer Investigative Forensic Analysts (CIFA): Also known as Computer Investigations and Forensics, these individuals are trained in recovering and tracking data found on a variety of electronic devices. Furthermore, their legal ability to execute search warrants makes them an invaluable force when investigating cases of visa fraud and child pornography.

- Special Agent – Computer Investigation Specialists (SA-CIS): Some IRS CI Special Agents receive additional training in order to become competent at practice digital forensics. This incorporates both federal law enforcement training and general IT certification training in order to ensure competence in both law enforcement and technology.

- Forensic Assistant Contractors: In addition to their dedicated teams of special agents and digital forensics analysts, the Electronic Crimes division frequently hires contractors for additional assistance. The educational and training requirements for these team members are more lax, meaning that they only serve a supplementary role in any serious investigation.

Source: Internal Revenue Service Criminal Investigations

One of the most noteworthy examples of a big win for the IRS CI’s Electronic Crimes division involved the arrest of Ross Ulbricht in 2013. Ulbricht was the creator of the Silk Road, a darkweb-based marketplace that sold high volumes of heroin and other illegal substances. IRS agent Gary Alford worked in conjunction with the DEA to make it happen.

Narcotics and Counterterrorism

Although it may seem bizarre for an organization dedicated to upholding tax laws to be involved in drug and terrorism investigations, it’s simply a matter of pragmatism. As page 19 of their annual report states, CI agents help “reduce or eliminate the profits and financial gains of individuals, entities, and Transnational Criminal Organizations involved in the financing of terrorism, narcotics trafficking, and money laundering.” Essentially, their investigation skills and techniques used to such great success in other criminal investigations can be easily and effectively applied to these crimes as well!

Other Investigations

Aside from these major focuses for the IRS CI’s non-tax related investigations, there are a handful of areas on which they also concentrate their investigative efforts, such as:

- General Fraud: As was previously mentioned, some of the CI team’s abilities when it comes to investigating money laundering come in handy during other fraud-related investigations. In particular, page 14 of their annual report states that they use said skillset to investigate fraud as it relates to financial institutions and the healthcare industry.

- International Operations: The goals of CI’s International Operations team are twofold. First, they provide valuable training resources for countries like Hungary, Thailand, El Salvador, Australia, and New Zealand. The second goal is to maintain strong diplomatic connections with nearby countries like Canada and Mexico so as to facilitate domestic investigations that may have international connections.

- Corruption: In addition to investigating United States citizens, CI also conducts investigations into the different branches and levels of government. The subject of these corruption investigations, as is mentioned on page 14 of their annual report, is “elected and appointed individuals who violate the public’s trust.”

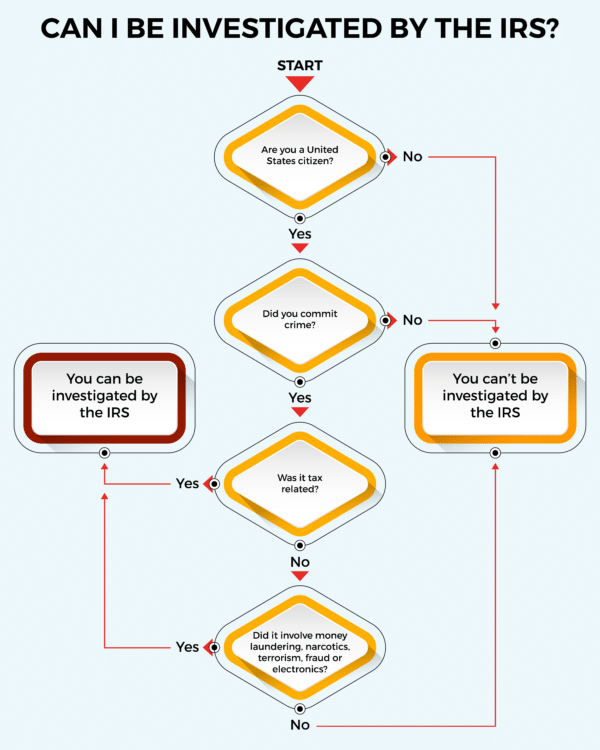

Can I Be Investigated by the IRS?

