Did you know there are tons of sites and resources available online for the CPA Exam?

Did you know that a lot of these sites and providers give you this information at the ideal price of FREE?

If you did, would you know where to locate this content? We do— which is why we organized this collection of free CPA exam questions and other assorted study materials!

We’re here to make your life easier when it comes to the entire CPA exam process. Whether you need help with locating free CPA study material, want to locate the best CPA online courses, or even just have questions about the exam content & sections, we can help.

Free CPA Exam Questions & Sample CPA Exams

While you could sign up for a full course to get all the CPA questions and answers you need, there are plenty of free resources available to help you get started.

It’s not hard to find many of these free study materials; in fact, many premium education companies offer them on their own sites! But in order to save you some time, we’ve collected the best options below.

Take a look at some of the free CPA exam questions we found for the different exam sections:

FAR CPA Exam Questions

Broken into 4 sections, the FAR section of the CPA exam consists of topics such as standard-setting, financial reporting, select financial statement accounts, and more.

Here are a couple of standout resources we recommend for free FAR CPA exam review:

|

Resource Type |

Additional Information |

Content Specifics |

|

AICPA Practice CPA Exam |

66 MCQs, 6 TBS | |

|

From CPA Army. Sample of a full selection for sale. |

12 MCQs, includes explanations | |

|

From CPA Army. Sample of a full selection for sale. |

5 Pages, includes explanations | |

|

From Quizlet. Flashcards covering CPA exam terms. |

860 Flashcards |

AUD CPA Exam Questions

Here are our top picks for free AUD CPA exam review:

|

Resource Type |

Additional Information |

Content Specifics |

|

From AICPA. |

72 MCQs, 8 TBS | |

|

From CPA Army. Sample of a full selection for sale. |

3 MCQs, includes explanations | |

|

From CPA Army. Sample of a full selection for sale. |

5 Pages, includes explanations |

REG CPA Exam Questions

Here are a few recommended items for studying for the REG CPA Exam:

|

Resource Type |

Additional Information |

Content Specifics |

|

From AICPA. |

76 MCQs, 8 TBS | |

|

From CPA Army. Sample of a full selection for sale |

5 Pages, includes explanations | |

|

From CPA Army. Sample of a full selection for sale |

3 MCQs, includes explanations |

BEC CPA Exam Questions

Our suggested free CPA study materials for the BEC section of the exam are as follows:

|

Resource Type |

Additional Information |

Content Specifics |

|

From AICPA. |

62 MCQs, 4 TBS, 3 WCs | |

|

From CPA Army. Sample of a full selection for sale |

3 MCQs, includes explanations | |

|

From CPA Army. Sample of a full selection for sale |

5 Pages, includes explanations |

Additional Free CPA Exam Questions and Answers (plus other resources)

From additional study guides, practice tests, and quizzes — all the way to heaping helpings of video content — check out this extra helping of free CPA content:

|

Resource Type |

Additional Information |

Content Specifics |

|

Problems are from Roger CPA Review. Courtesy of the New Jersey Society of CPAs. |

96 Total (24/section) all MCQs, includes explanations | |

|

1,000 questions included. Registration required. Pushes paid products affiliated with Fast Forward Academy. |

965 MCQs, includes explanations | |

|

Registration required. Answers not available until after your testlet has been submitted. Courtesy of Gleim CPA Review. |

276 MCQs, 28 TBS, includes explanations | |

|

AICPA released questions from the previous CPA exam. Courtesy of the Missouri Society of Certified Public Accountants. |

140 MCQs | |

| Practice Quiz from Wiley CPA. |

100 MCQs, includes explanations | |

|

Becker CPA Blog |

Blog, Updated Regularly | |

|

Roger CPA Learning Center Video Library |

Video Library, dozens of free informational videos | |

|

Complete handbook for students looking to take the CPA Exam. Found on the Department of Consumer Affairs website. |

20 page guide | |

|

Roger/U-World CPA Blog. |

Blog, Updated Regularly | |

|

Brief guide on preparing for the CPA Exam. Courtesy of Yaeger CPA Review. |

1 page guide | |

|

Free webinar section for upcoming recordings, recent webinars, and archived past recordings. Many recordings come with additional PDF downloads. Courtesy of Yaeger. |

