Accountants are always in high demand. They are needed in public accounting firms, corporations, the government, and in practically every other type of business organization. Consequently, if you are an accountant and looking for a job, it’s highly likely that your search will be successful.

But the best accounting jobs (and the most high-paying ones) are reserved for candidates who possess specific attributes.

Of course, it’s essential for any professional to be an expert in their area of specialization. For example, if you are applying for a job that requires tax knowledge, then you must be able to demonstrate that you are familiar with the relevant laws and statutes.

However, that may not be enough for many employers. Leading organizations are usually looking for something more in the candidates that they are interviewing.

Here are six attributes that successful accountants possess. It will be useful to develop these qualities and use them in your day-to-day work as an accountant.

Ethical Commitment

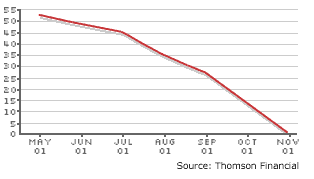

There are many companies that closed down because of the unethical practices adopted by senior management. Enron, a Houston-based commodities and energy firm, collapsed in 2001 through business malpractice. This resulted in shareholders losing billions of dollars and thousands of employees being left jobless. Enron’s CEO had masterminded a plan to hide the huge debts that the company had taken.

Enron’s share price

Source – BBC News

WorldCom, a large telecommunications company, closed down in 2002 as a result of a fraud committed by their top management. The closure resulted in the loss of 30,000 jobs and $180 billion in losses to investors.

What’s the common thread between these closures? Both involved accounting fraud.

Enron successfully hid its debts for many years. It was subsequently discovered that the company’s auditors shredded documents to hide their role in the fraud. The Worldcom scandal came to light when the internal audit department found a $3.8 billion fraud that involved the falsification of the company’s books.

There is a lesson in this for every accountant; while you need to be creative and think out of the box, you should never compromise your ethical standards in the process.

Your textbooks and CPA study materials will not prepare you for every type of business situation. When you are tackling accounting issues in the course of your work, you will have to think on your feet and take the best possible decision.

But you should remember that there is a fine line between a creative solution to a business issue and an action that is unethical. The situations that you face may not always be distinguishable as ethical or unethical. It’s crucial that you know how to identify the correct course of action and stick to it regardless of the pressure that you face.

An Ability To Use Technology

Computer literacy is an essential requirement for accountants. You should be familiar with spreadsheet software and word processing software; you must also be willing to learn about the other software that is in use in the organization in which you work.

An accountant who has a good understanding of technology can expect faster career growth. This doesn’t mean that you need to know how to write code! But you should be able to understand tech issues and explain accounting concepts to people in the IT department.

Accounting is becoming increasingly automated, and an accountant with tech skills can expect faster career progression as well as a higher salary.

Soft Skills

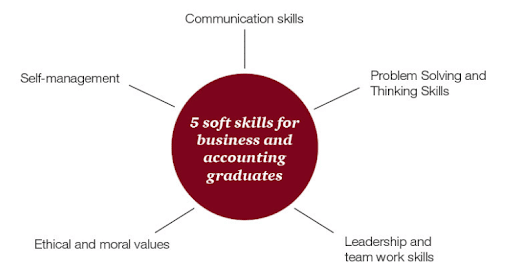

In addition to technical competence, accountants need a host of soft skills to be effective in their roles.

What exactly are “soft skills?”

These are distinct from “hard” (technical) skills and give you the ability to establish and maintain personal relationships with your peers, bosses, and team members.

Source – The Accountant

How can you enhance your soft skills? Here are a few of the steps that you can take:

- If you are the leader of a team, you should be willing to listen to every team member’s point of view. Giving everyone the chance to speak and express his or her opinion is a characteristic of a strong leader.

- Ensure that your actions are in sync with your words. If you stand by what you have said and keep the commitments that you have made, you will command the respect and trust of your colleagues.

- Don’t hesitate to compliment others and provide praise for their accomplishments.

If there is a problem, focus on the issue and not on the individual.

Strong Attention To Detail While Meeting Deadlines

You should never make commitments that you cannot keep. If you have said that you will accomplish a task within a specific period, you should ensure that you do what you have promised.