As you can see, the IRS CI team works in a wide range of fields and covers a vast array of criminal activity. If you’re having a tough time keeping track of what crimes the IRS does or doesn’t investigate, take a look at this flow chart:

A quick disclaimer about this flow chart:

While it may not be obvious at first, some criminal investigations that don’t fall neatly into these categories can still be investigated by the IRS. For example, the Alcohol and Tobacco Tax and Trade Bureau (TTB), covered on page 21 of the IRS CI annual report, is a partnership effort between the IRS and the ATF that handles alcohol and tobacco trade. Although many of the investigations conducted by this bureau will involve taxes in some way, some of them won’t but can still be investigated by this IRS-adjacent organization.

The same goes for gambling: a topic that isn’t covered in the 2018 annual report. Despite its absence, however, CI does have a Gaming Investigations team that handles gambling-related tax crimes. However, much like with their approach to alcohol, tobacco, narcotics, and terrorism, they will occasionally dip their toes into investigations regarding non-tax and non-money laundering gambling cases, such as those involving lapses of licenses.

Essentially, the information contained in this flowchart is simplified by design and definitely should not be construed as legal advice or gospel truth. Furthermore, it only applies to the current year; some aspects of it may be irrelevant or outdated in the future.

Criminal Investigation Procedures

In addition to providing ample information about the different types of crimes investigated by the IRS and the different teams dedicated to investigating them, the IRS Criminal Investigations annual report also provides insight into how they conduct their investigations. Here are some of the typical processes involved in an IRS investigation:

Undercover Operations

As I’m sure you’re aware, the IRS has a reputation. In fact, their reputation is even more severe than many other law enforcement organizations, as Dr. Dre so eloquently put it at the beginning of this article. Consequently, this reputation can make it very difficult for their Criminal Investigations team to make progress in their efforts.

Thus, a great deal of undercover work is involved in many IRS CI cases. As page 24 of their annual report states, undercover operations and techniques are used “in numerous investigations involving organized crime, illegal gambling operations, tax shelter schemes, illicit money movers, and investment scams.”

Asset Forfeiture

Out of all the outcomes from an IRS investigation, this is the most obvious and least avoidable. The logical conclusion to any successful criminal investigation from any IRS team is claiming assets. As the IRS CI annual report puts it on page 26, their asset forfeiture program “seeks to deprive criminals of property used in, or acquired through, illegal activities.” These activities include both tax-related crimes, such as evasion and fraud, as well as the numerous aforementioned non-tax related crimes that IRS CI teams investigate.

One noteworthy example of successful asset forfeiture is mentioned on page 26 that involves a large heroin smuggling operation. In order to reclaim $8 million worth of illicit assets, Criminal Investigations seized “four former barber shops and a barber college.” Typically, claimed assets of this type are auctioned off, with the profits reinvested into the IRS and other law enforcement agencies.