Free Videos and PDFs | |

|

Blog featuring CPA Related news and articles. Courtesy of Yaeger. |

Blog, Updated Regularly | |

|

88 Things you need to know for the CPA Exam + Bonus 14 Study Tips. Courtesy of CPAexam.com |

Free E-Book Download | |

|

Full schedule of Live Webinars. Courtesy of CPA Academy. |

Hour Long Webinars | |

|

Yaeger instructional videos and lectures. They release content regularly on this channel, with 2 years worth of material uploaded. |

Complete library of educational videos |

Recommended CPA Exam Prep Providers

There’s plenty of free content for you to take advantage of when preparing for the CPA exam, but what if you need more help?

One reason that we recommend checking out paid content in addition to the free stuff is that it’s typically more up-to-date with current rules and stipulations of the CPA exam.

Looking at providers that offer paid review courses can give you a better idea of any recent changes to exam structure and content. This means you can use even something as simple as a course outline to make sure you’re studying the right subject matter.

While these are by no means the only providers around, we are highlighting these CPA prep courses for their excellent balance of free vs. paid CPA study materials:

- 1.Becker CPA Review Course: Rated the #1 Best CPA Review Course of 2025

- 2.Surgent CPA Prep Course: Best Technology

- 3.Gleim CPA Review Course: Largest Question Bank

Becker CPA Review Course

Becker stands out to us due to their fusion of technology and personal instruction. The result of this synthesis is a unique hybrid of self-study and a traditional class. Their instructors are certified professionals, and the interactivity of their digital study planner tool is equally impressive.

Becker’s Free Content: Becker has a free blog on their site that is host to a ton of interesting and useful articles for certified public accountants or anyone in the accounting field. They also offer a course demo for those interested in what they have to offer.

Varsity Tutors

Varsity Tutors is the ultimate CPA tutoring service for those who love a personal touch.

Once you sign up, you’ll receive a one-on-one consultation with one of their accounting professionals; from there, the two of you will develop a study plan together. Nothing about the service is cookie-cutter, opting instead for customization based around your preferences every step of the way.

Varsity Tutors’ Free Content: While Varsity Tutors doesn’t offer a free trial of their services, they do have 9 free CPA exam practice tests and flashcards available to download.

Roger/U-World

In addition to Roger’s provided content, you can use their platform to create additional study tools for yourself. You can use their fully-featured mobile app or complete your coursework on a traditional desktop computer. Additionally, both platforms let you create additional practice tests at any time.

Roger’s Free Content: Roger also has a library of free CPA review videos and a blog they update with new information regularly. If this sounds interesting to you, we recommend trying their free trial to get a better sense of their platform.

CPA Army

CPA Army is a clear and concise review company. They break up their services specifically by section of the CPA exam. While they’re not a traditional CPA course, CPA Army’s approach to study packages is comprehensive enough to feel like one.

CPA Army’s Free Content: They allow you to sample most of their services in the form of downloadable PDFs and sample multiple choice questions. Each section of the exam has its own set of free questions and sample study guide pages to check out.

Yaeger CPA Review

With the variety on display with this prep course company, students looking for free content or paid content would have a tough time not liking Yaeger.

Yaeger’s Free Content: Over the past two years they’ve released a steady stream of free content to their YouTube channel. They also host a CPA podcast on their site that covers topics in accounting and current events. Finally, take a chance on their free trial and experience all that Yaeger has to offer firsthand.

Meet the CPA Exam: A brief overview

As the main test needed for a highly-sought after distinction in the field of accounting, it makes sense that the CPA exam would be quite difficult. With any challenge, it’s important to make yourself familiar with what you’re going up against so that you can better plan out how to overcome it.

How do you know where to start on your journey to pass the CPA exam? We’ve got the basics covered for you:

CPA Exam Sections

The CPA exam is broken down into 4 separate sections:1

- FAR, or Financial Accounting and Reporting: This section requires you to complete 62 multiple-choice questions and 4 task-based simulations. It covers subjects related to transactions, governments at the state and local level, and financial reporting frameworks.