Your job as an accountant could involve preparing reports that contain large amounts of data. At a senior level, you could be responsible for reviewing these types of reports. It’s critical to have the ability to spot and rectify any errors; If you prepare or approve a report that is inaccurate, it will leave a very poor impression of your capabilities.

But this attention to detail should not prevent you from losing sight of the big picture. Does the data provide the relevant information? Is the report that you have prepared consistent with the other information that is available with the reader? Keeping these factors in mind will help you to build your reputation as a reliable and competent accountant.

An Ability To Understand Business Issues

An accountant is not just a number cruncher or someone who only prepares or audits financial statements. Employers expect your role to be much greater than that.

You should have the ability to grasp how business functions; your business acumen will come into greater play as you rise in the organization.

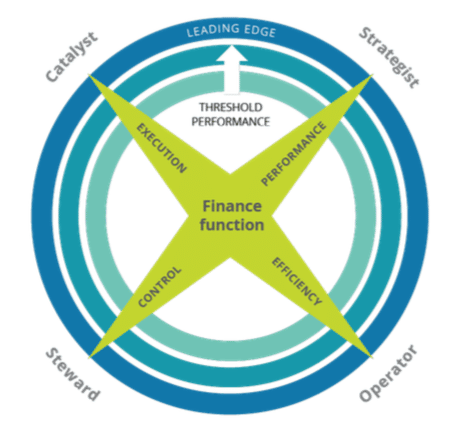

Traditionally, the Chief Financial Officer’s (CFO’s) role was restricted to preparing financial statements and managing the company’s financial function. But in recent years, the CFO is seen as a member of the top management team.

Four faces of the CFO

Source – Deloitte

Even if you are a junior accountant, you should be aware of business issues. This will help you to carry out your job more effectively. It could also increase your chances of getting promoted.

Strong Technical Skills

The skills that you require will depend upon the nature of your work and your level within the organization. A junior position is likely to involve working as a member of a team and handling routine tasks. When you are promoted, you may have to function as a team leader and take charge of the preparation of financial statements, or you may be asked to manage a new project.

Your work and seniority level will determine the technical skills that you need. Gaining the appropriate certification in accounting will help you to enhance your career. If you plan to work in public accounting or join a large corporation as a finance professional, you should consider becoming a Certified Public Accountant (CPA). This is the most widely recognized accounting certification and is also highly respected.

There are several other accounting and finance certifications that you could pursue. These include:

- Chartered Financial Analyst

- Certified Management Accountant

- Enrolled Agent

- Certified Internal Auditor

Regardless of the certification that you opt for, you must remember to update your knowledge on a regular basis. Why must you do that? Rick Reisig, CPA, and shareholder with Anderson ZurMuehlen & Co., P.C., provides an apt answer: “The more we know, the better the product will be that we can offer our clients, and the more successful we and our clients become.”

Of course, this rule applies to accountants who work in corporate accounting and the government as well.

The Bottom Line

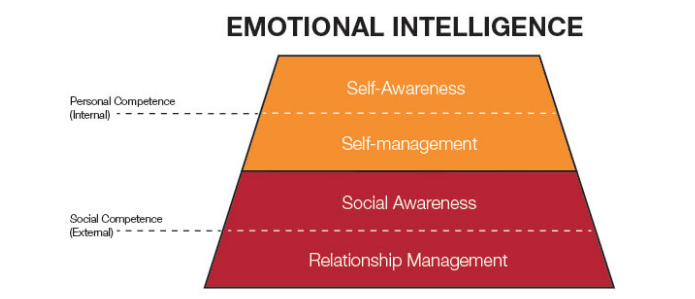

Your success as an accountant is going to be determined to a large extent by your emotional intelligence. A high EQ (emotional quotient) will help you to manage your professional relationships in a manner that allows you to carry out your job responsibilities more effectively.

Source – The Accountant

David Nally, the former Chairman of PricewaterhouseCoopers International, says that in addition to EQ, accountants need three other Qs for career success. These are IQ, CQ, and PQ. IQ, of course, refers to your intelligence quotient. CQ is cultural intelligence and PQ, the passion that you display at work.

Master all three and you will be able to CRUSH every obstacle in your path to a long and rewarding career!