Forensics Analysis

Source: Internal Revenue Service Criminal Investigations

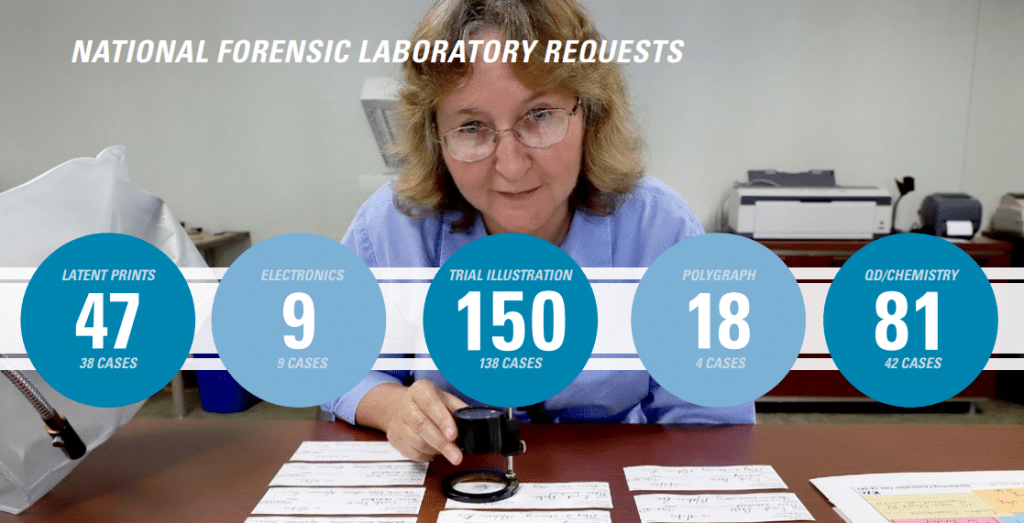

In order to complete thorough and accurate investigations of any kind, forensics plays an extremely important role. Hence, it should make sense that the IRS Criminal Investigations teams and departments place considerable emphasis on forensics. This has been the case for the past 40 years, since the IRS’s National Forensic Laboratory (NFL) was created.

On page 27 of their annual report, IRS CI states that the NFL “has supported IRS investigations by offering forensic testing and technical services in electronics, latent prints, polygraph, questioned documents, ink chemistry,” and other similar procedures and methods. As was previously mentioned in the Cyber Crimes and Electronic Crimes sections of these reports, it’s clear that a great deal of emphasis is place on digital forensics. However, it’s also clear from this quote that traditional analog methods of forensics also play a significant role in the IRS’s investigations.

The Big Picture

With all this information provided by the IRS through their Criminal Investigations annual report, what are the most important lessons to take away from it?

How can you, the average tax-paying citizen, use this information to better protect yourself from getting into trouble?

Here are some key takeaways that should help you see the big picture:

The IRS Follows the Money

If you’ve committed any kind of crime that involves a significant amount of money, chances are high that the IRS is going to be involved in some capacity. It doesn’t matter if this crime involves taxes in any way; if there’s money involved, so’s the IRS.

Depending on the type and severity of the crime, you will either be investigated by a specific IRS CI team or a team from a different law enforcement agency that cooperates with the IRS. Basically, don’t believe that you’re safe from the IRS if you run illegal operations relating to computers, gambling, drugs, alcohol, or political extremism.

The IRS Is Very Successful

When the IRS sets their sights on an individual or organization, the chances are very high that their investigation will lead to a conviction and prison time. According to the Appendix on pages 124-126 of their annual report, the average incarceration rates for their different investigation teams are very high, despite the fact that many of them have decreased in the past few years.

- Identity Theft, Narcotics, Money Laundering, and Public Corruption investigations are the ones with the highest incarceration rates as of 2018; all of them are greater than 85%. The average sentence length for these crimes is around 57 months or 4-5 years.

- Next up is Healthcare Fraud, Corporate Fraud, Non-Filers, and Questionable Refunds, at around the 80% mark for their incarceration rates. These crimes have an average sentence length of around 37 months or 3 years.

- On the lowest end of the curve is Financial Institution Fraud, Abusive Tax Schemes, and Employment Tax Fraud. Despite having the lowest incarceration rates out of the whole, they still have an impressive 70-77% rate and an average sentence length of roughly 2-3 years.

Do you want to know why that is the case? It has to do with this last point:

IRS Investigations are Rare

If you’re an average tax-paying citizen, the chances of you running afoul of the IRS is extremely low. The reason why the IRS manages to achieve so many convictions out of their investigations is that they are very selective with this process. As the Deputy Chief mentioned at the beginning of the Criminal Investigations annual report, they work smarter, not harder.

If you’re a multi-millionaire who avoids paying taxes or finances an illicit business operation, you are more likely to become the target of an IRS criminal investigation. But even then, you’d really have to be among the worst of the worst offenders.

Ultimately, the truth of the matter is that the IRS isn’t interested in going after small fry. So chances are good that you really don’t have anything to worry about when it comes to being investigated by the IRS.

Still, you definitely don’t want to attract their attention, so remember to pay your taxes and keep your nose clean!