- AUD, or Auditing and Attestation: This consists of 72 multiple-choice questions and 8 task-based simulations. Topics within the AUD CPA exam are broken up into 4 separate portions: ethics, professional responsibilities, assessing risk and developing a planned response, and forming conclusions and reporting.

- REG, or Regulation: This section tasks you with completing 66 multiple choice questions and 8 task-based simulations. Topics covered on the REG CPA exam include ethics and professional responsibilities, business law, and federal taxation (property transactions, individuals, and entities).

- BEC, or Business Environment and Concepts: This section of the CPA exam is a compilation of 76 multiple choice questions and 8 task-based simulations. Additionally, this is the only section of the exam that will require you to complete 3 written communication questions.2 The subject matter here includes corporate governance, economic concepts and analysis, financial management, information technology, and operations management.

You have 4 hours to complete each CPA exam section. As you can see, they most commonly include multiple choice questions and task-based simulations, though there are also written communication questions for some questions.3

CPA Exam Question Types

Multiple-choice questions are straightforward; if you’ve taken any standardized tests, you should already be very familiar with the format.

But what’s the difference between task-based simulations and written communication tasks? Here’s what you need to know:

- Task-Based Simulations (TBS) are case studies modeled after actual scenarios. These simulations are designed to test your knowledge of business issues and practical accounting. Each section of the CPA exam will include two or three TS testlets.

- Written Communication Tasks (WC) are only found on the BEC section of the exam.2 The exam will task you with reading information about a business situation and you must then write a response. Your response addressing the situation would be in the form of a business letter or memo.

CPA Exam Scoring

There are a few key points to keep in mind when understanding how grading for the CPA exam works:

First, remember that each section of the CPA exam is divided into testlets. This structure allows each portion of the test to have an associated difficulty level: either medium or high.4

If you feel that you didn’t do well on a particular portion of the exam, it could be that you were working through a testlet with a higher level of difficulty.

Next, it’s important to know that there are a select amount of questions that aren’t graded. These are known as pre-test questions and are included to help the test makers create new questions for future versions of the exam.5

There’s no designation on the exam that makes the distinction between regular and pre-test questions. Hence, you’ll have no way of knowing if a particular question is a pre-test question— so you should still answer each one as accurately as possible to get a high score!

Speaking of scores, it’s time to talk about grading.

Every person taking the CPA exam begins with 0 points. Each correct answer will earn you points; but as we learned earlier, not all questions are created equal. For this reason, you’ll actually receive a higher allotment of points for correct answers in testlets that provide a greater level of challenge.

A score of 75 points or higher is needed to pass the CPA exam. Achieving this score proves that you have a level of knowledge that will uphold public safety in accounting services.

This score requirement was determined by the AICPA Board of Examiners (AICPA BOE) They’ve determined this to be a sufficient passing score after considering factors like historical trends, changes in CPA exam content, study results, and input from academic circles and accounting professionals.7

Which section of the CPA Exam should you take first?

An important question to ask yourself the first time you take the CPA exam is which section to tackle first. But when researching test prep techniques and speaking with test takers, we’ve determined that the answer will vary.

Here’s what we recommend:

Instead of listening to people who tell you to take the hardest portion of the exam first or suggest particular study methods, consider your own strengths and weaknesses first. These are going to be key determining factors in your decision. Once you’ve figured this out, we recommend starting with your strongest section. This is because you only have so much time to pass all 4 exam sections— so you should start strong to build momentum.

How and when to take the CPA Exam

First, it’s important to know when the exam is actually facilitated. In the past, the exam was offered 4 times in a year on specific dates, referred to as testing windows. But recent developments from Prometric, NASBA, and the AICPA have changed this schedule.8 As part of their continuous testing model, these are the new testing windows.

- Window 1: January 1st through March 10th, 2020

- Window 2: April 1st through June 30th, 2020

- Window 3: July 1st through December 31st, 2020

The first step in taking the CPA exam is to apply to the Board of Accountancy. Once you’re deemed eligible to take the exam you’ll receive a Notice to Schedule (NTS)9. There are a few things to keep in mind when dealing with your NTS:

- A separate NTS is needed per section of the exam. If you do not receive the NTS for that specific section, you will not be able to take that exam.

- The NTS has a period of 6 months that it is valid for. You must use the NTS within this time period or it will expire and you can’t reuse it.

- While you are able to take more than 1 of the sections of the CPA Exam within a single testing window, if you fail a section you will have to wait until the next testing window in order to try again.

CPA Exam Time Limit

Although it’s important to take all 4 sections of the exam within a single testing window, you definitely don’t have to do all of the sections at once. You can take all 4 parts of the CPA exam at your own pace— so long as you pass all of them within 18 months of each other. Remember: if you fail a particular portion and don’t retake this section within 18 months of passing the other sections, you have to retake all portions in order to be eligible!

Keep this in mind when you plan to take your exams; otherwise you can waste a lot of time on retakes!

CPA Exam State Requirements

While the general requirements for taking the CPA exam are pretty consistent in most of the country, each state does have its own rules and regulations. Be sure to find the specific requirements for your state before you start studying.Here are some criteria that can vary in some state’s requirements:

- University degree

- Number and type of credit hours

- U.S. citizenship and/or SSN

- State residency

- Minimum age

- Work experience

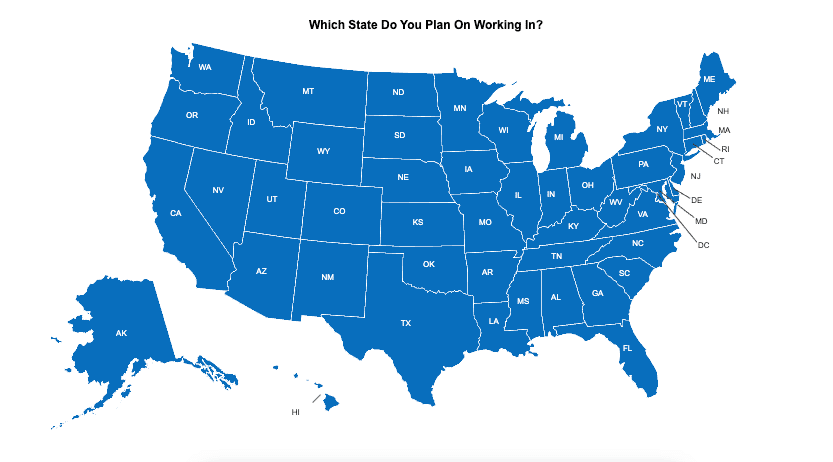

CPA State Requirements Map

Figuring out your specific state’s requirements for the CPA exam can be confusing. If you’re feeling confused or aren’t sure where to look for this information, you’re not alone. The good news is that there are several helpful resources, including these:

Wiley has a handy map on their site that allows you to select your state and provides you with the information that you need from there.10 Anyone who still needs some clarification on their particular state’s mandates should give this tool a closer look.

10 Tips on How to Pass the CPA Exam

1. Understand the Exam Structure

Before diving into your studies, familiarize yourself with the CPA exam structure. The exam is divided into four sections: FAR (Financial Accounting and Reporting), AUD (Auditing and Attestation), REG (Regulation), and BEC (Business Environment and Concepts). Each section has its own set of topics and question types, so knowing what to expect can help you tailor your study approach.

2. Prioritize Your Strengths

While it might be tempting to tackle the hardest section first, consider starting with the section you’re most confident in. This strategy can boost your morale and provide momentum for the subsequent sections.

3. Create a Study Schedule

Consistency is key. Allocate specific times for studying each day or week, ensuring you cover all topics in depth. Use tools like calendars or apps to track your progress and set reminders.

4. Utilize Multiple Study Resources

Don’t rely on just one study material. Combine textbooks, online courses, flashcards, and practice exams to get a holistic understanding of the topics. The article provides a plethora of free resources, so make sure to take advantage of them.

5. Practice with Real Exam Questions

Simulate the exam environment by taking practice tests regularly. This not only helps you get accustomed to the question format but also improves time management skills.

6. Join Study Groups

Engaging in group studies can offer different perspectives on complex topics. Discussing with peers can uncover areas you might have overlooked and provide mutual motivation.

7. Stay Updated

The world of accounting is ever-evolving. Ensure you’re studying the most recent materials and are aware of any changes to the CPA exam structure or content.

8. Take Care of Your Mental Health

While studying is crucial, don’t neglect your well-being. Take regular breaks, engage in physical activity, and ensure you get adequate sleep. A healthy mind is just as essential as a well-prepared one.

9. Review and Revise

As the exam date approaches, allocate time to revisit topics you found challenging. This reinforcement ensures that the information is fresh in your mind.

10. Believe in Yourself

Confidence can make a significant difference. Trust your preparation, stay positive, and approach the exam with a winning mindset.

Self-Study vs. Enrolling in CPA Exam Courses

Everyone learns differently— keep this in mind as you prepare to take your CPA exams. Consider your own personality traits to determine how effective a certain kind of exam study guide will be for you.

For example, consider your approach to organization. Are you highly organized? Can you develop your own study schedule without any assistance? If so, all you’ll probably need are some great study materials to work with and you’re set.

But if you’re someone who does not know where to even start with developing a study schedule — or you just struggle to stay organized — it’s a good idea to enroll in a review course. There are many courses available online from providers who specialize in knowing exactly how to pass the CPA Exam.

While your approach may differ from others when it comes to the CPA exam, both types of students we’ve mentioned can benefit from the resources below. No matter which category you fall under, we’ve put together a list of steps that can be applied to either type of student:

- Find study materials to use on your own or enroll in a course: Find content that engages you and will prepare you for the exam. Whether that’s a course or a more DIY approach will depend on your preference.

- Schedule your study time: Don’t make the classic mistake of procrastinating on your exam prep. Instead, plan study times into your daily schedule to ensure that you’re regularly exposed to the course content. This will make your study sessions feel more habitual and keep you on track.

- Familiarize yourself with the CPA Exam: The more you know about the CPA exam prior to taking each section, the better you will perform. Resources like practice exams, study guides, and flashcards can be instrumental to your success.

- Compare and contrast with other students: Experience can be the best teacher. Make sure to take advantage of the knowledge your friends and fellow students can share. Discuss CPA exam study tips, past experiences with the exams, and so on. You’ll be surprised at the amount of useful information that can be gleaned from these conversations.

- Stay Consistent: You can spend weeks planning for something, but none of it matters without proper follow-through. We know that studying for an exam of this scope and size can feel daunting. Break up your studies into segmented chunks and take short breaks if your study schedule starts to feel overwhelming. The most important thing is consistency!

Best of Luck Passing the CPA Exam!

Now that you have information on the structure and general process for applying to take the CPA exam — as well as plenty of study resources at your disposal — the rest is up to you.

Remember to take on larger topics in chunks and keep a consistent schedule. Furthermore, don’t forget to play to your strengths as well and focus on your stronger topics first. This will help you ease into the overall process and feel more confident in sections that you may not be quite as solid with.

We hope you enjoyed learning about the CPA Exam and various study tools currently available. This exam can be extremely difficult for some. Hopefully with this guide, we can be a helping hand to you in uncertain and difficult times.

Good luck on your exams!

Sources

- https://www.aicpa.org/becomeacpa/cpaexam.html

- https://www.aicpa.org/content/dam/aicpa/becomeacpa/cpaexam/examinationcontent/downloadabledocuments/cpa-exam-blueprint-bec-section-july-2019.pdf

- https://www.aicpa.org/content/dam/aicpa/becomeacpa/cpaexam/downloadabledocuments/cpa-exam-digital-brochure.pdf

- https://www.aicpa.org/becomeacpa/cpaexam/psychometricsandscoring.html

- https://www.aicpa.org/becomeacpa/cpaexam/psychometricsandscoring/scoringinformation/downloadabledocuments/how_the_cpa_exam_is_scored.pdf

- https://www.aicpa.org/becomeacpa/cpaexam/forcandidates/faq.html#scoring

- https://www.aicpa.org/becomeacpa/cpaexam/examoverview/governance.html

- https://nasba.org/blog/2020/07/01/nasba-aicpa-and-prometric-to-begin-year-round-testing-for-u-s-cpa-exam/

- https://nasba.org/blog/2018/03/14/what-is-an-nts/

- https://www.efficientlearning.com/cpa/resources/state-requirements/